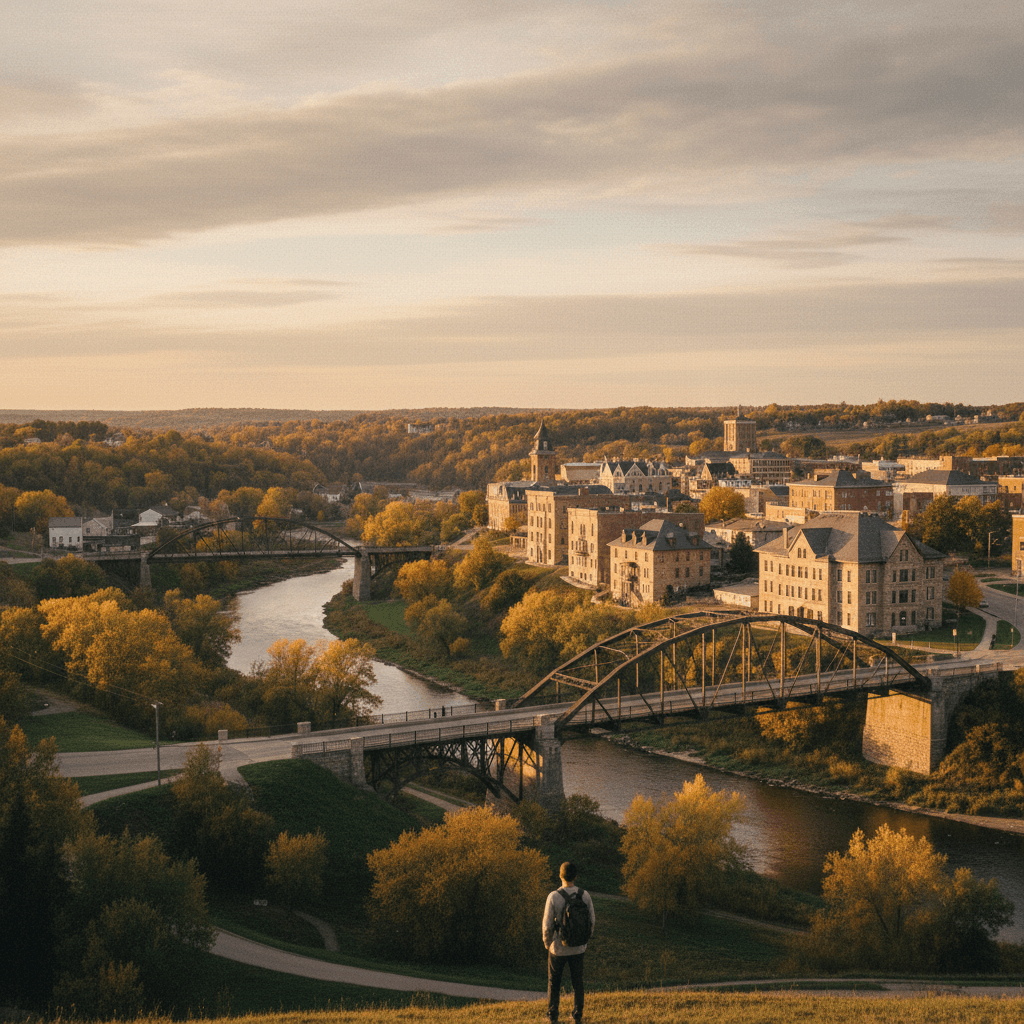

Moving to a new city is an exciting adventure, full of new beginnings and opportunities. But let's be honest, it can also feel a bit overwhelming, especially when you start thinking about the financial side of things. If you're considering making Valley City, North Dakota, your new home, you're in for a treat! This charming community, often called the 'City of Bridges,' offers a friendly atmosphere and a quality of life that many cherish. As you embark on this journey, understanding the financial landscape of your move is key to a smooth and stress-free transition. This guide is designed to help you navigate the costs, plan your budget, and set yourself up for financial success in Valley City.

Initial Budgeting & Pre-Move Costs

Before you even pack your first box, there are financial considerations to tackle. A solid pre-move budget is your best friend, helping you anticipate and manage expenses before you arrive in Valley City.

Estimating Moving Expenses

Moving costs can add up quickly, whether you're moving across the state or across the country. Start by getting quotes from various moving companies. Are you hiring professional movers, or will you rent a truck and DIY? Don't forget to factor in packing supplies like boxes, tape, and bubble wrap. If you're driving, gas costs, potential overnight stays, and even food on the road need to be part of your plan. Consider insurance for your belongings during transit. A local company like Prairie Movers & Storage could offer valuable insights into local moving solutions, even if you're coming from afar, they can provide storage or local delivery options.

Beyond the big-ticket items, think about smaller, often overlooked expenses. Will you need to pay for temporary housing before your new home is ready? What about utility connection fees in your new place? Sometimes, old leases might have early termination fees, or you might need professional cleaners for your old residence. Every little bit counts towards your overall moving budget, so try to think of everything!

Saving for the Down Payment & Closing Costs (if buying) / Security Deposit (if renting)

Whether you're planning to buy a home or rent an apartment in Valley City, you'll need a significant amount of upfront cash. For homebuyers, this means saving for a down payment, which can range from 3% to 20% or more of the home's purchase price, depending on your loan type. On top of that, closing costs typically amount to 2-5% of the loan amount and include fees for appraisals, inspections, title insurance, and legal services. It's a sizable sum, so start saving early and consider consulting with a mortgage lender to understand the exact figures you'll need.

If renting is your path, you'll generally need to budget for a security deposit (often one month's rent) and potentially the first and last month's rent upfront. Some landlords might also charge application fees or pet deposits. Research local rental markets to get an idea of average costs. Valley City offers a range of housing options, from historic homes near the Sheyenne River to newer developments, so prices can vary.

Understanding Housing Costs in Valley City

Once you've made the initial move, your housing costs will likely be your biggest ongoing expense. Understanding the local market is crucial for effective budgeting.

Renting vs. Buying: What to Expect

Valley City's housing market offers a diverse landscape. Renting can provide flexibility, especially if you're new to the area and want to get a feel for different neighborhoods. Average rental prices here are generally more affordable than in larger metropolitan areas, but they can vary based on size, location, and amenities. You might find apartments downtown, duplexes in quiet residential areas, or homes for rent a bit further out.

Buying a home in Valley City can be a rewarding long-term investment. The median home prices are typically attractive for first-time buyers or those looking for more value compared to other regions. While prices fluctuate, Valley City generally offers a good balance of affordability and community charm. Consider the long-term benefits of building equity versus the flexibility of renting. Researching current listings and talking to local real estate professionals can give you a clearer picture of what's available and what fits your budget.

Navigating Property Taxes & Insurance

When buying a home, property taxes are an ongoing cost that needs to be factored into your monthly budget. North Dakota generally has lower property taxes compared to many other states, but the exact amount will depend on your home's assessed value and the local mill levy. You can usually find information on property tax rates through Barnes County's official website or by asking a local real estate agent. These taxes contribute to local services like schools, roads, and emergency services, so they're an important part of community funding.

Homeowner's insurance is another essential expense that protects your investment from unforeseen events like fires, storms, or theft. The cost of insurance can vary based on your home's age, construction, location, and the coverage you choose. It's wise to shop around and get multiple quotes to find the best policy for your needs. Similarly, renters should consider renter's insurance to protect their personal belongings, as landlord's insurance only covers the building itself. A local agency like Valley City Insurance Group can help you explore your options for both home and auto insurance, ensuring you're adequately protected.

Day-to-Day Living Expenses in Valley City

Beyond housing, understanding your daily living costs is critical for a sustainable budget in Valley City. While generally more affordable than urban centers, it's good to know what to expect.

Utilities, Groceries & Transportation

Utility costs in Valley City include electricity, natural gas (especially important during North Dakota's winters!), water, sewer, and trash removal. Internet and cable are also standard household expenses. It's a good idea to contact local utility providers like Midwest Energy Solutions (hypothetical example for energy) or the city's water department to get average costs for homes of similar size to yours. This will help you budget accurately for these essential services.

For groceries, Valley City has options like Valley City Grocers (a hypothetical local supermarket) where you can find fresh produce and daily necessities. Prices for food staples are generally comparable to national averages, but you might find savings by utilizing local farmer's markets in season. When it comes to transportation, Valley City is a very drivable community. Most errands and commutes are easily done by car. Gas prices fluctuate, so factor in fuel costs for your daily activities and any travel outside of town. While public transportation options are limited, the compact nature of the city means many areas are walkable or bike-friendly, especially around the downtown area and the scenic Sheyenne River Valley.

Local Entertainment & Lifestyle Costs

Valley City boasts a vibrant community spirit with many affordable or free activities. Exploring the numerous bridges, walking trails along the Sheyenne River, or visiting local parks won't break the bank. The Valley City Community Center often hosts events and offers programs, many at a low cost or for free, providing excellent opportunities for recreation and social engagement. Dining out can be a treat, and you'll find a selection of local eateries ranging from casual diners to more upscale options. A cup of coffee at a local spot like The Daily Grind Coffee Shop is an affordable way to enjoy the local atmosphere.

Budgeting for entertainment means deciding how often you'll dine out, participate in paid activities, or travel to nearby cities for larger events. Remember to set aside a discretionary fund for these lifestyle choices. Being mindful of these expenses will help you enjoy all that Valley City has to offer without overstretching your budget.

Financial Planning for Settling In

Moving is just the beginning. Long-term financial stability in your new home requires thoughtful planning beyond the initial relocation.

Emergency Fund & Unexpected Expenses

Life is full of surprises, and some of them come with a price tag. Building or maintaining a robust emergency fund is paramount, especially when settling into a new area. Aim for at least three to six months' worth of living expenses saved in an easily accessible account. This fund acts as a financial safety net for unexpected job loss, medical emergencies, or home repairs. For instance, if your new home needs a sudden repair, having funds readily available means you won't have to go into debt. Even small things like needing a new tool from Valley City Hardware & Home can be managed easily with a little financial cushion.

Moving itself can often uncover unexpected costs. You might need new furniture to fit your space, or perhaps a winter coat that's warmer than anything you owned before. Having a buffer in your budget for these 'settling in' expenses can prevent stress and help you feel more secure in your new environment.

Setting Up Local Banking & Services

One of the first financial tasks after moving should be to establish local banking relationships. Opening an account with a local bank or credit union can simplify your finances, making it easier to pay local bills and access services. Many institutions offer competitive rates and personalized service. For example, Sheyenne Valley Bank (a hypothetical local bank) could be a good option for managing your day-to-day banking needs, setting up direct deposit, and even exploring local loan options. They can also offer insights into the local economic landscape.

Beyond banking, consider updating your address for all financial accounts, credit cards, and subscriptions. This ensures you receive important mail and prevents any service interruptions. Setting up automatic payments for your new utilities and housing costs can also streamline your budget management and help you avoid late fees.

Exploring Local Financial Resources & Support

Valley City, like many close-knit communities, offers various resources that can support your financial well-being. Knowing where to look can make a big difference.

Community Programs & Local Employment Opportunities

Connecting with the community can lead to both social and financial benefits. Local organizations, churches, and the Valley City Area Chamber of Commerce (hypothetical, but typical for small towns) are excellent places to learn about community programs, job fairs, and networking events. These can be invaluable if you're looking for employment or simply want to integrate into the local economy. The Chamber can often provide information on local businesses that are hiring or resources for starting your own venture. Additionally, many community programs offer support for families, seniors, or those needing a little extra help, which can indirectly impact your budget by providing services or educational opportunities.

For those seeking employment, research key industries in Valley City, such as education (Valley City State University is a major employer), healthcare, agriculture, and manufacturing. The local job market might be different from what you're used to, so understanding the demand and typical salary ranges is important for budgeting and career planning.

Connecting with Financial Advisors

Even with a solid plan, navigating a new financial landscape can be complex. Consider consulting with a local financial advisor. They can offer tailored advice on everything from investment strategies to retirement planning, taking into account North Dakota's specific tax laws and economic environment. A local advisor will also have a deeper understanding of the community and can help you align your financial goals with your new life in Valley City. Whether you're planning for a child's education, saving for a future home upgrade, or just want to ensure your finances are in good order, professional guidance can provide peace of mind and help you optimize your financial journey.

Making a move to Valley City, ND, is an exciting chapter, and with careful financial planning, it can be a truly rewarding one. By taking the time to budget for moving expenses, understand housing and daily costs, and plan for your long-term financial health, you're setting yourself up for success. Valley City welcomes you with open arms and a community ready to support your new beginning. Embrace the journey, make smart financial choices, and enjoy all that the 'City of Bridges' has to offer!

Frequently Asked Questions

What are the typical upfront costs when moving to Valley City, ND?

When moving to Valley City, typical upfront costs include moving expenses (professional movers, truck rental, packing supplies), security deposits and first month's rent for renters, or a down payment and closing costs for homebuyers. Don't forget potential utility connection fees and temporary housing if your new home isn't immediately ready.

Is it more affordable to rent or buy a home in Valley City, ND?

The affordability of renting versus buying in Valley City depends on your individual financial situation and long-term goals. Generally, Valley City offers a more affordable housing market compared to larger metropolitan areas, making homeownership accessible for many. Renting provides flexibility, while buying allows you to build equity. It's best to research current market prices for both options and consult with local real estate professionals to determine what fits your budget and lifestyle.

What are the average utility costs in Valley City, ND?

Average utility costs in Valley City include electricity, natural gas (which can be higher in winter months due to heating needs), water, sewer, and trash removal. Internet and cable services are additional monthly expenses. While specific costs vary based on household size and usage, contacting local providers for average rates for properties similar to yours can help you budget accurately.

Are there financial resources or support systems for newcomers in Valley City?

Yes, Valley City offers various community-based support systems. The Valley City Area Chamber of Commerce is a great resource for local business information and networking. Community centers and local organizations often provide programs and events that can help you connect and find support. For personalized financial guidance, local financial advisors can offer insights into the region's economic landscape and help you plan your finances effectively.

How can I budget for unexpected expenses when relocating to Valley City?

To budget for unexpected expenses during your relocation to Valley City, it's crucial to establish and maintain an emergency fund. Aim to save at least three to six months' worth of living expenses in an easily accessible account. Additionally, build a buffer into your initial moving budget for 'settling in' costs like unexpected home repairs, new furniture, or items needed to adjust to the local climate. This financial cushion will provide peace of mind and help you manage unforeseen challenges.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.