Retirement often brings a welcome shift in pace, but it also necessitates a re-evaluation of one's financial landscape. For many seniors in Battle Lake, MN, the family home, once a hub of activity, can become a significant financial burden and an asset ripe for strategic optimization. As a market analyst, my observations consistently point to downsizing as a powerful tool for achieving enhanced financial freedom and a more comfortable retirement. This article delves into the financial implications and strategic approaches to downsizing specifically tailored for Battle Lake seniors, leveraging local market insights and practical advice. Learn more about Downsizing in Battle Lake, MN: Senior Living Options and....

The Financial Imperative for Downsizing in Retirement

The decision to downsize is rarely purely emotional; it is increasingly a calculated financial move. For retirees, the equity tied up in a larger home represents a substantial, often untapped, resource. Moreover, the ongoing costs of maintaining a larger property—taxes, insurance, utilities, and repairs—can significantly erode retirement savings. Data from the National Association of Realtors indicates that older adults often hold the most equity in their homes, making it a prime asset for strategic leverage.

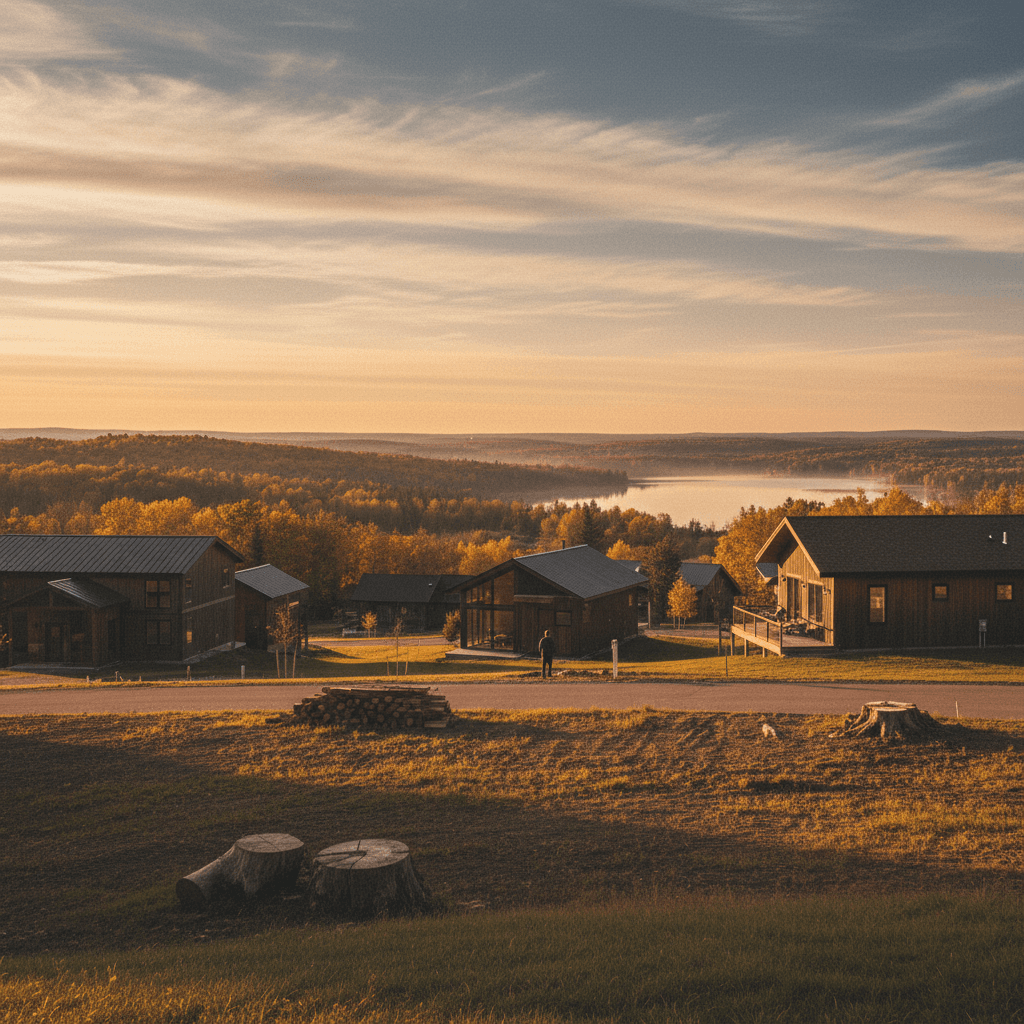

Understanding Battle Lake's Real Estate Market

Battle Lake's real estate market, characterized by its unique blend of charming small-town living and serene lakeside properties, presents specific opportunities and considerations for downsizing seniors. While national trends show a slight cooling in some markets, demand for accessible, well-maintained homes in desirable communities like Battle Lake remains robust. Properties with modern amenities, single-level living options, and proximity to local conveniences tend to attract strong buyer interest. Recent market analysis for Otter Tail County shows a steady appreciation in property values over the last decade, with a median home price growth that outpaces inflation, suggesting a favorable environment for sellers. However, inventory levels can fluctuate, influencing both pricing and time on market. Understanding these local nuances is crucial for timing a sale effectively and maximizing returns. Learn more about Downsizing in Battle Lake, MN: A Guide to Retirement....

The Cost-Benefit Analysis of Smaller Living

Beyond unlocking equity, downsizing directly impacts monthly expenditures. A smaller home typically translates to lower property taxes, reduced utility bills (heating, cooling, water), and less expensive homeowners insurance. Furthermore, the cost and effort associated with maintenance and repairs are significantly diminished. Consider a typical 2,500 sq ft home versus a 1,200 sq ft home: the difference in annual maintenance costs alone can amount to thousands of dollars, representing a substantial boost to disposable income. This financial liberation allows Battle Lake seniors to allocate more resources towards healthcare, travel, leisure activities, or simply bolstering their emergency funds, providing a greater sense of security and flexibility in their golden years. Learn more about Is Battle Lake, MN Affordable? A Breakdown of Cost of....

Unlocking Equity: Selling Your Current Battle Lake Home

The primary financial benefit of downsizing is the ability to convert illiquid home equity into liquid assets. For many, this means a significant cash infusion that can fund retirement, pay off debts, or create an income stream. Strategic selling is key to maximizing this outcome.

Maximizing Home Value in a Competitive Market

To achieve the best possible sale price in Battle Lake, a proactive approach to home preparation is essential. Minor updates can yield significant returns. For instance, fresh paint, decluttering, and professional staging can enhance a home's appeal. Focusing on key areas like kitchens and bathrooms, even with modest renovations, can increase perceived value. Data suggests that properties that are well-maintained and presented often sell faster and closer to their asking price, even in a competitive market. Furthermore, highlighting unique Battle Lake features, such as proximity to Battle Lake Parks & Recreation Department facilities or lake access points, can appeal to specific buyer segments. Engaging with a local real estate professional, such as the experts at Battle Lake Realty Group, who possess deep knowledge of Battle Lake's specific neighborhoods and buyer preferences, is paramount.

Navigating the Selling Process with Financial Prudence

Selling a home involves various costs, including realtor commissions, closing costs, and potential capital gains taxes. Understanding these expenses upfront is crucial for accurate financial planning. While capital gains tax exemptions exist for primary residences, consulting with a tax advisor is highly recommended to understand your specific situation. A careful review of market comparables will help set a realistic asking price, avoiding overpricing that can lead to prolonged market time and subsequent price reductions. Negotiation skills, either directly or through your agent, will also play a role in securing favorable terms. Planning for interim housing, if necessary, and budgeting for moving expenses are also vital components of a financially sound selling strategy. Professional services like Battle Lake Moving Solutions can streamline the physical transition, allowing seniors to focus on financial aspects. Learn more about Budgeting for Your Move: A Financial Guide to Relocating....

Exploring Downsizing Options in Battle Lake

Battle Lake offers a range of housing options that cater to the needs and preferences of downsizing seniors. The choice depends on lifestyle, financial capacity, and long-term care considerations.

Condos, Townhomes, and Smaller Single-Family Residences

Many seniors find smaller single-family homes, often with fewer stairs and smaller yards, to be an ideal compromise. These properties offer independence with reduced maintenance. Battle Lake has several neighborhoods that feature such homes, providing a sense of community without the extensive upkeep of larger estates. Alternatively, the region is seeing a growing interest in condominium and townhome developments, which often come with homeowners' association (HOA) fees that cover exterior maintenance, landscaping, and sometimes even snow removal. While these fees add to monthly expenses, they alleviate the physical burden and unpredictable costs of homeownership, allowing for a more predictable budget and greater freedom to enjoy Battle Lake's amenities. For those seeking a vibrant social life, the Battle Lake Senior Center offers a variety of programs and events.

The Appeal of Independent Senior Living Communities

For some Battle Lake seniors, the most appealing downsizing option is an independent senior living community. While less prevalent in very small towns, nearby larger communities offer options that provide an all-inclusive lifestyle with meals, activities, transportation, and sometimes even light housekeeping. These communities can be an excellent choice for those who prioritize social engagement and convenience, and where the financial calculations often involve comparing the all-in cost of community living against the combined costs of maintaining a home plus independent living expenses. While the upfront costs might seem higher, the comprehensive services often lead to a simplified and often more economical lifestyle when all factors are considered, particularly for those who would otherwise pay for many of these services individually.

Financial Planning for a Seamless Transition

A successful downsizing journey is underpinned by meticulous financial planning. It's not just about selling one home and buying another; it's about optimizing your entire financial picture for retirement.

Budgeting for Moving Costs and New Expenses

Beyond the sale and purchase of property, there are numerous transitional costs to consider. Moving expenses can range from a few hundred dollars for a DIY move to several thousands for full-service movers. Utility hook-up fees, new furniture, and unexpected repairs in the new home can add up. It is prudent to create a detailed budget that accounts for all these potential expenditures. Furthermore, assess how your monthly budget will shift. While property taxes and utility bills may decrease, new expenses such as HOA fees, community amenity fees, or increased dining out might emerge. A thorough financial review with a trusted advisor can help map out these changes and ensure a smooth transition without financial surprises. Local institutions like Battle Lake Community Bank can assist with financial guidance and services tailored to seniors.

Estate Planning and Asset Management Considerations

Downsizing provides an opportune moment to review and update estate plans. With a significant amount of equity potentially converted to cash, questions around asset allocation, investment strategies, and gifting may arise. Revisiting wills, trusts, and power of attorney documents ensures that your financial wishes align with your current circumstances and future goals. For instance, liquidating a large asset might impact inheritance plans or charitable giving. Consulting with an estate planning attorney, such as those at Battle Lake Legal Services, and a financial planner is crucial to ensure that the financial gains from downsizing are managed effectively and contribute to your long-term legacy. This holistic approach ensures that the benefits of downsizing extend beyond immediate financial relief to encompass comprehensive wealth management.

Lifestyle Enhancements and Community Integration

Downsizing is not merely a financial transaction; it's a lifestyle choice that can significantly enhance the quality of retirement, especially in a community as engaging as Battle Lake.

Embracing Battle Lake's Amenities on a Downsized Budget

With reduced housing costs and a potentially larger liquid asset base, Battle Lake seniors can more readily enjoy the vibrant life the town offers. Whether it's dining at local eateries, pursuing hobbies, or taking advantage of the natural beauty of the lakes, financial freedom provides greater access to these experiences. For example, the savings from a smaller home could fund regular visits to Battle Lake Market for fresh, local produce, or allow for more frequent participation in community events. The focus shifts from property maintenance to personal enrichment and engagement. This reorientation of resources allows for a more active and fulfilling retirement, where experiences take precedence over expenditures on a large, underutilized home.

Connecting with Local Senior Resources and Services

Battle Lake and the surrounding Otter Tail County area offer a network of resources designed to support seniors. From healthcare services available through facilities like Lake Region Healthcare to social programs and volunteer opportunities, these resources contribute to a rich and supportive environment. Downsizing can free up time and energy previously spent on home maintenance, allowing seniors to more fully engage with these community offerings. Whether it's joining a local club, volunteering for a cause, or simply enjoying the camaraderie of peers, Battle Lake provides ample opportunities for connection and continued personal growth. The financial flexibility gained through downsizing empowers seniors to fully embrace these aspects of community life, fostering a retirement rich in experiences and social interaction.

For Battle Lake seniors, downsizing is more than just moving to a smaller home; it is a strategic financial decision that can unlock significant equity, reduce ongoing expenses, and provide a robust foundation for a financially secure and enjoyable retirement. By understanding the local market, prudently planning for the transition, and thoughtfully choosing a new living arrangement, retirees can transform their housing assets into a powerful tool for achieving genuine financial freedom. The expert analysis consistently affirms that such a move, when approached strategically, leads to a more flexible, less burdened, and ultimately more fulfilling retirement experience in our cherished Battle Lake community.

Related Articles

Frequently Asked Questions

What are the primary financial benefits of downsizing in Battle Lake, MN?

The primary financial benefits include unlocking significant home equity, reducing ongoing housing expenses such as property taxes, insurance, utilities, and maintenance costs, and potentially lowering overall living expenses. This frees up capital for retirement savings, investments, or discretionary spending, enhancing financial security.

How can I maximize the sale price of my Battle Lake home when downsizing?

To maximize your home's sale price, consider strategic updates like fresh paint, decluttering, and professional staging. Focus on key areas like kitchens and bathrooms. Highlight local amenities and lake proximity. Most importantly, partner with a local real estate agent who understands the Battle Lake market to price your home competitively and market it effectively.

What are the typical costs associated with selling and moving in Battle Lake?

Costs include realtor commissions (typically 5-6% of the sale price), closing costs (which can range from 2-5% of the sale price), potential capital gains taxes (consult a tax advisor), and moving expenses. It's crucial to budget for these from the outset to avoid unexpected financial burdens during the transition.

Are there specific senior living communities or housing options in Battle Lake suitable for downsizing?

Battle Lake offers various options, including smaller single-family homes, often with features like single-level living. The region also sees interest in townhomes and condos, which reduce maintenance responsibilities. While dedicated large-scale senior living communities might be more prevalent in larger nearby towns, Battle Lake provides a supportive environment with local services and a strong sense of community for independent seniors.

How does downsizing impact estate planning and long-term asset management?

Downsizing often converts illiquid home equity into liquid assets, necessitating a review of your estate plan. This is an ideal time to update wills, trusts, and consider how the increased liquidity affects inheritance plans or charitable giving. Consulting with an estate planning attorney and a financial advisor ensures that your assets are managed according to your long-term goals and legacy wishes.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.