As life progresses, many seniors in Casselton, ND, find themselves contemplating a significant life transition: downsizing and planning for retirement living. This pivotal stage often brings a complex array of financial considerations, from optimizing assets to navigating housing options and ensuring long-term security. The decision to downsize is not merely about moving to a smaller space; it's a strategic financial maneuver that can unlock equity, reduce recurring expenses, and streamline one's lifestyle for a more comfortable and secure retirement. In Casselton, a community known for its welcoming atmosphere and steady growth, understanding the local market dynamics and available resources is paramount. This comprehensive guide will delve into the critical financial aspects of senior living and downsizing in Casselton, providing data-driven insights and practical advice to help you make informed decisions for your future. Learn more about Retiring in Casselton, ND: A Guide to Downsizing and....

Understanding the Financial Landscape of Downsizing in Casselton

Market Trends and Property Values in Casselton

Casselton, a vibrant community within Cass County, has experienced consistent growth, making its real estate market a key factor for seniors considering downsizing. Over the past five years, the median home value in Casselton has seen an approximate increase of 15-20%, a solid indicator for homeowners looking to leverage their equity. For instance, a home purchased two or three decades ago could represent a substantial asset, offering significant capital for retirement or reinvestment. Current market analysis suggests that while inventory can fluctuate, demand for well-maintained properties remains strong. This favorable environment means that seniors often find themselves in a strong selling position, potentially realizing substantial gains that can fund their next chapter. However, understanding the nuances of local property assessments and potential selling costs—such as realtor fees, staging, and minor repairs—is crucial for an accurate financial projection. Consulting with a local real estate expert, such as those at Casselton Realty Group, can provide tailored insights into current market conditions and optimal listing strategies. Learn more about Investing in Casselton, ND: A Financial Guide to the....

Cost Analysis: Selling Your Current Home vs. New Living Arrangements

The financial equation of downsizing extends beyond the sale price of your current home. A thorough cost analysis must encompass all associated expenditures and potential savings. Selling costs typically range from 6-10% of the sale price, including real estate commissions, title insurance, and other closing fees. Moving expenses, while variable, can add another layer, particularly if professional movers or storage solutions are required. However, the financial benefits often outweigh these initial outlays. Moving to a smaller home or a senior living community can drastically reduce monthly utility bills, property taxes, and the often-overlooked costs of home maintenance. Data suggests that maintaining a larger, older home can consume 1-4% of its value annually in repairs and upkeep. By downsizing, seniors can eliminate these substantial expenditures, freeing up capital for lifestyle enhancements, travel, or bolstering their retirement savings. For example, a shift from a 2,500 sq ft family home to a 1,200 sq ft condo could save hundreds, if not thousands, of dollars annually in heating, cooling, and property taxes alone, especially considering Casselton's property tax rates. Learn more about Budgeting for Fun: The Cost of Entertainment and Living....

Exploring Senior Living Options and Their Costs

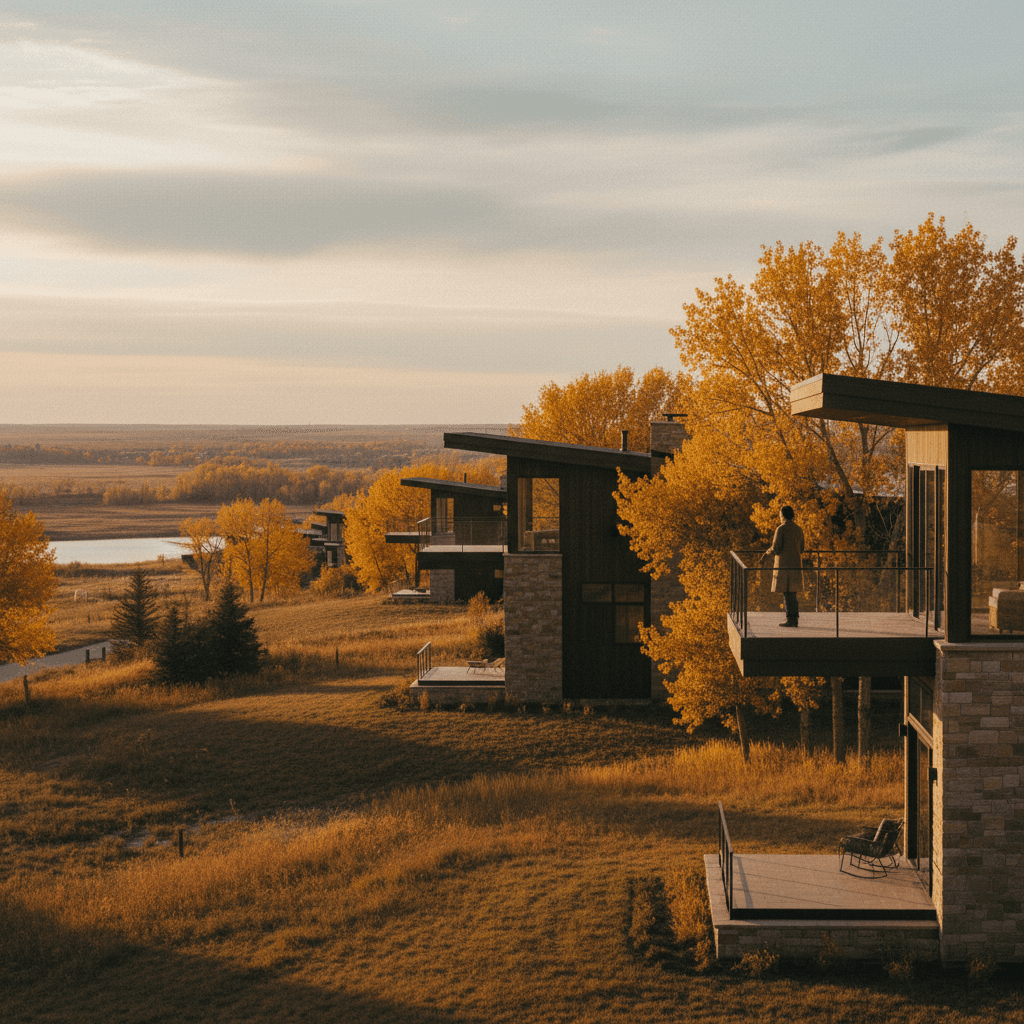

Independent Living Communities and Their Financial Models

For active seniors in Casselton seeking a vibrant, maintenance-free lifestyle, independent living communities offer an attractive option. These communities are designed for individuals who can live independently but desire access to amenities, social activities, and often, prepared meals. Financial models for independent living can vary significantly. Some operate on a rental basis, similar to an apartment, with monthly fees covering rent, utilities, and access to services. Others may require an upfront 'buy-in' fee, which can be partially refundable, coupled with ongoing monthly service charges. For example, a typical independent living apartment in a well-appointed facility might range from $2,500 to $4,500 per month, depending on size and included services. This comprehensive fee often covers utilities, housekeeping, transportation, and a robust calendar of social events, effectively consolidating many previous household expenses into a single, predictable payment. The convenience and community aspect often present a compelling value proposition, allowing seniors to enjoy their retirement without the burdens of homeownership. Exploring options like the hypothetical Riverbend Retirement Village could provide a clearer picture of local offerings.

Assisted Living and Long-Term Care Considerations

As needs evolve, some seniors may require more comprehensive support, leading them to consider assisted living or long-term care facilities. Assisted living communities provide assistance with daily activities such as bathing, dressing, and medication management, while promoting independence. Long-term care facilities, or nursing homes, offer 24-hour skilled nursing care for individuals with more significant medical needs. The financial implications for these levels of care are substantial. In North Dakota, the median cost for assisted living can range from $4,000 to $6,000 per month, while a private room in a nursing home can exceed $10,000 per month. These costs are typically paid privately, through long-term care insurance, or in some cases, through Medicaid for those who meet specific income and asset thresholds. Medicare generally covers short-term skilled nursing care after a hospitalization but does not cover custodial long-term care. Proactive financial planning, including the potential for long-term care insurance or careful asset allocation, is critical to addressing these potential future expenses. Early consultation with financial advisors specializing in senior care, such as those at Casselton Wealth Management, is highly recommended to understand strategies for mitigating these significant costs and securing peace of mind.

Strategic Financial Planning for Retirement in Casselton

Maximizing Retirement Income and Asset Management

Effective financial planning is the cornerstone of a secure retirement, particularly when navigating the transitions of downsizing. Maximizing retirement income involves a holistic review of all available resources. Social Security benefits often form a significant portion of income for many seniors, and understanding optimal claiming strategies—for example, delaying benefits until age 70 for higher monthly payments—can yield substantial long-term gains. Pensions, if applicable, and distributions from retirement accounts like 401(k)s and IRAs also play a crucial role. For those with substantial assets, strategic investment management becomes paramount. A common approach for retirees involves shifting from aggressive growth-oriented portfolios to those that prioritize income generation and capital preservation, often incorporating a mix of bonds, dividend stocks, and potentially real estate income. The goal is to create a sustainable income stream that can comfortably cover living expenses in Casselton, while minimizing market volatility risks. Understanding Required Minimum Distributions (RMDs) from retirement accounts, typically starting at age 73, is also vital to avoid penalties and ensure efficient tax planning. A well-structured plan can ensure that your assets work effectively for you throughout your retirement years. Learn more about Navigating Closing Costs and Property Laws in Casselton, ND.

Estate Planning and Legacy Considerations

Beyond daily financial management, downsizing and retirement present an opportune moment to review and update your estate plan. A comprehensive estate plan ensures that your assets are distributed according to your wishes, minimizing family disputes and potential tax burdens. Key components include a will, which dictates asset distribution; trusts, which can offer greater control over how and when assets are distributed, and can avoid probate; and powers of attorney for financial and healthcare decisions. The act of selling a significant asset like a home and potentially consolidating other assets can have profound implications for your estate. For instance, proceeds from a home sale might be invested differently, or new properties might be acquired (e.g., a smaller condo), all of which should be reflected in updated legal documents. Moreover, healthcare directives, such as living wills and durable powers of attorney for healthcare, are essential to ensure your medical wishes are honored. Consulting with an estate planning attorney, such as the professionals at Casselton Legal Services, is indispensable to ensure all documents are current, legally sound, and reflective of your current financial situation and future desires. Learn more about Building Wealth: Why Real Estate Investing in Casselton,....

Navigating Legal and Tax Implications

Property Taxes and Senior Exemptions in North Dakota

One of the most significant financial benefits of downsizing for seniors in Casselton can be the reduction in property tax obligations. North Dakota offers several programs designed to assist seniors with their property taxes, which can be a substantial recurring expense. While Casselton maintains its local tax rates, the overall assessment on a smaller, less valuable property will naturally be lower. Additionally, North Dakota provides a Homestead Property Tax Credit for homeowners who are elderly (65 or older) or have a disability, and meet certain income requirements. This program can significantly reduce the property tax burden, making smaller, more affordable homes even more attractive. Understanding eligibility criteria and the application process for these credits is vital. For example, a senior couple with a combined income below a certain threshold might qualify for a reduction, which can translate into hundreds of dollars in annual savings. These savings, when combined with reduced utility and maintenance costs, contribute substantially to a more financially comfortable retirement. It is advisable to consult with the Cass County Tax Equalization Department or a local tax professional to ascertain specific eligibility and application procedures.

Legal Counsel and Documentation for Downsizing

The process of downsizing involves numerous legal documents and contracts, from the sale agreement of your current home to the purchase or lease agreement of your new residence. Ensuring all legal aspects are handled correctly is paramount to protect your financial interests. This includes reviewing purchase agreements, understanding property deeds, and navigating title transfers. For those selling their long-term family home, there might be complex considerations regarding property boundaries, easements, or historical records that require meticulous attention. Furthermore, if you are considering a senior living community, their residency agreements can be lengthy and complex, detailing everything from services provided to fee structures and termination clauses. Having an independent legal review of these documents by an attorney specializing in real estate or elder law is highly advisable. This ensures you fully understand your rights and obligations, and that all transactions comply with North Dakota state laws. This preventative measure can save substantial time, money, and stress in the long run, safeguarding your assets during this significant transition.

Local Resources and Support for Seniors in Casselton

Financial Advisors Specializing in Senior Planning

Access to qualified financial expertise is invaluable for seniors navigating the complexities of downsizing and retirement. While national firms exist, a local financial advisor in Casselton offers the distinct advantage of understanding the specific economic nuances of the region, including local property values, tax regulations, and community resources. These professionals can provide personalized guidance on a range of topics, including optimizing retirement portfolios, managing income streams, evaluating long-term care insurance options, and integrating the proceeds from a home sale into a comprehensive financial plan. They can help seniors assess their current financial standing, project future needs, and develop strategies to achieve their retirement goals. A knowledgeable advisor can also assist in connecting seniors with other local professionals, such as elder law attorneys or real estate specialists, creating a cohesive support network. Seeking out firms with a proven track record and certifications relevant to elder planning is a prudent step in securing your financial future. Consider reaching out to a local institution like Casselton Community Bank for their wealth management services or referrals to trusted local advisors.

Community Programs and Services

Casselton is a community that values its senior population, offering various programs and services designed to support their well-being and independence. The Casselton Senior Center, for instance, often serves as a hub for social activities, educational workshops, and access to vital resources. These centers can provide information on local transportation services, meal programs, and health and wellness initiatives. Beyond direct services, community programs can offer invaluable social connections, helping seniors maintain an active and engaged lifestyle, which is crucial for overall health and happiness in retirement. They might also host seminars on topics relevant to seniors, such as navigating Medicare, understanding wills, or managing personal finances. Engaging with these local resources can provide not only practical assistance but also a strong sense of community and belonging, enriching the retirement experience in Casselton. Information on various state and local benefits can also often be found through these community channels, ensuring seniors are aware of all available support.

Downsizing and planning for retirement in Casselton, ND, represents a significant life chapter filled with both opportunities and complexities. By approaching this transition with a strategic financial mindset, seniors can unlock substantial equity, reduce ongoing expenses, and secure a comfortable, fulfilling retirement. From understanding the local real estate market and exploring diverse senior living options to meticulously planning your finances and leveraging community resources, each step is crucial. The insights provided here, coupled with personalized advice from local professionals in real estate, finance, and law, can empower you to make informed decisions. Casselton offers a supportive environment for seniors, and with diligent preparation, your retirement years can be a period of peace, prosperity, and continued enjoyment within this welcoming North Dakota community.

Frequently Asked Questions

What are the primary financial benefits of downsizing for seniors in Casselton?

Downsizing in Casselton can offer several financial benefits, including unlocking significant home equity, reducing monthly expenses like property taxes, utilities, and maintenance costs, and potentially freeing up capital for retirement savings or lifestyle enhancements. The local real estate market's appreciation can also mean a favorable selling position for many seniors.

How do property taxes for seniors work in North Dakota, and how can downsizing affect them?

North Dakota offers a Homestead Property Tax Credit for homeowners aged 65 or older, or those with disabilities, who meet specific income requirements. Downsizing to a smaller, less valuable property in Casselton will naturally lead to lower property tax assessments. When combined with potential eligibility for the Homestead Credit, seniors can significantly reduce their annual property tax burden.

What are the typical costs associated with different senior living options in Casselton, like independent versus assisted living?

Independent living communities in Casselton typically range from $2,500 to $4,500 per month, often covering rent, utilities, and amenities. Assisted living, providing more daily support, can range from $4,000 to $6,000 per month. Long-term care facilities, offering 24-hour skilled nursing, can exceed $10,000 per month. These costs vary based on services, location, and facility type.

What role does estate planning play when a senior downsizes their home in Casselton?

Downsizing is an ideal time to review and update your estate plan. Selling a home and reallocating assets can impact your will, trusts, and powers of attorney. Proper estate planning ensures your assets are distributed according to your wishes, minimizes tax implications, and reflects any new living arrangements or financial strategies implemented after downsizing.

Are there local resources in Casselton that can help seniors with financial planning for retirement and downsizing?

Yes, Casselton offers local resources such as financial advisors specializing in senior planning who understand the regional market. Community institutions like local banks may offer wealth management services or referrals. Additionally, the Casselton Senior Center often provides information on various programs, workshops, and services relevant to seniors' financial and social well-being.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.