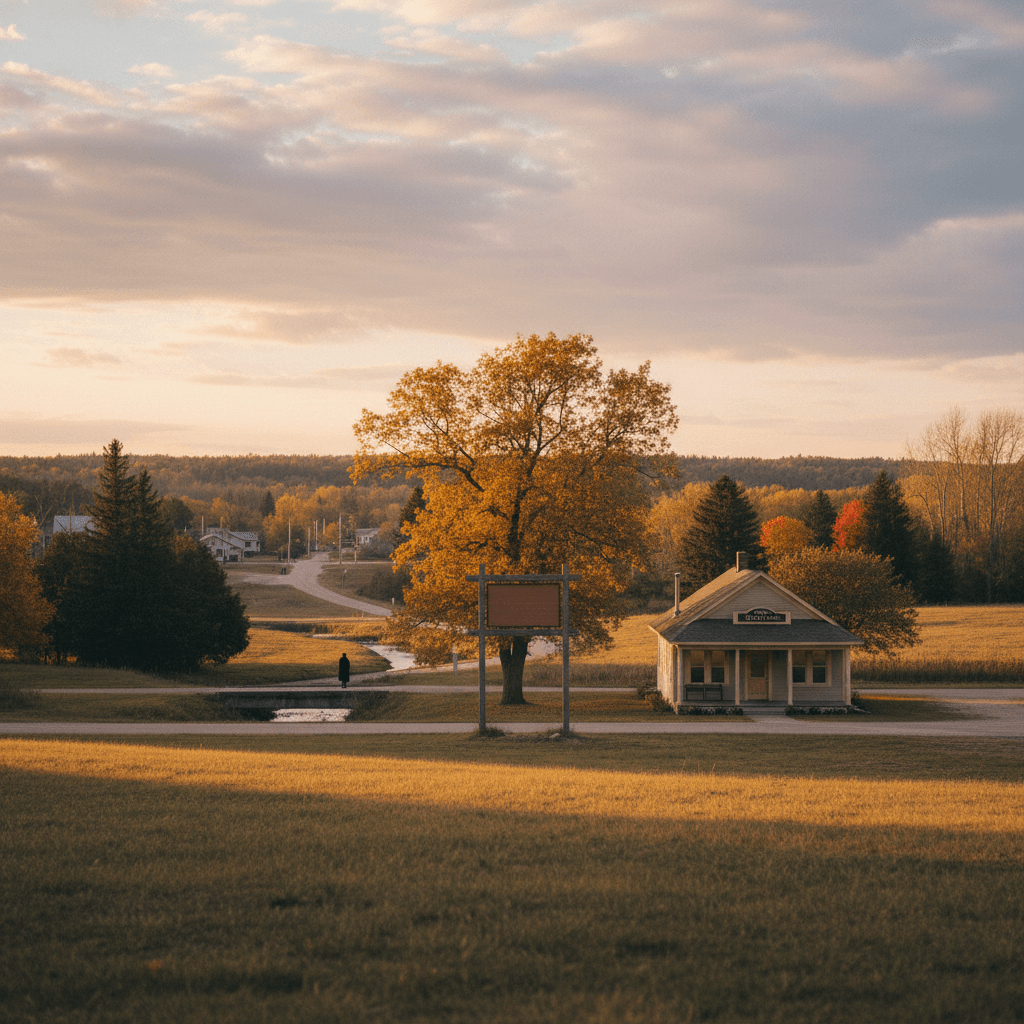

Buying your first home is an incredibly exciting journey, and for many, it’s the biggest financial decision they’ll ever make. If you’re dreaming of settling down in a charming Minnesota town like Vergas, with its beautiful lakes and tight-knit community, you’re in for a treat! But before you start picturing yourself enjoying a sunset over Lake Sybil or exploring the local shops, it’s crucial to get your financial ducks in a row. Don't worry, it might seem like a lot, but by breaking it down, you'll be well on your way to homeownership in Vergas.

Getting Your Finances in Order: The First Steps to Homeownership in Vergas

Think of this as your financial warm-up. Just like you wouldn't run a marathon without training, you shouldn't jump into home buying without preparing your personal finances. This foundational work will not only make the process smoother but can also save you a significant amount of money in the long run.

Boosting Your Credit Score

Your credit score is like your financial report card, and lenders use it to determine how reliable you are as a borrower. A higher score typically means lower interest rates on your mortgage, which translates to thousands of dollars saved over the life of your loan. Before you even think about looking at homes in Vergas, take some time to review your credit report. You can get free copies annually from AnnualCreditReport.com. Look for any errors and dispute them. Pay bills on time, keep credit card balances low, and avoid opening new lines of credit.

Saving for Your Down Payment and Closing Costs

This is often the biggest hurdle for first-time buyers. While 20% down isn't always required, having a solid down payment can significantly reduce your monthly payments and eliminate the need for private mortgage insurance (PMI). Beyond the down payment, you'll also need to budget for closing costs, which typically range from 2% to 5% of the loan amount. These include fees for appraisals, inspections, title insurance, and more. Start saving early and consider setting up an automatic transfer to a dedicated savings account. Even small, consistent contributions add up! Learn more about Navigating Mortgage Options and Home Financing in....

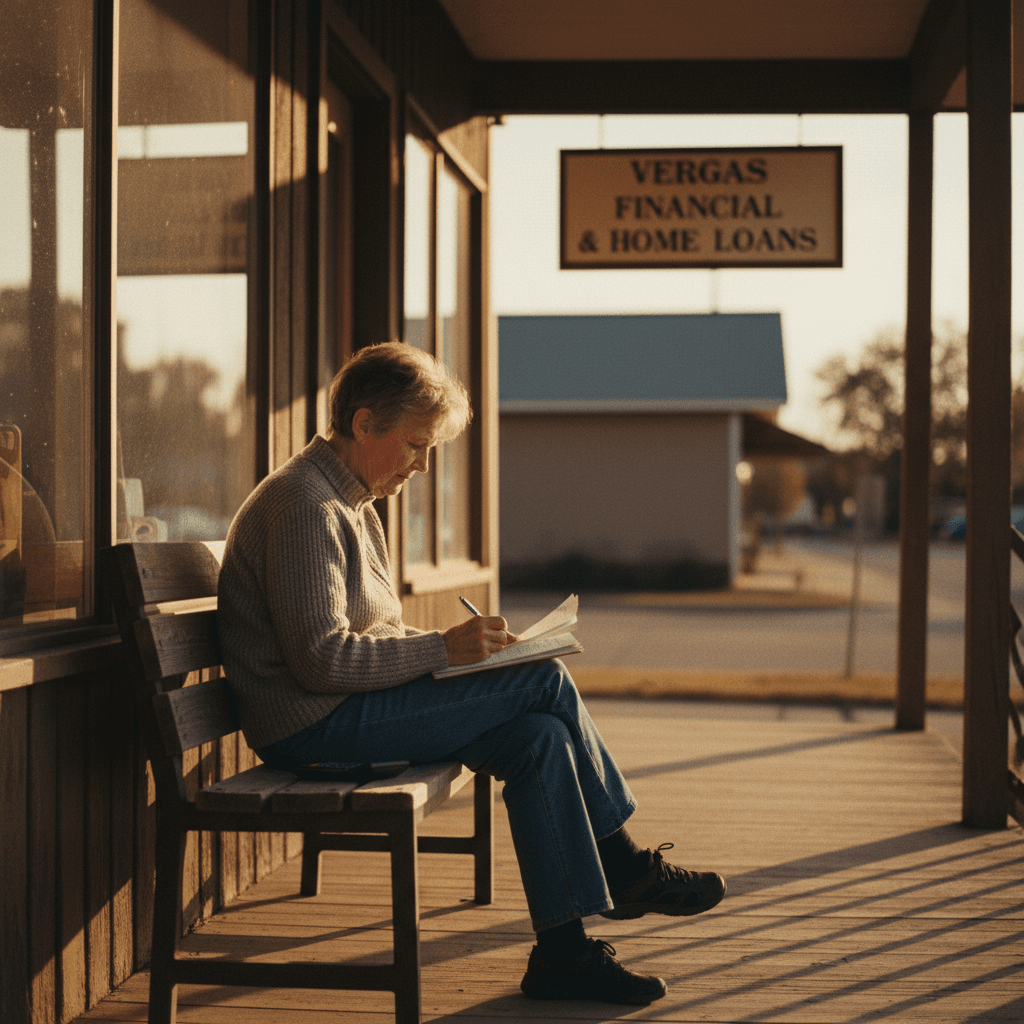

Navigating Mortgage Options for Your Vergas Home

Once your finances are looking good, it's time to explore the world of mortgages. This is where many first-time buyers feel overwhelmed, but understanding your options is key to making an informed decision for your Vergas home. Learn more about Navigating Home Loans: Mortgage Tips for Buyers in....

Understanding Different Loan Types

There are several types of mortgage loans, each with its own benefits. For first-time buyers, government-backed loans like FHA (Federal Housing Administration) loans are popular because they require lower down payments (as little as 3.5%). VA (Department of Veterans Affairs) loans offer incredible benefits for eligible service members and veterans, often with no down payment required. Conventional loans are also an option, typically for those with strong credit and a larger down payment. It's wise to discuss these options with a local lender, like the folks at Vergas Community Bank, who understand the local market nuances. Learn more about First-Time Buyer Financing: How to Afford a Home in....

Pre-Approval: Your Key to the Vergas Market

Getting pre-approved for a mortgage is a critical step. It’s not the same as pre-qualification; pre-approval means a lender has thoroughly reviewed your financial information and determined how much they are willing to lend you. This gives you a clear budget and shows sellers in Vergas that you’re a serious and qualified buyer, which can be a huge advantage in a competitive market. It also helps you understand what your monthly payments will look like, so you can factor in property taxes and potential insurance costs for homes around Vergas Lake or in the charming downtown area. Learn more about Securing the Best Mortgage Rates: A Financial Guide for....

Beyond the Mortgage: Essential Financial Considerations in Vergas

Your financial journey doesn't end once you secure a mortgage. Homeownership comes with ongoing responsibilities, and it's important to budget for them from day one.

Property Taxes and Insurance: What to Expect

As a homeowner in Vergas, you'll be responsible for property taxes, which contribute to local services like schools and infrastructure. These can vary significantly based on the home's value and location. Your mortgage lender will often collect these as part of your monthly payment and hold them in an escrow account. Homeowner's insurance is also mandatory and protects your investment from unforeseen events like fires or storms. Given Vergas's proximity to lakes, it's also worth investigating if flood insurance might be a consideration for certain properties. Don't hesitate to reach out to local experts like Vergas Insurance Solutions to get quotes and understand your options.

Budgeting for Life in Vergas

Beyond your mortgage, taxes, and insurance, there are other costs to consider. Utilities, home maintenance, and unexpected repairs can add up. It's a good idea to set aside an emergency fund specifically for home-related expenses. Living in Vergas means you'll want to enjoy the local lifestyle – perhaps a visit to the famous Loon Lake or supporting local businesses like The Vergas General Store. Factor these lifestyle costs into your budget so you can truly enjoy your new community without financial stress. Learn more about Balancing Lifestyle and Budget: Mortgage Options for....

Making Your Offer and Closing the Deal

With your finances in order and a pre-approval in hand, you're ready to find your dream home in Vergas!

Working with Local Professionals

A great real estate agent who knows the Vergas market inside and out is invaluable. They can help you find homes that fit your budget and preferences, negotiate offers, and guide you through the complexities of the purchase agreement. Similarly, having a trusted lender, like Vergas Credit Union, who understands the local economic landscape, can make a world of difference. These professionals are your allies in making smart financial decisions throughout the buying process.

What to Expect on Closing Day

Closing day is the culmination of all your hard work! This is when you'll sign all the final paperwork, transfer funds, and officially become the owner of your Vergas home. Your lender and real estate agent will guide you through this process, explaining each document. It can feel like a lot of signatures, but it’s the exciting final step before you get the keys and start making memories in your new Vergas abode.

Buying a home in Vergas, MN, is a rewarding experience, especially when you're financially prepared. By focusing on your credit, saving diligently, understanding your mortgage options, and budgeting for ongoing costs, you'll be well-equipped to navigate the journey to homeownership. Don't hesitate to lean on local experts and resources along the way. Your dream home in Vergas is within reach!

Frequently Asked Questions

What are the typical down payment requirements for a first-time homebuyer in Vergas, MN?

While a 20% down payment can help you avoid private mortgage insurance (PMI), many first-time homebuyers in Vergas utilize programs like FHA loans, which allow down payments as low as 3.5%. VA loans, for eligible veterans, often require no down payment at all. Conventional loans typically require 3-5% down, depending on your credit and the lender.

How important is a good credit score when applying for a mortgage in Vergas?

A good credit score is very important! It significantly impacts the interest rate you'll receive on your mortgage. A higher score typically leads to lower interest rates, saving you thousands of dollars over the life of the loan. Lenders in Vergas, like anywhere else, use your credit score to assess your reliability as a borrower.

What are closing costs, and how much should I budget for them when buying in Vergas?

Closing costs are various fees and expenses paid at the closing of a real estate transaction, beyond the down payment. These can include appraisal fees, inspection fees, title insurance, attorney fees, and loan origination fees. In Vergas, as elsewhere, these typically range from 2% to 5% of the total loan amount. It's crucial to budget for these in addition to your down payment.

Are there any specific first-time homebuyer programs available for Vergas residents?

While specific Vergas-only programs might be limited, Minnesota offers statewide programs that first-time homebuyers in Vergas can often utilize. The Minnesota Housing Finance Agency (MN Housing) provides various loan programs, down payment assistance, and tax credit programs designed to help first-time buyers. It's advisable to speak with a local lender or housing counselor to see which state programs you might qualify for.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.