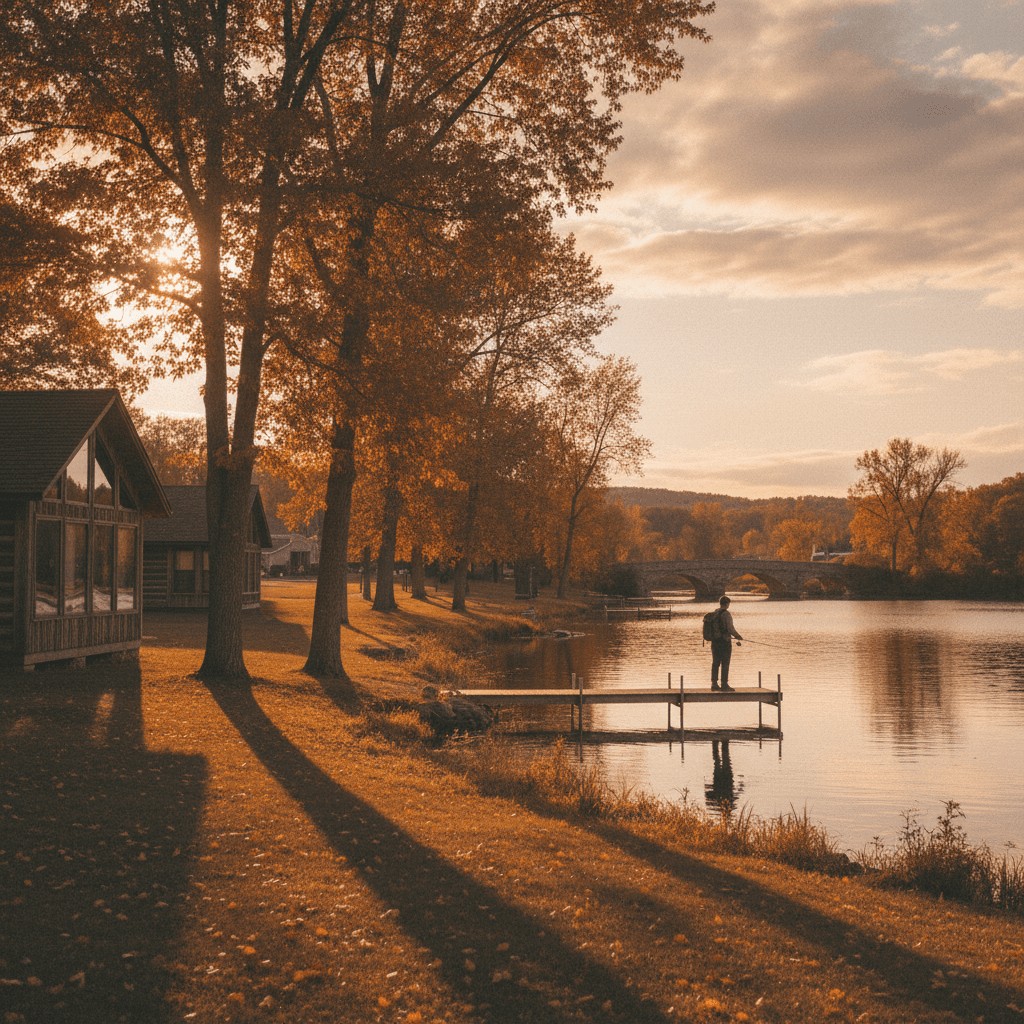

There's something truly special about the idea of owning a slice of lake life, especially in a charming Minnesota town like Perham. Known for its sparkling lakes, friendly community, and a slower pace that invites relaxation, Perham, MN, is a prime destination for those dreaming of a recreational property. But beyond the picturesque views and the promise of endless summer days, there's a practical side to this dream: the financing. Understanding the economics of purchasing a lake home or cabin in Perham is your first step toward making that dream a reality. Learn more about Why Investors Are Choosing Perham, MN: Market Insights....

Understanding Perham's Recreational Property Market

Perham isn't just a dot on the map; it's a vibrant community nestled amidst a stunning chain of lakes. When you think of Perham, images of Big Pine Lake, Little Pine Lake, Dent Lake, and Dead Lake often come to mind, each offering unique recreational opportunities, from fishing and boating to swimming and simply enjoying the tranquility. This natural beauty, combined with a welcoming small-town atmosphere, makes Perham a highly desirable location for both year-round residents and those seeking a seasonal escape. Learn more about Relocating to Perham, MN: A Complete Guide to Housing....

What Makes Perham Unique?

Beyond its abundant natural beauty, Perham boasts a community that supports a fantastic quality of life. The city offers amenities like the beautiful Perham Golf Club, which provides stunning views and a challenging course, and the popular Perham City Beach, a perfect spot for families. The downtown area is charming, with local shops and eateries that add to its appeal. When you invest in a Perham property, you're not just buying a house; you're buying into a lifestyle that includes community events, outdoor adventures, and a strong sense of belonging. This unique blend of natural assets and community spirit significantly influences property values and the overall market.

Current Market Trends and Values

The recreational property market in Perham, like many popular lake regions, can be dynamic. Factors such as limited inventory, increasing demand for escape properties, and the region's consistent appeal contribute to its value. Properties vary widely, from quaint cabins perfect for weekend getaways to luxurious lakefront estates. Understanding the current market trends, including average sale prices, days on market, and property appreciation rates, is crucial. It’s important to research recent sales of comparable properties on specific lakes to get a realistic sense of what your budget will afford. While the market can fluctuate, Perham's enduring appeal as a lake destination often provides a stable, long-term investment opportunity. Learn more about Why Real Estate Investors are Eyeing Perham, MN: Growth....

Navigating Mortgage Options for Your Lake Home

Financing a recreational property isn't always the same as financing a primary residence. While many principles overlap, there are key differences that first-time buyers of lake homes should be aware of. The goal is to find a mortgage solution that fits your financial situation and your Perham dream.

Conventional vs. Specialty Loans

For many, a conventional mortgage is the go-to option. However, if the Perham property will be a second home or a vacation home, lenders often have specific criteria. Generally, second homes are viewed as less risky than investment properties (which are bought solely for rental income) but may still require a larger down payment than a primary residence. You might also encounter slightly higher interest rates. Some lenders offer "vacation home loans" or "recreational property loans" which are tailored to these specific situations. These specialty loans can sometimes offer more flexible terms, especially if the property has unique features or is in a more remote area. It’s worth exploring these options to see what best suits your needs. Learn more about Exploring Perham, MN: A Guide to the City’s Distinct....

Down Payments and Interest Rates

When it comes to down payments, expect to put down more for a recreational property than you might for your primary residence. While 20% is often a good benchmark to avoid Private Mortgage Insurance (PMI) on a primary home, for a second home, lenders might require 20-30% down. This higher down payment mitigates the lender's risk, as a second home is often seen as a discretionary purchase that owners might default on if financial hardships arise. Interest rates for recreational properties can also be slightly higher than those for primary residences due to this perceived increased risk. However, with good credit and a stable financial history, you can still secure competitive rates. Shopping around and comparing offers from multiple lenders, especially those familiar with the Perham market, is highly recommended.

Beyond the Mortgage: Additional Costs and Considerations

A common mistake first-time recreational property buyers make is focusing solely on the mortgage payment. While crucial, it's just one piece of the financial puzzle. Owning a lake home in Perham comes with a unique set of ongoing expenses and considerations that you need to budget for.

Property Taxes and Insurance

Property taxes in Perham, like anywhere, are based on the assessed value of your property. It's essential to research the current tax rates and understand how they apply to recreational properties. These taxes contribute to local services and infrastructure, which ultimately benefit your property value and the community. Beyond taxes, insurance is a critical component of protecting your investment. Lakefront properties, in particular, may require specialized insurance policies, including flood insurance depending on the specific location and elevation, even if not in a designated flood zone. Standard homeowner's insurance might not cover all potential risks associated with water proximity, so discuss comprehensive coverage with your insurance provider. It's also wise to consider additional coverage for docks, boats, and other watercraft you might keep on the property.

Maintenance and HOA Fees

Lake homes often come with their own set of maintenance needs. Think about winterizing a cabin, maintaining a dock, landscaping for waterfront erosion, and general upkeep that might be more extensive than a typical suburban home. If your Perham property is part of a lake association or a planned community, you might also be subject to Homeowners Association (HOA) fees. These fees typically cover shared amenities like private beach access, community docks, road maintenance, or common area landscaping. While an added expense, HOA fees can also contribute to maintaining the overall quality and value of the community, ensuring your investment is well-protected. Always review the HOA documents thoroughly to understand what's covered and what your responsibilities are.

Making Your Perham Lake Dream a Reality

The journey to owning a recreational property in Perham, MN, is an exciting one. By approaching it with a clear understanding of the financial landscape, you can navigate the process confidently and make informed decisions.

Getting Pre-Approved and Working with Local Experts

The first step in any home buying process, especially for a competitive market like Perham's lakefront properties, is to get pre-approved for a mortgage. This not only gives you a clear budget but also signals to sellers that you are a serious and qualified buyer. When seeking financing, consider working with United Community Bank or First National Bank of Perham, as local lenders often have a deeper understanding of the regional market and can offer tailored solutions. Partnering with a knowledgeable local real estate agent, perhaps through Perham Area Real Estate Agents, is equally important. They can provide invaluable insights into specific lakes, neighborhoods, and property values, helping you find the perfect fit for your lifestyle and budget. Don't forget to explore local gems like Disgruntled Brewing for a taste of local life while you're visiting!

The Long-Term Investment

Owning a recreational property in Perham is more than just a place to escape; it can also be a sound long-term investment. The enduring appeal of lakefront living, coupled with the charming community of Perham, often leads to steady property appreciation over time. Furthermore, if you're not using your property year-round, you might consider renting it out as a short-term vacation rental, which can help offset ownership costs and potentially generate passive income. Always research local regulations regarding short-term rentals before making this decision. With careful planning and a clear financial strategy, your Perham lake home can offer both invaluable memories and a smart addition to your financial portfolio.

Making the move to own a piece of Perham's beautiful lake country is an exciting prospect. By understanding the financing options, preparing for all associated costs, and leveraging local expertise, you can confidently turn your dream of lake life into a tangible reality. It’s an investment in lifestyle, family memories, and a future filled with the tranquility and adventure that only Perham, MN, can offer.

Related Articles

Frequently Asked Questions

Is financing a recreational property in Perham different from a primary home?

Yes, it can be. While many core principles of mortgages apply, lenders often view recreational or second homes differently than primary residences. You might encounter requirements for a higher down payment (often 20-30%) and potentially slightly higher interest rates due to the perceived increased risk. Some specialized "vacation home loans" may also be available with specific terms tailored to these properties.

What are the typical down payment requirements for a lake home in Perham?

For a recreational property or second home in Perham, you should generally expect to put down a larger down payment than you would for a primary residence. While 20% is a common benchmark, many lenders require 20-30% of the purchase price. A higher down payment can also help you secure a more favorable interest rate and potentially avoid Private Mortgage Insurance (PMI).

Besides the mortgage, what other costs should I budget for when buying a Perham lake property?

Beyond your mortgage payment, crucial ongoing costs include property taxes, which contribute to local services in Perham, and specialized insurance. Lakefront properties may require additional coverage, such as flood insurance, and policies for docks or watercraft. You'll also need to budget for maintenance (e.g., winterizing, dock upkeep, landscaping) and potentially Homeowners Association (HOA) fees if the property is part of a managed community.

How can local Perham lenders help with financing a lake home?

Local lenders like United Community Bank or First National Bank of Perham often have a distinct advantage when financing recreational properties. They possess an intimate understanding of the local Perham market, including specific lake values, property types, and regional economic factors. This local expertise can enable them to offer more tailored financing solutions, a smoother application process, and valuable insights that larger, national banks might miss.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.