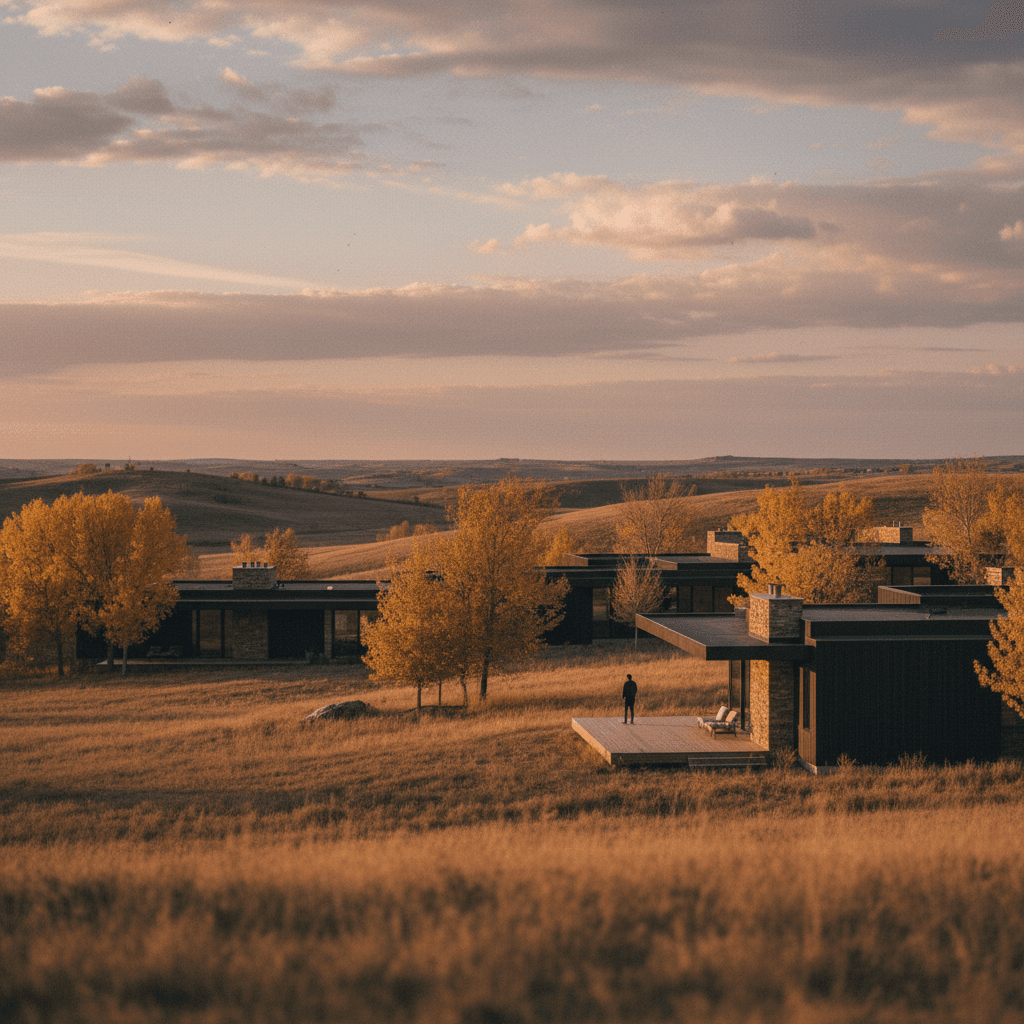

Hillsboro, North Dakota, a charming community nestled in the Red River Valley, might not be the first location that comes to mind when discussing high-end real estate. However, a closer look reveals a burgeoning luxury market, driven by discerning buyers seeking space, privacy, and a high quality of life within a close-knit community. This article delves into the financial intricacies of acquiring luxury properties in Hillsboro, offering market insights and strategic considerations for investors and prospective homeowners. From understanding market dynamics to navigating financing options, we provide a comprehensive analysis for those eyeing the upscale segment of Hillsboro's real estate landscape. Learn more about Luxury Real Estate Trends in Hillsboro, ND: What....

Market Overview & Investment Potential in Hillsboro's Luxury Sector

Hillsboro's real estate market, while traditionally stable, has seen a notable uptick in demand for properties exceeding the median price point. This trend is influenced by several factors, including its strategic location near Fargo, the allure of larger lot sizes, and a desire for custom-built homes that offer modern amenities alongside rural tranquility. Analyzing the market from a financial perspective reveals a compelling case for investment. Learn more about Real Estate Legalese: Navigating Taxes and Laws in....

Current Market Trends and Valuation

The luxury segment in Hillsboro, though smaller in volume compared to metropolitan areas, demonstrates robust value retention and appreciation. Data from recent years indicates an average annual appreciation rate for high-end homes in the broader North Dakota region of approximately 4-6%, outpacing national averages in some periods. Properties in Hillsboro often feature expansive acreage, custom architecture, and premium finishes, driving their valuation. While specific local luxury market data can be niche, the overall North Dakota market experienced a median home price increase of 8.5% year-over-year in Q1 2023, reflecting a strong demand environment. Buyers are increasingly looking for value beyond mere square footage, prioritizing unique features, privacy, and the potential for personalization. Learn more about Luxury Living in Hillsboro, ND: High-End Real Estate Trends.

Long-Term Value Appreciation and ROI

Investing in Hillsboro's luxury properties offers more than just a place to live; it presents a strategic long-term asset. The limited supply of truly high-end homes, coupled with ongoing demand from those seeking a quieter lifestyle without sacrificing amenities, contributes to sustained value appreciation. Furthermore, the potential for development or enhancement of larger plots can significantly boost return on investment (ROI). For example, properties with additional land suitable for outbuildings, recreational facilities, or even small-scale agricultural pursuits can command a premium, appealing to a diverse range of luxury buyers. The stability of the North Dakota economy, anchored by agriculture and energy, provides a solid foundation for real estate investment. Learn more about Investing in Hillsboro, ND: A Financial Look at the....

Financing Strategies for High-End Homes in Hillsboro

Acquiring a luxury property often requires more sophisticated financing approaches than a conventional mortgage. Understanding these options is crucial for successful acquisition.

Navigating Jumbo Loans and Portfolio Lenders

For properties exceeding conventional loan limits—typically around $766,550 in most of the U.S. for 2024, though this can vary by county—jumbo loans become the primary financing vehicle. These loans come with stricter underwriting criteria, often requiring higher credit scores (720+), lower debt-to-income ratios, and larger down payments (typically 10-20%). Lenders like Bell Bank, a prominent regional financial institution, are experienced in originating jumbo mortgages and can offer tailored solutions. Additionally, portfolio lenders, who keep loans on their books rather than selling them on the secondary market, may offer more flexible terms for unique or high-value properties, making them a valuable resource for luxury buyers.

Exploring Alternative Financing Options

Beyond traditional jumbo loans, high-net-worth individuals might consider alternative financing structures. These can include interest-only mortgages, which offer lower monthly payments for a set period, freeing up capital for other investments. Another option is a securities-backed loan, where liquid assets like stocks or bonds are used as collateral, often providing very competitive interest rates and avoiding the sale of assets. For those with significant liquid wealth, a cash purchase remains a powerful negotiation tool, potentially securing a better price or more favorable terms in a competitive market. Furthermore, exploring private banking divisions of larger institutions can unlock bespoke lending products designed specifically for affluent clients.

Understanding the Total Cost of Luxury Ownership

The financial commitment to a luxury home extends well beyond the purchase price. Prospective buyers must budget for ongoing expenses to truly understand the investment.

Property Taxes and Insurance Considerations

Property taxes in Hillsboro, like anywhere, are a significant ongoing cost. While North Dakota generally has lower property taxes compared to many other states, luxury properties, by nature of their higher assessed value, will incur substantial annual tax bills. It's essential to factor these into long-term financial planning. For instance, a $1 million property might incur annual property taxes upwards of $10,000-$15,000, depending on specific mill levies. Similarly, insuring a high-value home, especially one with unique features, extensive landscaping, or located in areas with specific weather risks, requires specialized coverage. Policies for luxury homes often include higher liability limits, coverage for valuable art or collectibles, and comprehensive protection against various perils. Consulting with an insurance broker specializing in high-net-worth clients is advisable.

Maintenance, Upkeep, and Management

Luxury properties often come with larger footprints, more complex systems, and extensive grounds, all of which demand considerable investment in maintenance and upkeep. This can include professional landscaping, pool maintenance (if applicable), advanced HVAC systems, smart home technology, and potentially a dedicated property manager. For example, maintaining a sprawling estate in Hillsboro might involve regular services from local experts like Thomsen Homes for custom builds and renovations, or a local landscaping company to preserve curb appeal. These costs can easily amount to 1-3% of the property's value annually, a figure that must be meticulously factored into the overall financial feasibility of the investment. Neglecting these aspects can lead to rapid depreciation of the asset. Learn more about Local Investment Opportunities: The Rising Real Estate....

Navigating the Hillsboro Luxury Market with Expertise

Successfully acquiring a luxury property in Hillsboro requires a nuanced understanding of the local market and expert guidance.

The Importance of Local Expertise and Due Diligence

While Hillsboro is a smaller market, it possesses unique characteristics that demand local insights. Engaging with a local real estate agent who specializes in high-end properties is paramount. They can provide invaluable information on unlisted properties, local zoning laws, and the nuances of neighborhood desirability. Due diligence for luxury homes should be extensive, including comprehensive inspections, title searches, and environmental assessments, especially for properties with significant acreage. Understanding the history of the property and any potential future developments in the area is critical for safeguarding your investment. For local community insights, resources like the City of Hillsboro website can offer valuable context.

Future Outlook for Hillsboro's High-End Sector

The outlook for Hillsboro's luxury real estate market remains positive, albeit with a steady, rather than explosive, growth trajectory. The appeal of small-town living, coupled with access to opportunities in nearby Fargo, continues to draw a specific demographic. As remote work becomes more prevalent and individuals seek greater space and quality of life, Hillsboro is well-positioned to see continued demand for its upscale offerings. Financial projections suggest continued stability and gradual appreciation, making it an attractive proposition for long-term investors and those seeking a permanent, high-quality residence. The community's commitment to maintaining its charm while slowly modernizing ensures its enduring appeal. For local news and events that impact the community, the Hillsboro Banner is a key resource.

Conclusion

Hillsboro, ND, offers a unique opportunity in the luxury real estate market for those who appreciate its quiet charm, community spirit, and strategic location. From understanding the nuanced market dynamics and securing appropriate financing to budgeting for the total cost of ownership, a data-driven approach is essential. With careful planning and the right expert guidance, investing in Hillsboro's high-end properties can be a financially rewarding decision, providing both a valuable asset and an exceptional lifestyle.

Frequently Asked Questions

What are the typical financing options for luxury homes in Hillsboro, ND?

For luxury homes in Hillsboro, typical financing options include jumbo loans, which are necessary for properties exceeding conventional loan limits. Additionally, portfolio lenders may offer more flexible terms, and high-net-worth individuals can explore alternative options such as interest-only mortgages or securities-backed loans.

How do property taxes impact the total cost of luxury home ownership in Hillsboro?

Property taxes are a significant ongoing cost for luxury homes in Hillsboro. While North Dakota generally has lower property taxes than many states, the higher assessed value of luxury properties results in substantial annual tax bills. These must be factored into the overall budget, potentially ranging from $10,000-$15,000 annually for a $1 million property.

Is investing in Hillsboro's luxury real estate market a good long-term strategy?

Yes, investing in Hillsboro's luxury real estate market can be a good long-term strategy. The market demonstrates robust value retention and appreciation, driven by limited supply, demand for space and privacy, and proximity to Fargo. The stable North Dakota economy further supports sustained value growth and a positive return on investment.

What kind of down payment is usually required for a jumbo loan on a luxury property?

For jumbo loans on luxury properties, lenders typically require larger down payments compared to conventional loans. A common range for down payments on jumbo loans is between 10% and 20% of the purchase price, though this can vary based on the lender, the borrower's creditworthiness, and the specific property.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.