Building a new home is an exciting journey, offering the unique opportunity to create a living space perfectly tailored to your dreams and lifestyle. In a vibrant, growing community like West Fargo, ND, new construction is booming, with families and individuals eager to put down roots in a place that blends small-town charm with modern amenities. But for many first-time buyers, the idea of financing a brand-new build can seem a bit daunting. It's not quite the same as buying an existing home, and the loan process has its own unique twists and turns.

That's where this guide comes in! We're going to break down everything you need to know about new construction loans in West Fargo, making the complex simple and helping you navigate the path to your custom-built dream home with confidence. From understanding different loan types to finding the right lender and builder, we'll walk you through each step, ensuring you're well-equipped to make informed decisions for your future in this wonderful North Dakota community.

Why Build New in West Fargo? Understanding the Appeal

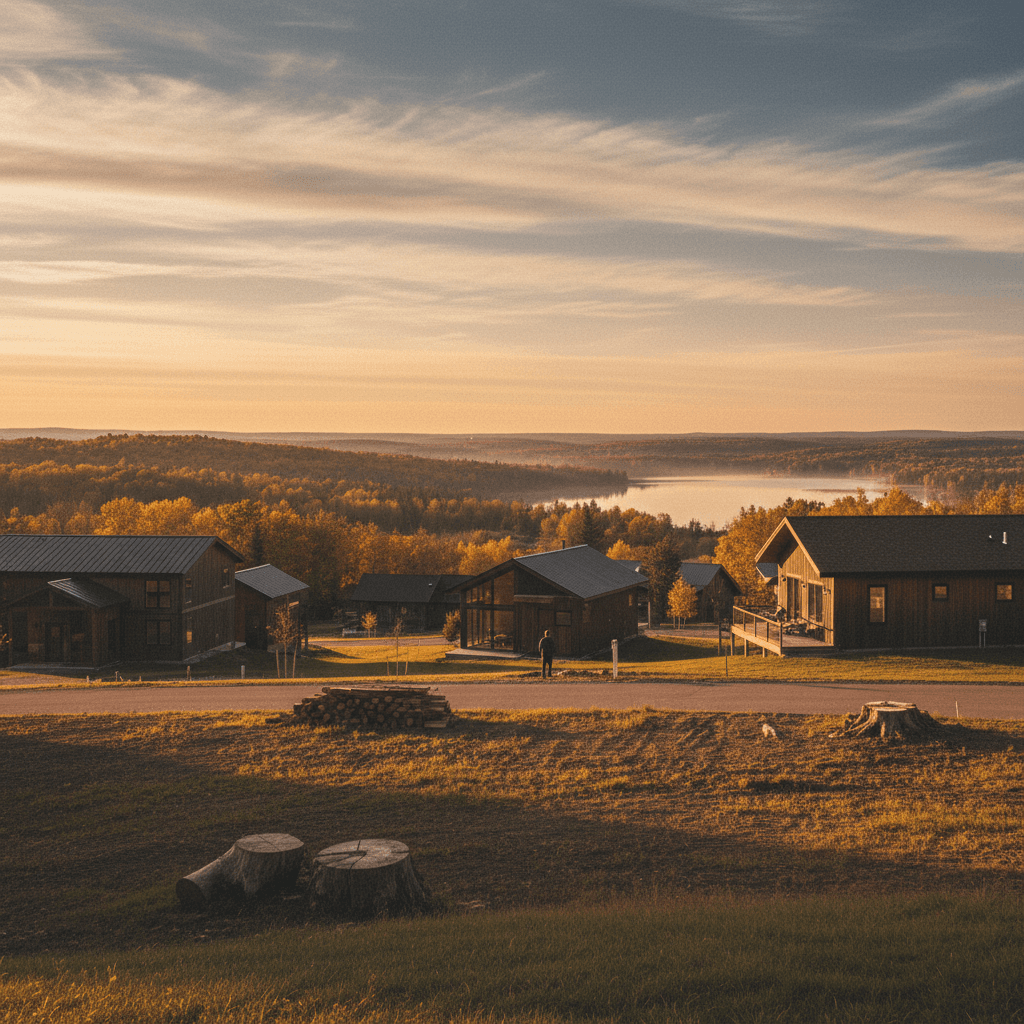

West Fargo is more than just a city; it's a thriving community experiencing remarkable growth, attracting new residents with its excellent schools, diverse recreational opportunities, and friendly atmosphere. The appeal of building a new home here is multifaceted, offering distinct advantages over purchasing an existing property.

The Growth of West Fargo

Over the past decade, West Fargo has seen significant development, transforming into a highly desirable place to live. New neighborhoods are continuously emerging, featuring modern designs, energy-efficient homes, and planned community spaces. This growth is supported by top-notch public services and a forward-thinking city plan, ensuring that infrastructure keeps pace with expansion. Families are drawn to areas with highly-rated educational institutions like West Fargo High School, known for its comprehensive programs and high AP participation rate, and Legacy Elementary School, a top-ranked elementary school providing an excellent foundation for younger students. The community truly embraces a family-friendly lifestyle, making it an ideal place to custom-build a home that fits your specific needs.

The Benefits of a Brand-New Home

Opting for new construction means you get a home built to your specifications, often featuring modern layouts, state-of-the-art appliances, and the latest in energy efficiency. This translates to lower utility bills and fewer immediate repair costs compared to older homes. Imagine choosing your finishes, selecting your ideal kitchen island, or designing a master suite that's truly a sanctuary. Beyond the aesthetics, new homes often come with warranties, providing peace of mind. Plus, you'll be the first to create memories within its walls, establishing a unique connection to your property from day one. You're not just buying a house; you're building a home that perfectly suits your West Fargo lifestyle, whether that means being close to Rendezvous Park for family outings or having a quick drive to grab a coffee at Thunder Coffee.

Navigating New Construction Loan Types

Financing a new build isn't like a standard mortgage; it requires a specialized approach. There are typically two main types of loans designed for new construction, each with its own structure and advantages.

Construction-to-Permanent Loans: The All-in-One Solution

This is arguably the most popular option for financing a new home build. A construction-to-permanent loan, often called a single-close or one-time close loan, simplifies the process by combining both the construction phase financing and the long-term mortgage into one loan. During construction, you'll make interest-only payments on the funds disbursed as the builder completes stages of the project. Once construction is finished and the Certificate of Occupancy is issued, the loan automatically converts into a permanent mortgage, often with a fixed interest rate. This means you only go through one application and closing process, saving you time and money on multiple sets of closing costs. It's a streamlined approach that many West Fargo homebuyers find appealing for its convenience.

Construction-Only Loans: A Phased Approach

Alternatively, a construction-only loan provides funds solely for the building phase. Once the home is complete, you'll need to secure a separate, traditional mortgage to pay off the construction loan. This involves two separate applications, two approval processes, and two sets of closing costs. While it might seem less convenient, it can offer flexibility. For instance, if you anticipate significant changes in your financial situation or interest rates during the construction period, you might prefer the option to shop for a new permanent mortgage once the home is complete. However, the risk of not qualifying for the permanent mortgage after construction is a significant consideration, making the construction-to-permanent option generally favored by most.

Other Financing Options for Customization

While less common for full new builds, some homeowners might consider other financing avenues for specific parts of their project or if they are acting as their own general contractor. For example, a personal loan or a home equity line of credit (HELOC) could potentially be used for smaller, custom upgrades or specific phases if you already own the land outright and have substantial equity. However, these options usually come with higher interest rates and shorter repayment terms, making them less suitable for the entire construction of a new home. Always discuss all your options with a financial advisor or a local West Fargo lender to understand the best fit for your unique situation.

The New Construction Loan Application Journey

Applying for a new construction loan involves a few extra steps compared to a standard mortgage, primarily due to the nature of financing a project that doesn't yet exist. Lenders need to assess not only your financial stability but also the viability of the construction project itself.

Preparing Your Finances and Documentation

Just like any mortgage, lenders will scrutinize your credit score, income, debt-to-income ratio, and assets. For a construction loan, you'll typically need a strong credit history and a lower debt-to-income ratio, as these loans can be seen as higher risk. Be prepared to provide extensive documentation: tax returns, pay stubs, bank statements, and proof of assets. Additionally, lenders will want to see a detailed construction contract, blueprints, specifications, and a timeline from your builder. They'll also require a professional appraisal of the future home's value once completed, which is often based on the plans and comparable new builds in West Fargo neighborhoods. Having all your financial ducks in a row before you apply will significantly smooth out the process.

The Role of Your Builder and Lender

In a new construction loan, your builder plays a crucial role. The lender will often vet the builder to ensure they are reputable, experienced, and financially stable. They'll review the builder's track record, licenses, insurance, and the detailed construction plans. The loan funds are typically disbursed in stages, known as "draws," as construction progresses. Before each draw is released, the lender will usually send an inspector to verify that the work has been completed according to the agreed-upon schedule and quality standards. This protects both you and the lender, ensuring that funds are only released for work that has been done. Establishing clear communication with both your builder and lender from the outset is key to a successful project. Imagine celebrating the completion of your dream home with a fantastic meal at Spitfire Bar & Grill, knowing every detail was handled professionally.

Budgeting for Your West Fargo Dream Build

Building a new home offers unparalleled customization, but it also means you need to be meticulous with your budget. Understanding all potential costs upfront will prevent surprises down the road.

Understanding Construction Costs and Contingencies

The primary cost will be the construction itself, outlined in your contract with the builder. This includes labor, materials, and permits. However, it's crucial to budget for a contingency fund, typically 10-15% of the total construction cost. This fund is for unexpected expenses that can arise during building, such as unforeseen site conditions, material price increases, or last-minute design changes. For example, if you decide you absolutely need a smart home system or an upgraded landscaping package while your home is being built near Urban Air Adventure Park for the kids, having that contingency fund makes it possible without derailing your finances. Discuss potential contingencies with your builder and ensure they are clearly defined in your contract.

Beyond the Loan: Closing Costs and Other Expenses

Beyond the actual construction, you'll encounter various other costs. Closing costs, similar to buying an existing home, include fees for appraisals, title insurance, loan origination, and legal services. For new construction, you might also have costs for land acquisition (if you don't already own it), utility hook-ups, landscaping, driveways, and sometimes even builder's fees not covered by the loan. Property taxes will also begin once the home is completed. It’s essential to get a detailed breakdown of all these potential expenses from your lender and builder to ensure your budget is comprehensive. A well-planned budget means less stress and more enjoyment as you watch your West Fargo dream home take shape.

Choosing Your Team: Builders and Lenders in West Fargo

The success of your new construction project heavily relies on the professionals you choose to work with. Selecting the right builder and a knowledgeable local lender is paramount.

Selecting a Reputable Builder

Your builder is your partner in bringing your vision to life. Look for builders with a strong reputation in West Fargo, excellent references, and a portfolio of homes that align with your style and quality expectations. Check their licensing, insurance, and warranty offerings. Don't hesitate to visit their completed projects and talk to previous clients. A good builder will be transparent about costs, timelines, and potential challenges. They should also be familiar with local zoning laws and building codes in West Fargo, ensuring a smooth permitting process. Many local builders have extensive experience creating homes that fit the West Fargo aesthetic and lifestyle, whether you're looking for a cozy spot near Bowler or a more expansive property further out.

Finding a Local Lender Who Understands New Construction

While national lenders offer construction loans, a local West Fargo lender often provides invaluable advantages. They are more likely to be familiar with the local real estate market, appraisal values, and reputable builders in the area. They understand the nuances of North Dakota's regulations and can offer personalized service. Look for a lender who specializes in new construction loans and can clearly explain the process, draw schedules, and any specific requirements. A local lender can be a fantastic resource, guiding you through every step and answering your questions with expertise honed in the very community you're building in. Their local insights, perhaps gained over a coffee at Bully Brew Coffee, can be incredibly helpful.

Building Your Future in West Fargo: A Rewarding Endeavor

Building a new home in West Fargo, ND, is more than just a financial transaction; it's an investment in your lifestyle and your future. From the serene walking paths of Veterans Memorial Park to the bustling culinary scene at places like Smoke & Iron, West Fargo offers a quality of life that makes the effort of building your dream home incredibly worthwhile. While the process of securing a new construction loan can seem complex, it's entirely manageable with the right knowledge and a dedicated team.

By understanding the different loan types, preparing your finances, and carefully selecting your builder and lender, you can navigate the journey with confidence. Imagine the satisfaction of stepping into a home designed exactly for you, in a community you love. West Fargo is ready to welcome you to your new address, and with this guide, you're well on your way to making that dream a reality.

Frequently Asked Questions

What is the main difference between a construction-to-permanent loan and a construction-only loan in West Fargo?

A construction-to-permanent loan, also known as a single-close loan, combines the financing for both the building phase and the long-term mortgage into one loan with a single closing. You make interest-only payments during construction, and it converts to a traditional mortgage upon completion. A construction-only loan, conversely, is solely for the building phase, requiring you to secure a separate, permanent mortgage once the home is finished, involving two separate closings and sets of fees. Most West Fargo homebuyers prefer the streamlined construction-to-permanent option.

What kind of documentation will I need for a new construction loan application in West Fargo?

Beyond standard financial documents like tax returns, pay stubs, bank statements, and credit history, you'll need extensive documentation related to the construction project itself. This includes a detailed construction contract, complete blueprints and specifications from your builder, a clear construction timeline, and proof of your builder's licensing and insurance. Lenders will also require an appraisal of the future home's value based on these plans and comparable new builds in West Fargo.

How do lenders disburse funds for new construction projects in West Fargo?

Lenders typically disburse funds in stages, known as 'draws,' as the construction progresses. Before each draw is released, the lender will usually send an inspector to the construction site in West Fargo to verify that the work outlined for that particular stage has been completed according to the agreed-upon plans and quality standards. This process ensures that funds are only released for work that has been performed, protecting both the borrower and the lender.

Should I budget for a contingency fund when building a new home in West Fargo?

Absolutely! It is highly recommended to budget for a contingency fund, typically 10-15% of the total construction cost. This fund is crucial for covering unexpected expenses that can arise during the building process, such as unforeseen site conditions, material price fluctuations, or last-minute design changes or upgrades you might decide on. Having this buffer prevents financial stress and ensures your West Fargo dream home can be completed without major budget disruptions.

What are the advantages of using a local West Fargo lender for a new construction loan?

A local West Fargo lender often offers significant advantages due to their familiarity with the local market. They have a better understanding of local property values, specific zoning regulations, and reputable builders in the area. This local expertise can lead to a smoother approval process, more personalized service, and valuable insights into the West Fargo real estate landscape. They can often provide tailored advice and support that a national lender might not be able to offer.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.