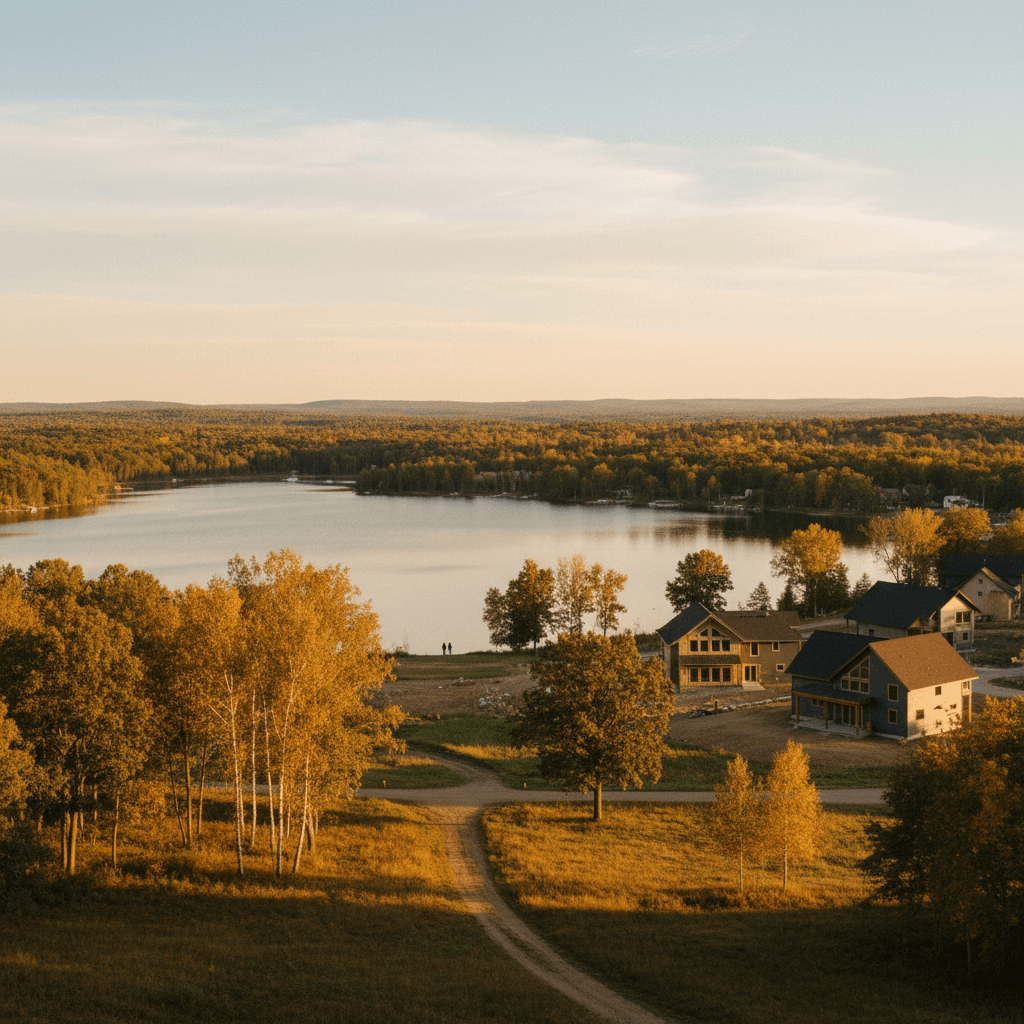

Buying your first home is one of life's most exciting milestones, a true journey toward independence and building a future. And when that journey leads you to a place as beautiful and welcoming as Detroit Lakes, Minnesota, the experience becomes even more special. Nestled amidst pristine lakes and vibrant natural beauty, Detroit Lakes offers a unique blend of small-town charm, community spirit, and abundant recreational opportunities, making it an ideal place to put down roots. For first-time homebuyers, however, the process can often feel overwhelming, filled with unfamiliar terms, complex paperwork, and big decisions. But don't worry – you're not alone, and this handbook is designed to be your trusted companion. Learn more about Exploring Detroit Lakes, MN: A Buyer’s Guide to the Best....

This comprehensive guide will walk you through every essential step of purchasing your first home in Detroit Lakes, from preparing your finances and understanding the local market nuances to making a competitive offer and finally, receiving the keys to your very own place. We'll break down the complexities into easy-to-understand stages, offering insights specific to our beloved lakeside community. By the time you finish reading, you'll feel confident and empowered to navigate the Detroit Lakes real estate market, turning your dream of homeownership into a wonderful reality. Learn more about Detroit Lakes, MN Real Estate: A Beginner’s Guide to....

Getting Ready to Buy: Your Financial Foundation

Before you even start browsing listings or dreaming about paint colors, the very first step in your homebuying journey is to get your finances in order. This crucial preparation will not only give you a clear picture of what you can afford but also make the rest of the process smoother and less stressful.

Assessing Your Financial Health

Think of this as your personal financial check-up. Lenders will closely examine several aspects of your financial history to determine your eligibility for a mortgage. Your credit score is paramount; a higher score typically translates to better interest rates. Make sure to check your credit report for any errors and work to improve your score if needed. Next, consider your debt-to-income (DTI) ratio. This is a percentage that compares your monthly debt payments to your gross monthly income. Lenders generally prefer a DTI ratio below 43%, but lower is always better. Start paying down high-interest debts and avoid taking on new loans or making large purchases before and during the homebuying process. Learn more about Financial Prep 101: Steps to Buying Your First Home in....

Saving for a down payment is another significant hurdle for many first-time buyers. While 20% down is often recommended to avoid private mortgage insurance (PMI), many loan programs, especially for first-time buyers, allow for much lower down payments, sometimes as little as 3-5% or even 0% for VA or USDA loans (though USDA is typically for rural areas, which Detroit Lakes has surrounding it). Beyond the down payment, you'll also need to budget for closing costs, which typically range from 2-5% of the loan amount, covering fees for appraisals, title insurance, legal services, and more. Don't forget to factor in an emergency fund for unexpected home repairs and initial moving expenses. Being financially prepared means understanding all these costs upfront.

Pre-Approval: Your Golden Ticket

Once you have a good handle on your financial health, the next critical step is to get pre-approved for a mortgage. This isn't just a suggestion; it's a necessity in today's competitive market, especially in desirable areas like Detroit Lakes. A pre-approval letter from a lender is a formal statement indicating that you qualify for a specific loan amount based on their preliminary review of your credit, income, and assets. It shows sellers that you are a serious and qualified buyer, giving your offer significant credibility.

To get pre-approved, you'll typically provide your lender with documents like pay stubs, tax returns, bank statements, and information about your debts. They will then pull your credit report and give you an estimate of how much you can borrow. This figure is crucial because it sets your maximum budget, allowing you to focus your home search on properties you can realistically afford. While Detroit Lakes offers a range of housing options, from charming starter homes to lakeside retreats, knowing your budget upfront will save you time and potential heartbreak. Remember, pre-approval is different from pre-qualification; pre-approval involves a more thorough review and is a much stronger indicator of your buying power.

Understanding the Detroit Lakes Market: What to Expect

Every real estate market has its own rhythm and unique characteristics, and Detroit Lakes is no exception. Understanding these local nuances is key to a successful first-time home purchase, ensuring you approach the market with realistic expectations and a strategic mindset.

Current Market Trends and Property Types

The Detroit Lakes real estate market often reflects a blend of year-round community living and a vibrant seasonal tourism industry. This can influence property values, demand, and the types of homes available. While general market conditions can fluctuate, Detroit Lakes typically sees a steady demand, especially for properties offering lake access or close proximity to downtown amenities. You’ll find a diverse range of homes here, from cozy bungalows perfect for a first-time buyer, to more spacious family homes in established neighborhoods, and of course, stunning lakeside properties that often command a premium. Condos and townhomes also offer appealing options for those seeking lower maintenance living.

Understanding whether it's currently a buyer's or seller's market is vital. In a seller's market, homes tend to sell quickly, often with multiple offers, which means you might need to act fast and make a strong, competitive offer. In a buyer's market, you might have more negotiating power and time to consider your options. Your real estate agent, who has their finger on the pulse of the local scene, will be your best resource for current trends, average selling prices, and how quickly homes are moving in various Detroit Lakes neighborhoods. They can also advise on popular features and amenities that add value in this specific area. Learn more about Selling in Detroit Lakes, MN: How to Navigate the Market....

The Role of a Local Real Estate Agent

For first-time homebuyers in Detroit Lakes, partnering with a knowledgeable local real estate agent isn't just helpful – it's absolutely essential. While online listings are a great starting point, they can't replace the in-depth, boots-on-the-ground expertise a local agent provides. An agent who specializes in the Detroit Lakes area will have an intimate understanding of the different neighborhoods, their unique characteristics, and even the micro-markets within them. They know which areas are quiet and family-friendly, which offer the best lake views, and which provide easy access to places like Hugo's Family Marketplace for groceries or Essentia Health St. Mary's for healthcare needs.

Beyond local knowledge, your agent will be your advocate throughout the entire process. They can alert you to new listings often before they hit public sites, help you interpret complex contracts, negotiate on your behalf, and recommend trusted local professionals for inspections, lending, and title services. Their expertise will be invaluable in crafting a compelling offer that stands out, especially if you're in a competitive bidding situation. Don't underestimate the power of a local expert; they are your guide, negotiator, and trusted advisor, ensuring your first home purchase in Detroit Lakes is as smooth and successful as possible.

Finding Your Dream Home: Neighborhoods & Amenities

With your finances in order and a local agent by your side, the exciting part begins: finding the home that perfectly fits your lifestyle and needs within the beautiful landscape of Detroit Lakes. This isn't just about finding a house; it's about finding a community that feels like home.

Exploring Detroit Lakes Neighborhoods

Detroit Lakes offers a diverse array of neighborhoods, each with its own charm and appeal. If you envision living close to the vibrant downtown area, you might look for homes that offer easy walking access to local shops, restaurants like the historic Lakeside Tavern & Brewery, and coffee spots like Mi Cartagena Cafe with its lakeside patio. These areas often feature older, charming homes with established trees and a strong sense of community.

For families, proximity to excellent schools is often a top priority. Detroit Lakes is proud of its educational institutions, including the highly-rated Rossman Elementary School and the well-regarded Detroit Lakes High School, known for its strong academics and B+ rating. Neighborhoods around these schools are often sought after, offering a family-friendly atmosphere with parks and safe streets. If lakeside living is your ultimate dream, areas surrounding Detroit Lake itself, or even nearby Long Lake, offer properties ranging from seasonal cabins to year-round luxury homes, providing unparalleled access to water activities. Even if a direct lakefront property is beyond your first-time buyer budget, many neighborhoods offer lake access points or are just a short drive from public beaches and parks, ensuring you can still enjoy the quintessential Detroit Lakes lifestyle.

Community Conveniences and Lifestyle

Beyond the four walls of your future home, the surrounding community plays a massive role in your quality of life. Detroit Lakes excels in this regard, offering a wealth of amenities that cater to a variety of interests. For outdoor enthusiasts, the opportunities are endless. Spend your summers swimming and picnicking at Detroit Lake City Beach, or explore the scenic walking trails and fishing spots at Long Lake Park. Winters bring ice fishing, snowmobiling, and cross-country skiing, making Detroit Lakes a year-round recreational paradise.

When it comes to dining and socializing, Detroit Lakes has you covered. Enjoy elevated pub grub and house-brewed beers at Lakeside Tavern & Brewery, or savor Caribbean-inspired cuisine and beautiful lake scenery at Long Bridge. For your daily dose of caffeine or a quick bite, local favorites include Mi Cartagena Cafe and La Barista in Washington Square Mall. Having convenient access to essential services like Hugo's Family Marketplace for groceries and Essentia Health St. Mary's for medical care ensures peace of mind. The strong sense of community, combined with these fantastic amenities, creates a welcoming environment for new residents. Your agent can help you explore areas that best align with your desired lifestyle, whether you prioritize walkability, quiet streets, or quick access to the lake.

Making Your Offer and Navigating the Purchase Process

Once you’ve found that perfect place in Detroit Lakes, the real work of securing it begins. This stage involves making a competitive offer and meticulously navigating the subsequent steps, including inspections, appraisals, and loan underwriting. It’s a period that requires attention to detail and trust in your real estate agent.

Crafting a Competitive Offer

Making an offer isn't just about naming a price; it's about presenting a compelling package that stands out to the seller. Your real estate agent will be instrumental here, helping you understand the property's market value based on comparable sales in Detroit Lakes and the current market conditions. They’ll advise you on a strategic offer price, taking into account your budget and the home’s worth. Beyond the price, an offer includes various contingencies – conditions that must be met for the sale to proceed. Common contingencies include a home inspection (allowing you to back out or renegotiate if major issues are found) and a financing contingency (protecting you if your loan doesn't go through).

In a competitive market, you might consider ways to strengthen your offer beyond just the price. This could involve offering a larger earnest money deposit, being flexible with the closing date, or even waiving certain contingencies (though this should be approached with extreme caution, especially for first-time buyers). Your pre-approval letter is also a key component, reassuring sellers of your financial readiness. Your agent will help you draft all the necessary paperwork, ensuring every detail is accurate and legally sound. Remember, a well-crafted offer reflects not only your interest but also your understanding of the local market and your commitment to the purchase.

Inspections, Appraisals, and Loan Underwriting

After your offer is accepted, the next phase is a series of critical evaluations of the property. The home inspection is paramount. You'll hire a professional inspector to thoroughly examine the home’s structure, systems (HVAC, plumbing, electrical), and overall condition. This is your chance to uncover any potential issues, from minor repairs to significant problems, before you commit fully. Based on the inspection report, you may negotiate with the seller for repairs, a credit, or a price reduction. This step is non-negotiable for your peace of mind and financial protection.

Simultaneously, your lender will arrange for an appraisal. An appraisal is an independent assessment of the home’s value, ensuring that it’s worth at least the amount you’re borrowing. Lenders require this to protect their investment. If the appraisal comes in lower than the purchase price, you may need to renegotiate with the seller, bring more cash to closing, or even walk away if a resolution can't be reached. Finally, your loan enters the underwriting phase, where the lender verifies all your financial information and ensures everything aligns with their lending criteria. This can feel like a waiting game, but it’s a necessary step to finalize your mortgage. Throughout this intricate process, clear communication with your agent and lender is key to keeping everything on track.

Closing Day and Settling into Detroit Lakes Life

You've navigated the market, secured your financing, and made it through inspections and appraisals. Now, the finish line is in sight! Closing day is the exciting culmination of your hard work, and soon you'll be holding the keys to your very own home in Detroit Lakes.

The Grand Finale: Closing Day

Closing day is when all the legal and financial paperwork is finalized, and ownership of the property officially transfers from the seller to you. Before closing, you’ll typically have a final walk-through of the property to ensure it’s in the agreed-upon condition and that any agreed-upon repairs have been completed. This is your last chance to check everything before the big signing. At the closing table, which usually takes place at a title company or attorney's office in Detroit Lakes, you’ll sign a stack of documents, including the promissory note (your promise to repay the loan), the deed of trust (which gives the lender the right to foreclose if you don’t repay), and various disclosures and agreements. Your real estate agent and often a representative from the title company will be there to guide you through each document and answer any last-minute questions. You'll also bring your down payment and closing costs (minus any earnest money already paid) in the form of a cashier's check or wire transfer. Once all the papers are signed and funds are disbursed, you'll officially receive the keys to your new home – congratulations, you're a homeowner!

Embracing Your New Community

With the excitement of closing behind you, the next chapter begins: settling into your new home and embracing life in Detroit Lakes. This vibrant community offers a welcoming atmosphere for new residents. Take time to explore your new surroundings, meet your neighbors, and discover all the local gems. Whether it’s enjoying a leisurely stroll along the shores of Detroit Lake, grabbing a coffee at La Barista, or trying out a new dish at Long Bridge, there's always something to do and see. Familiarize yourself with local services, from utility providers to community events. Getting involved in local activities or joining community groups is a fantastic way to connect and truly feel at home. Detroit Lakes is more than just a place to live; it’s a lifestyle, rich in natural beauty, friendly faces, and endless opportunities for recreation and relaxation. We hope you find as much joy living here as we do.

Buying your first home in Detroit Lakes, MN, is an incredible journey, one filled with anticipation, learning, and ultimately, immense reward. While the process has many moving parts, remember that you don't have to navigate it alone. With careful financial planning, a clear understanding of the local market, the expertise of a trusted real estate agent, and this guide in hand, you are well-equipped to achieve your homeownership dreams. Welcome to Detroit Lakes – we’re thrilled to have you join our community!

Related Articles

Frequently Asked Questions

What are the typical down payment requirements for first-time homebuyers in Detroit Lakes, MN?

While 20% is often suggested, many first-time buyer programs allow for much lower down payments, often as little as 3-5%. Some government-backed loans like VA (for veterans) or USDA (for eligible rural areas surrounding Detroit Lakes) can even offer 0% down. It's best to consult with a local lender to understand all available options and determine what you qualify for.

How competitive is the real estate market in Detroit Lakes for first-time buyers?

The Detroit Lakes market can vary, often influenced by its appeal as a lakeside community and tourism hub. Properties, especially those with lake access or in desirable school districts, can be competitive. Working with an with an experienced local real estate agent is crucial to understand current trends, identify opportunities, and craft a strong, competitive offer.

What should I look for in a neighborhood if I'm a first-time homebuyer in Detroit Lakes?

Consider your lifestyle priorities. For families, look at proximity to top-rated schools like Rossman Elementary or Detroit Lakes High School, and local parks. If community engagement and walkability are key, explore areas near downtown for easy access to shops and restaurants like Lakeside Tavern & Brewery. If lake activities are a priority, many neighborhoods offer easy access to public beaches like Detroit Lake City Beach, even if direct lakefront property isn't in your budget.

What are some hidden costs first-time homebuyers should be aware of in Detroit Lakes?

Beyond the down payment, be prepared for closing costs (2-5% of the loan amount), which cover fees like appraisal, title insurance, and loan origination. After moving in, factor in ongoing expenses like property taxes, homeowner's insurance, utilities, and potential HOA fees. Also, consider initial renovation or repair costs, and remember to budget for things like new furniture or landscaping to make your new house a home.

Why is a local real estate agent important when buying a first home in Detroit Lakes?

A local agent offers invaluable expertise specific to the Detroit Lakes market. They understand neighborhood nuances, property values, and local market trends better than anyone. They can connect you with trusted local lenders and inspectors, help you navigate complex contracts, and negotiate on your behalf to ensure you get the best deal. Their local connections and insights are crucial for a smooth and successful home purchase.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.