Making the move to senior living or simply downsizing your home is a significant life transition, and it often comes with a whirlwind of emotions and practical considerations. For those of you in our charming community of Glyndon, MN, navigating this process with financial wisdom is key to ensuring a smooth, stress-free, and ultimately rewarding next chapter. You've built a life here, perhaps raised a family, and now you're thinking about what comes next. It’s not just about finding a smaller space; it’s about optimizing your finances, maximizing your comfort, and preserving your peace of mind. Learn more about Downsizing in Glyndon, MN: Tips for Seniors Selling....

This guide is designed to help you understand the financial landscape of downsizing and senior living real estate right here in Glyndon. We'll break down complex topics into easy-to-understand steps, from assessing your current home's value to exploring local housing options and smart financing strategies. Our goal is to empower you with the knowledge to make informed decisions, ensuring your transition is not only comfortable but also financially sound. Let's explore how you can make your move a financially smart one, right here in the heart of Clay County. Learn more about Financial Readiness for First-Time Homebuyers in Glyndon, MN.

Understanding Your Financial Landscape for Downsizing in Glyndon

Before you even begin looking at new homes, the most crucial first step is to get a clear picture of your current financial situation. This isn't just about how much you have saved; it's about understanding the true value of your current assets, particularly your home, and anticipating the costs and potential savings associated with downsizing.

Assessing Your Current Home's Value in Today's Market

Your current home in Glyndon is likely your most significant asset, and understanding its market value is foundational to your downsizing plan. The real estate market can fluctuate, so getting an up-to-date, accurate appraisal is essential. What are homes like yours selling for in neighborhoods around Maplewood Park or near Glyndon-Felton High School? A local real estate professional, like those at Glyndon Realty Group, can provide a comparative market analysis (CMA) that gives you a realistic idea of your home's worth. They'll consider factors unique to Glyndon, such as proximity to local amenities, school districts, and recent sales of comparable properties.

Don't just rely on online estimators; while they can offer a general idea, a local expert's insight is invaluable. They understand the nuances of the Glyndon market – whether it’s the demand for homes with larger lots, or the appeal of properties closer to the center of town where you might find local favorites like The Corner Cafe. Knowing your home's true value will help you project the equity you can unlock, which will be a significant factor in financing your next home.

Calculating Downsizing Costs and Potential Savings

Downsizing isn't just about selling one home and buying another; there are a host of costs involved that need to be factored into your budget. These include real estate commissions, closing costs on both the sale and purchase, moving expenses, and potential repairs or upgrades to your current home to maximize its sale price. For instance, if you need minor repairs or painting to get your home market-ready, consider reaching out to Glyndon Home Services for reliable local help.

On the flip side, downsizing often comes with significant savings. A smaller home typically means lower utility bills, reduced property taxes, and less maintenance. Imagine the savings on heating and cooling in a smaller space during our long Minnesota winters! Factor in potential reductions in homeowner's insurance premiums and the elimination of mortgage payments if you're able to buy your next home outright. Understanding these costs and savings upfront will help you create a realistic budget and determine how much equity you’ll have available for your next steps or for your retirement fund.

Exploring Glyndon's Senior-Friendly Real Estate Market

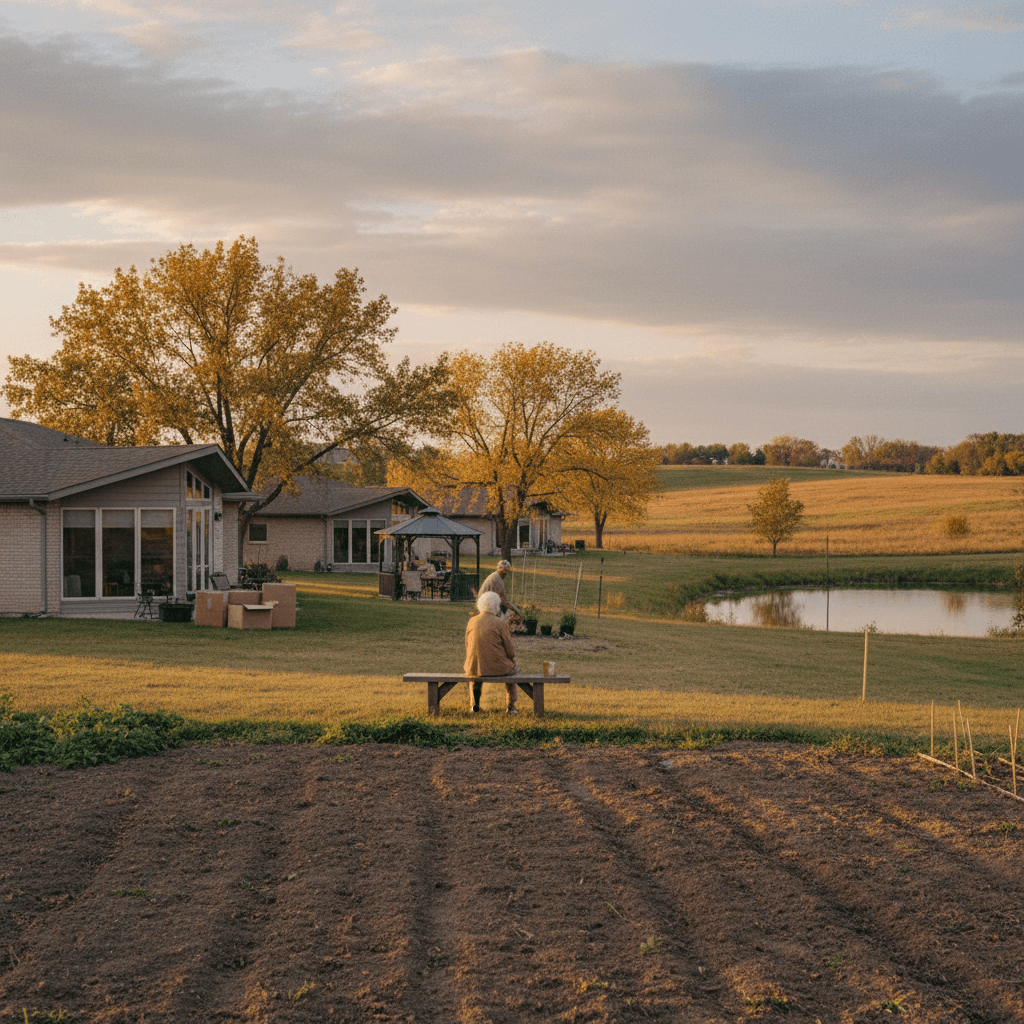

Glyndon, with its friendly atmosphere and tight-knit community, offers a welcoming environment for seniors looking to downsize. The real estate market here, while smaller than larger cities, provides distinct advantages and options that cater to a more relaxed, manageable lifestyle.

The Appeal of Single-Story Homes and Townhouses

Many seniors find single-story homes or townhouses incredibly appealing. Eliminating stairs can significantly improve daily comfort and safety, making these properties highly sought after. In Glyndon, you'll find charming single-family ramblers and split-level homes that offer convenient layouts. These often come with smaller yards, reducing yard work and freeing up time for hobbies or enjoying community events.

Townhouses, while less common directly within Glyndon, are an option in nearby communities and offer a blend of independent living with reduced exterior maintenance. They can be a great middle-ground, providing a sense of community without the full commitment of a larger single-family home. When exploring these options, consider the long-term accessibility – wide doorways, walk-in showers, and minimal thresholds can make a huge difference as needs evolve.

Considering 55+ Communities and Independent Living Near Glyndon

While Glyndon itself doesn't host large dedicated 55+ communities, the broader Fargo-Moorhead metropolitan area, just a short drive away, offers a variety of independent living and active adult communities. These communities are designed specifically for seniors, often featuring amenities like clubhouses, fitness centers, social activities, and sometimes even meal services. They provide opportunities for social engagement and a sense of belonging, which can be invaluable.

For those who wish to stay within Glyndon's close-knit fabric, exploring smaller, age-friendly neighborhoods or homes that are part of a homeowners association (HOA) that handles exterior maintenance can be an excellent alternative. The key is to find a balance between independence, community, and the level of service and support that aligns with your lifestyle and budget. Visiting the Glyndon Senior Center can also provide valuable insights into local social opportunities and resources, helping you choose a location that truly fits your desired lifestyle.

Smart Financing Strategies for Your Glyndon Senior Move

Once you have an idea of what you're looking for and the value of your current home, it's time to delve into the financial strategies that can make your downsizing dreams a reality. There are several avenues to explore, each with its own benefits and considerations. Learn more about Securing Your Dream Home: Mortgage and Financing Tips....

Leveraging Home Equity: Reverse Mortgages and HELOCs

Your home equity is a powerful financial tool. For many seniors, it represents years of diligent mortgage payments and market appreciation. There are a couple of ways to tap into this equity:

- Selling Your Home: The most straightforward approach is to sell your current Glyndon home and use the proceeds to purchase your new, smaller residence. If you've lived in your home for many years, you might find you have substantial equity, potentially allowing you to buy your next home outright or with a much smaller mortgage. This can significantly reduce your monthly expenses and free up cash for retirement.

- Home Equity Line of Credit (HELOC): If you're not ready to sell immediately but need funds for renovations on your current home, or to bridge a gap between selling and buying, a HELOC can provide flexible access to funds based on your home's equity. However, remember this is a loan that needs to be repaid.

- Reverse Mortgage: A reverse mortgage allows homeowners aged 62 or older to convert a portion of their home equity into tax-free cash, without having to sell their home or make monthly mortgage payments (though property taxes and insurance must still be paid). This can be an attractive option if you wish to stay in your current home but need additional income or funds for home modifications. However, it's a complex financial product, and it's vital to consult with a trusted financial advisor and a HUD-approved counselor to understand all the implications before making a decision. Local banks like the First State Bank of Glyndon can provide information on these options.

Understanding Property Taxes and Insurance in Glyndon

Property taxes in Clay County, and specifically in Glyndon, are an ongoing expense that will impact your long-term budget. When you downsize to a smaller, less expensive home, your property tax burden will likely decrease, which is a significant financial benefit. However, it's important to understand how these taxes are assessed and if there are any programs for seniors.

Minnesota offers a Homestead Credit for qualifying homeowners, and seniors might be eligible for additional property tax refunds or deferrals based on income. The Minnesota Senior Citizens' Property Tax Deferral Program, for example, allows eligible seniors (65+, low income) to defer a portion of their property taxes. It's highly recommended to consult with the Clay County Auditor-Treasurer's office or a local tax professional to understand your specific eligibility and potential savings.

Similarly, homeowner's insurance will vary based on the value, size, and age of your new home. A smaller, newer home might result in lower premiums. Always get multiple quotes and ensure your policy adequately covers your new property and possessions. These ongoing costs are crucial to factor into your monthly budget for your new Glyndon home.

Navigating the Downsizing Process: Maximizing Value and Minimizing Stress

The actual process of downsizing, from preparing your home for sale to moving into your new space, can feel overwhelming. However, with careful planning and the right support, you can maximize the value of your current home and make the transition as smooth as possible.

Decluttering and Staging for Maximum Value

Before putting your Glyndon home on the market, decluttering is essential. Buyers want to envision themselves in the space, and too many personal items can make a home feel small and dated. Start early, go room by room, and be ruthless! Consider donating items to local charities, selling valuables, or passing heirlooms to family members. This process not only makes your home more appealing to buyers but also simplifies your eventual move.

Once decluttered, staging your home can significantly impact its sale price and time on the market. Simple steps like fresh paint, deep cleaning, minor repairs, and arranging furniture to highlight space and natural light can make a huge difference. Remember, the goal is to present a clean, neutral, and inviting space that appeals to the widest range of potential buyers, ensuring you get the best possible return on your investment.

Finding Local Real Estate and Moving Expertise

Partnering with experienced local professionals is key. A knowledgeable real estate agent, like those at Glyndon Realty Group, will guide you through pricing, marketing, negotiations, and all the intricacies of selling your home in the Glyndon market. They can also help you find your ideal new home, whether it’s a single-story home in a quiet neighborhood or a property closer to community amenities.

When it comes to the physical move, don't underestimate the value of professional help. Companies like Glyndon Moving Solutions can handle packing, transportation, and even unpacking, significantly reducing the physical and emotional burden of moving. They understand the local area and can ensure your belongings arrive safely and efficiently. Investing in these services can save you time, stress, and potential damage, making it a financially smart decision in the long run. Learn more about Investing in Glyndon, MN: A Guide to Buying Properties....

Long-Term Financial Planning and Lifestyle in Glyndon

Downsizing is more than just a real estate transaction; it's a lifestyle adjustment that requires ongoing financial consideration. Planning for your long-term financial well-being in your new Glyndon home is just as important as the initial move itself.

Budgeting for Retirement in Glyndon

With a smaller home and potentially lower monthly expenses, you’ll have more flexibility in your retirement budget. This is an excellent opportunity to reassess your financial plan. Consider how your new housing costs fit into your overall retirement income, including social security, pensions, and investments. Will you have more discretionary income for hobbies, travel, or simply enjoying the local offerings in Glyndon, like a leisurely stroll through Maplewood Park?

Create a detailed budget that accounts for all your income and expenses. Think about healthcare costs, entertainment, transportation, and any new activities you might pick up. A well-structured budget provides clarity and peace of mind, allowing you to enjoy your retirement years without financial worry. Regular reviews of your budget are important, as your needs and the economic landscape can change over time.

Accessing Local Financial and Legal Resources

Even after you've settled into your new home, having access to local financial and legal resources remains crucial. You might need assistance with estate planning, updating wills, or managing investments. Local financial advisors, often found at institutions like First State Bank of Glyndon, can help you fine-tune your retirement portfolio and ensure your assets are protected and growing.

For legal matters, such as ensuring your new property deeds are in order or updating your power of attorney, seeking out an elder law attorney in the broader Clay County area can provide invaluable expertise. These professionals specialize in legal issues affecting seniors and can offer tailored advice for your specific situation. Don't hesitate to leverage these local experts to ensure your financial and legal affairs are in perfect order, allowing you to fully embrace your new, downsized life in Glyndon.

Embracing Your Financially Smart Future in Glyndon

Downsizing and transitioning to senior living in Glyndon, MN, is a journey filled with opportunities for financial optimization and a renewed sense of purpose. By taking a strategic approach to assessing your home's value, understanding the local real estate market, leveraging smart financing tools, and preparing meticulously for your move, you can ensure a transition that is not only smooth but also financially empowering.

Remember, this isn't just about moving; it's about setting yourself up for a comfortable, secure, and enjoyable retirement in a community you love. Glyndon offers a wonderful backdrop for this next chapter, and with the right financial planning and local expertise, you can confidently step into a future where your home supports your lifestyle and your financial well-being. Embrace the possibilities, plan wisely, and look forward to the many wonderful years ahead in your perfectly sized Glyndon home.

Related Articles

Frequently Asked Questions

What are the typical closing costs associated with selling a home and buying a new one in Glyndon, MN?

Closing costs in Glyndon, MN, typically range from 2-5% of the home's purchase price for buyers and 6-10% (including real estate commissions) for sellers. These costs cover items like title insurance, appraisal fees, loan origination fees, transfer taxes, and attorney fees. It's crucial to get a detailed estimate from your real estate agent and lender early in the process to budget accurately.

Are there any property tax breaks or exemptions for seniors in Clay County, MN (where Glyndon is located)?

Yes, Minnesota offers a Homestead Credit for qualifying homeowners, and seniors might be eligible for additional property tax refunds or deferrals based on income. While there isn't a specific "senior exemption" like in some states, the "Senior Citizens' Property Tax Deferral Program" allows eligible seniors (65+, low income) to defer a portion of their property taxes. It's best to consult with the Clay County Auditor-Treasurer's office or a local tax professional to understand your specific eligibility and potential savings.

How can I assess if a reverse mortgage is a financially sound option for my downsizing plans in Glyndon?

A reverse mortgage can be a powerful tool for seniors (62+) to convert home equity into cash without selling their home, but it's not for everyone. To assess if it's right for you in Glyndon, consider your long-term financial goals, how long you plan to stay in your home, and the fees involved. It's essential to consult with a HUD-approved counselor and a trusted financial advisor who understands your local market to fully weigh the pros and cons and ensure it aligns with your overall financial strategy.

What types of senior living communities are available in or near Glyndon, MN, and how do their costs compare?

While Glyndon itself is a smaller community, nearby Fargo-Moorhead offers a range of senior living options including independent living, assisted living, and memory care facilities. Independent living often involves monthly fees covering amenities and services, while assisted living and memory care will have higher costs due to increased levels of personal care and medical support. Costs vary significantly based on location, services, and amenities, so it's vital to research specific communities and their pricing structures, and consider how they fit into your long-term budget.

What local resources are available in Glyndon, MN, to help seniors with financial planning or legal advice related to downsizing?

While Glyndon is a smaller town, you can find financial planning and legal resources in the broader Clay County area and nearby Fargo-Moorhead. Local banks often have financial advisors, and you can seek out estate planning attorneys or elder law specialists in the region. Organizations like the <a href="https://www.co.clay.mn.us/depts/social/social.php" target="_blank" rel="noopener">Clay County Social Services</a> or the Area Agency on Aging may also provide guidance or referrals to services that assist seniors with financial and legal matters related to housing and downsizing.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.