Navigating the complexities of property taxes and zoning laws is a fundamental aspect of homeownership and real estate investment, particularly in dynamic communities like Hillsboro, North Dakota. For both long-time residents and prospective newcomers, a clear understanding of these regulations is not just about compliance; it's about informed financial planning and strategic decision-making. As a market analyst, I frequently observe how these localized legal and fiscal frameworks significantly influence property values, development potential, and the overall economic landscape of a town. Hillsboro, with its unique blend of agricultural heritage and burgeoning community development, presents a specific set of considerations that warrant a comprehensive exploration. This guide aims to demystify the intricacies of property taxation and land use regulations in Hillsboro, offering clarity and actionable insights for anyone looking to engage with its real estate market. Learn more about The Financial Side of Selling: Closing Costs and Net....

The Foundation of Property Taxation in Hillsboro, ND

Property taxes are a cornerstone of local government funding, directly supporting essential services such as schools, public safety, and infrastructure. In Hillsboro, as in the rest of North Dakota, these taxes are levied at the county and local levels, based on the assessed value of real property. Understanding how these values are determined and how tax rates are applied is crucial for every property owner. North Dakota generally boasts a relatively favorable property tax environment compared to the national average, with effective property tax rates often falling below 1%, according to recent analyses by organizations like the Tax Foundation. However, local variations can be significant, making a granular understanding of Hillsboro's specific context indispensable. Learn more about Hillsboro, ND Real Estate Market Report: Financial....

How Property Values Are Assessed in Traill County

Property assessment in Hillsboro falls under the jurisdiction of Traill County. The county assessor's office is responsible for determining the market value of all taxable properties within its boundaries. This process involves a meticulous review of various factors, including recent sales of comparable properties, the property's physical characteristics (size, age, condition, amenities), location, and any income-generating potential for commercial properties. Assessments are typically conducted periodically, often on a biennial or quadrennial cycle, to ensure that property values reflect current market conditions. It's important for property owners to understand that the assessed value is generally a percentage of the property's true market value, as defined by state law. For instance, North Dakota uses an assessment ratio, meaning the taxable value is a fraction of the full market value. Property owners have the right to appeal their assessment if they believe it is inaccurate, a process that typically begins with a review by the local assessor and can escalate to the county board of equalization and beyond. Engaging with the Traill County Assessor's Office directly can provide detailed information on specific assessment methodologies and appeal procedures. Learn more about Local Investment Opportunities: The Rising Real Estate....

Understanding Mill Levies and Tax Rates

Once a property's assessed value is established, the next step in calculating the tax bill involves mill levies. A mill is a unit equal to $1 per $1,000 of assessed value (or 0.001). Various taxing authorities – the city of Hillsboro, Traill County, the Hillsboro Public School District, and other special districts – each set their own mill levies annually. These levies are determined by the budgets required to fund their respective services. The sum of all applicable mill levies constitutes the total tax rate for a property. For example, if the combined mill levy is 300 mills, a property with an assessed taxable value of $100,000 would incur a tax of $3,000 (300 / 1000 * $100,000). These rates can fluctuate year over year based on budgetary needs and changes in the overall tax base. Monitoring these changes, often published by the Hillsboro City Hall and the county, is essential for accurate financial forecasting for property owners and investors. The stability of these rates, driven by a consistent local economy and responsible fiscal management, is a key indicator of Hillsboro's financial health and attractiveness for investment. Learn more about Financial Wisdom for New Homeowners in Hillsboro, ND.

Navigating Hillsboro's Zoning Ordinances and Land Use

Zoning laws are the regulatory backbone of urban and rural development, dictating how land within a municipality can be used. In Hillsboro, these ordinances are designed to promote orderly growth, protect property values, and ensure the health, safety, and welfare of its residents. For anyone considering purchasing land, developing property, or even making significant renovations, a thorough understanding of Hillsboro's zoning map and its associated regulations is non-negotiable. These laws define everything from the types of structures allowed in certain areas to minimum lot sizes, building setbacks, and parking requirements. The foresight embedded in Hillsboro's zoning plan helps maintain the town's character while accommodating future expansion, a balance critical for sustainable community development.

Residential Zoning Districts and Development

Hillsboro's zoning map typically delineates several residential districts, each with specific rules governing density, building height, and accessory structures. Common residential zones might include R-1 (single-family detached homes on larger lots), R-2 (single-family homes with potentially smaller lots or duplexes), and R-3 (allowing for multi-family dwellings like apartments or townhouses). For instance, a property zoned R-1 might have strict regulations on minimum lot frontage and side yard setbacks to preserve neighborhood aesthetics and privacy, while an R-3 zone might encourage higher density development near commercial centers or public transportation routes. Developers and homeowners must consult the official zoning map and text available through the Hillsboro Community Development Office before undertaking any construction or significant alteration. Ignorance of these regulations can lead to costly delays, fines, or even the forced removal of non-compliant structures. The stability and predictability offered by clear residential zoning are often cited by local real estate professionals, such as those at Prairie Winds Realty, as a significant factor in maintaining property values and buyer confidence in Hillsboro's housing market. Learn more about Real Estate Legalese: Navigating Taxes and Laws in....

Commercial and Industrial Zoning: Opportunities and Restrictions

Beyond residential areas, Hillsboro also designates specific zones for commercial and industrial activities. Commercial zones (e.g., C-1 for neighborhood retail, C-2 for general commercial) are typically located along main thoroughfares or in the downtown core, allowing for businesses that serve the community, such as shops, restaurants, and professional offices. These zones often have regulations concerning signage, parking ratios, and building aesthetics to create an inviting business environment. Industrial zones, conversely, are typically situated on the outskirts of town, providing space for manufacturing, warehousing, and other light or heavy industrial operations, often with considerations for noise, emissions, and truck access. These areas are vital for Hillsboro's economic growth, attracting businesses that create jobs and contribute to the tax base. Businesses looking to establish or expand operations in Hillsboro must meticulously review the specific requirements for their intended zoning district, as restrictions can include operational hours, environmental impact assessments, and specific building codes. The strategic placement of these zones reflects Hillsboro's commitment to fostering economic diversity while protecting residential areas from incompatible uses, a balance that supports long-term community prosperity.

The Impact of Property Taxes and Zoning on Real Estate Investment

For investors and homeowners alike, property taxes and zoning laws are not merely administrative hurdles; they are powerful determinants of financial viability and potential returns. A thorough understanding of these factors allows for more accurate financial projections, risk assessment, and ultimately, more successful real estate endeavors in Hillsboro. The stability of property tax rates and the clarity of zoning regulations contribute significantly to the predictability of the local real estate market, making it an attractive prospect for both long-term residents and those seeking investment opportunities.

Financial Implications for Homeowners and Investors

Property taxes represent an ongoing operational cost that directly impacts the affordability of homeownership and the profitability of investment properties. For homeowners, higher taxes mean a larger portion of their monthly housing budget is allocated to taxes, potentially affecting purchasing power. For investors, these taxes reduce net operating income (NOI) and can significantly alter capitalization rates and return on investment (ROI) calculations. Moreover, changes in tax assessments or mill levies can introduce financial volatility. Prudent investors in Hillsboro routinely factor in a buffer for potential tax increases and conduct thorough due diligence, often consulting with local financial institutions like Hillsboro State Bank, to understand the long-term financial implications. Beyond taxes, zoning also carries financial weight. A property's zoning classification dictates its highest and best use. A parcel zoned for single-family residential development will have a vastly different value proposition than one zoned for commercial use or multi-family housing, even if their physical attributes are similar. Investors must ensure their proposed use aligns with zoning to avoid costly re-zoning applications or the inability to develop their property as intended, which can lead to significant financial losses. The local real estate market in Hillsboro, while generally stable, requires this level of detailed financial scrutiny.

Future Development and Market Trends in Hillsboro

The interplay of property taxes and zoning laws is particularly critical when considering future development and market trends. Hillsboro's master plan and future land use maps, often available through the city planning department, provide a roadmap for the town's anticipated growth. These documents indicate areas targeted for residential expansion, commercial growth, or preservation, directly influencing where new development is likely to occur and what types of properties will be in demand. For instance, if a specific area is re-zoned from agricultural to residential, it can dramatically increase the land's value and development potential. Conversely, stricter environmental zoning or historical preservation overlays can limit development, increasing the value of existing, compliant properties. Analyzing these trends, alongside demographic shifts and economic indicators (such as employment rates and local business growth), allows investors to anticipate future demand and supply dynamics. For example, North Dakota has seen steady, albeit modest, population growth in recent decades, with certain rural areas experiencing revitalization. Understanding Hillsboro's specific growth trajectory and how its zoning regulations are adapted to meet these needs is key to identifying lucrative investment opportunities and contributing positively to the town's evolution. The transparency of these planning efforts, often discussed at Hillsboro City Council meetings, empowers residents and investors to make forward-looking decisions.

Legal Frameworks and Compliance for Property Owners

Owning property in Hillsboro, like anywhere else, comes with a responsibility to adhere to a myriad of legal frameworks. These regulations extend beyond just paying taxes and understanding zoning; they encompass building codes, environmental regulations, and the specific processes for obtaining permits. Compliance is not optional; it is a legal requirement that protects both the property owner and the wider community. Failure to comply can result in significant legal and financial repercussions, underscoring the importance of diligence and, when necessary, professional guidance.

Essential Permits and Regulatory Processes

Any significant construction, renovation, or alteration to a property in Hillsboro typically requires one or more permits from the city. These can include building permits, electrical permits, plumbing permits, and sometimes specific zoning permits or variances. The permit application process ensures that proposed projects comply with local building codes, safety standards, and zoning ordinances. For example, adding an extension to a home will likely require a building permit to ensure structural integrity and adherence to setback requirements, while installing a new septic system would necessitate a plumbing permit and potentially an environmental review. The Hillsboro Community Development Office serves as the primary point of contact for these applications, providing forms, guidelines, and often offering pre-application consultations. Navigating these processes can be complex, especially for larger projects, and often involves inspections at various stages of construction. Understanding the required permits early in a project's lifecycle can prevent costly delays and ensure the legality and safety of the work being performed.

Resolving Zoning Disputes and Appeals

Despite best intentions, conflicts or misunderstandings regarding zoning regulations can arise. A property owner might find that their proposed use for a property is not permitted under current zoning, or they might disagree with a neighbor's development that they believe violates an ordinance. In such cases, Hillsboro provides formal mechanisms for resolving these disputes. The first step often involves consulting with the City Planner or the Community Development Office to clarify the regulations. If a desired use is prohibited, a property owner may apply for a variance, which is an exception to zoning rules granted when strict application of the ordinance creates an undue hardship unique to the property, not a general condition. Alternatively, a re-zoning application can be submitted to change the zoning classification of a parcel, though this is a more extensive process involving public hearings and approval by the City Council. For disputes involving alleged violations, formal complaints can be filed, leading to investigations and potential enforcement actions. Understanding these avenues for redress and appeal is crucial for protecting one's property rights and ensuring fair application of the law. Engaging with a local attorney specializing in real estate law can be invaluable in navigating these often-contentious processes, ensuring that all legal steps are correctly followed.

Resources and Support for Hillsboro Property Owners

Successfully navigating the landscape of property taxes and zoning laws in Hillsboro does not have to be a solo endeavor. A wealth of resources and professional support is available to assist property owners, from direct engagement with local government departments to seeking advice from seasoned legal and financial experts. Leveraging these resources can provide clarity, prevent costly mistakes, and empower individuals to make well-informed decisions regarding their property assets in Hillsboro.

Engaging with Local Government and Community Resources

The most direct and often most valuable resources for property owners are the local government offices themselves. The Hillsboro City Hall, specifically its Community Development Office and the City Clerk's office, can provide access to official zoning maps, ordinance texts, permit applications, and property tax records. They are the authoritative source for current regulations and procedures. Similarly, the Traill County Auditor's Office can provide detailed information on property tax statements, assessment history, and payment schedules. Beyond official channels, local community organizations and real estate associations often host workshops or provide informational materials that can be highly beneficial. Attending city council meetings or planning commission hearings can also offer invaluable insights into upcoming changes in regulations or development plans, allowing property owners to stay ahead of potential impacts on their investments. Active participation and direct communication with these entities foster a more transparent and responsive local governance environment.

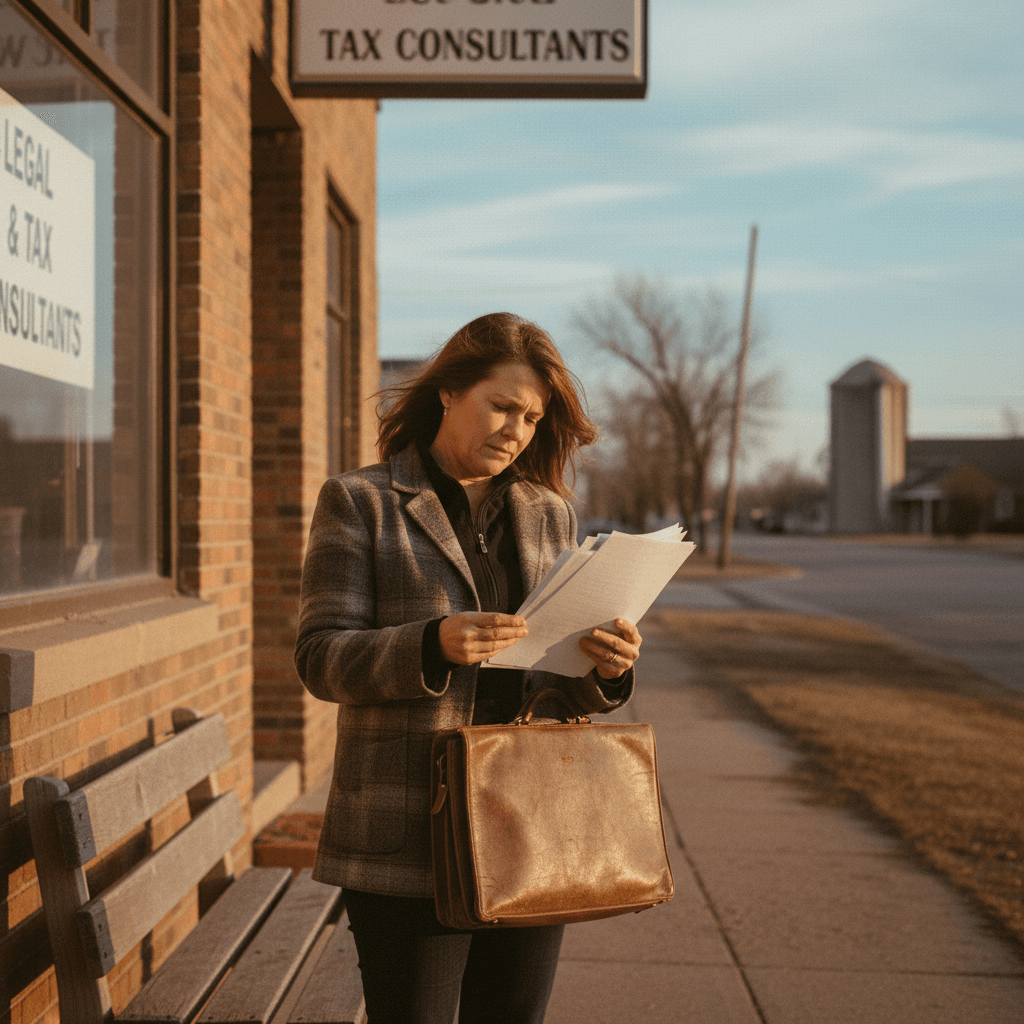

Professional Guidance: Legal and Financial Experts

While local government resources are indispensable, complex situations often warrant the expertise of dedicated professionals. A local real estate attorney, for instance, can provide tailored advice on property titles, easements, contractual agreements, and represent property owners in zoning disputes or assessment appeals. Their understanding of North Dakota's property law and Hillsboro's specific ordinances can be critical in protecting legal rights and ensuring compliance. Similarly, financial advisors, accountants, or real estate appraisers can offer specialized insights into the financial implications of property taxes, investment strategies, and property valuation. For major transactions, such as buying or selling property, engaging a local title company, like Hillsboro Title Company, is essential to ensure a clear title and smooth closing process. These professionals not only offer expert advice but also help navigate the intricate paperwork and legal requirements, ensuring that property owners in Hillsboro are well-equipped to manage their assets effectively and responsibly. The value of such expertise often far outweighs the cost, providing peace of mind and safeguarding significant investments.

Understanding the nuances of property taxes and zoning laws in Hillsboro, ND, is an essential component of responsible property ownership and shrewd investment. From the initial assessment of property values by Traill County to the intricate details of Hillsboro's zoning ordinances, each element plays a critical role in shaping the local real estate landscape. By staying informed, engaging with local resources, and seeking professional guidance when needed, property owners can confidently navigate these regulatory frameworks. This proactive approach not only ensures compliance but also unlocks opportunities for sustainable growth and contributes to the overall vitality of the Hillsboro community. The town's commitment to balanced development, coupled with its stable financial environment, makes it a compelling location for those looking to invest in North Dakota's promising real estate market.

Frequently Asked Questions

How often are property assessments updated in Hillsboro, ND?

Property assessments in Hillsboro, managed by the Traill County Assessor's Office, are typically updated periodically, often on a biennial (every two years) or quadrennial (every four years) cycle. This ensures that property values reflect current market conditions. Property owners are usually notified of significant changes to their assessment.

What is a mill levy and how does it affect my property tax bill?

A mill levy is a unit of taxation equal to $1 per $1,000 of assessed property value (or 0.001). Various local taxing authorities (city, county, school district) each set their own mill levies. Your total property tax bill is calculated by multiplying your property's assessed taxable value by the sum of all applicable mill levies. Higher mill levies result in higher property taxes.

Where can I find Hillsboro's official zoning map and ordinances?

Hillsboro's official zoning map and detailed zoning ordinances are typically available through the Hillsboro City Hall, specifically the Community Development Office. These documents outline permitted land uses, building requirements, and other regulations for different areas within the city. Many municipalities also make these available on their official websites.

What should I do if I disagree with my property's assessed value in Hillsboro?

If you disagree with your property's assessed value, you have the right to appeal. The process typically begins with contacting the Traill County Assessor's Office to discuss the assessment. If a resolution isn't reached, you can formally appeal to the local board of equalization and potentially to the county board of equalization. It's advisable to gather comparable sales data and any other evidence to support your claim.

Are there specific permits required for home renovations in Hillsboro?

Yes, most significant home renovations in Hillsboro, such as additions, structural changes, major electrical work, or plumbing system alterations, will require specific permits from the city. These permits ensure that the work complies with local building codes, safety standards, and zoning regulations. It is best to consult with the Hillsboro Community Development Office before starting any project to determine the necessary permits.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.