Dreaming of a spacious, beautiful home in the charming and growing community of Horace, North Dakota? As Horace continues to expand, offering excellent amenities and a welcoming atmosphere, more and more people are discovering its appeal. With this growth comes an increasing interest in luxury properties, which often means navigating a specific type of financing: the jumbo loan. If you're looking to purchase a home that exceeds conventional loan limits, understanding jumbo loans is your first step toward making that dream a reality. Let's break down what jumbo loans are, why they're relevant in Horace, and how you can confidently secure financing for your ideal luxury home. Learn more about Financing Your Dream Build: A Guide to New Construction....

What Are Jumbo Loans and Why Are They Relevant in Horace?

When you hear the term “jumbo loan,” it simply refers to a mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). For most of the United States, in 2024, this limit is $766,550 for a single-family home, though it can be higher in certain high-cost areas. In a vibrant community like Horace, where new developments and custom-built homes are becoming more common, properties can often surpass this threshold, especially if you're looking for extra square footage, premium finishes, or a larger lot. This is where jumbo loans come into play. Learn more about Mortgage and Financing Guide for Homebuyers in Horace, ND.

Understanding Conforming vs. Non-Conforming Loans

The main difference between a conforming loan and a jumbo loan (which is a type of non-conforming loan) lies in their size and the entities that back them. Conforming loans can be bought and sold by government-sponsored enterprises like Fannie Mae and Freddie Mac, which standardizes their requirements and makes them less risky for lenders. Jumbo loans, on the other hand, are too large for these agencies to purchase. This means lenders bear more risk, which often translates to slightly stricter eligibility criteria and a more rigorous underwriting process. However, don't let that deter you! Many lenders are eager to offer jumbo loans, especially in desirable markets like Horace, knowing there's a strong demand for higher-priced homes. Learn more about Investing in Horace, ND: Financial Insights into the....

Horace's Growing Appeal for Luxury Homebuyers

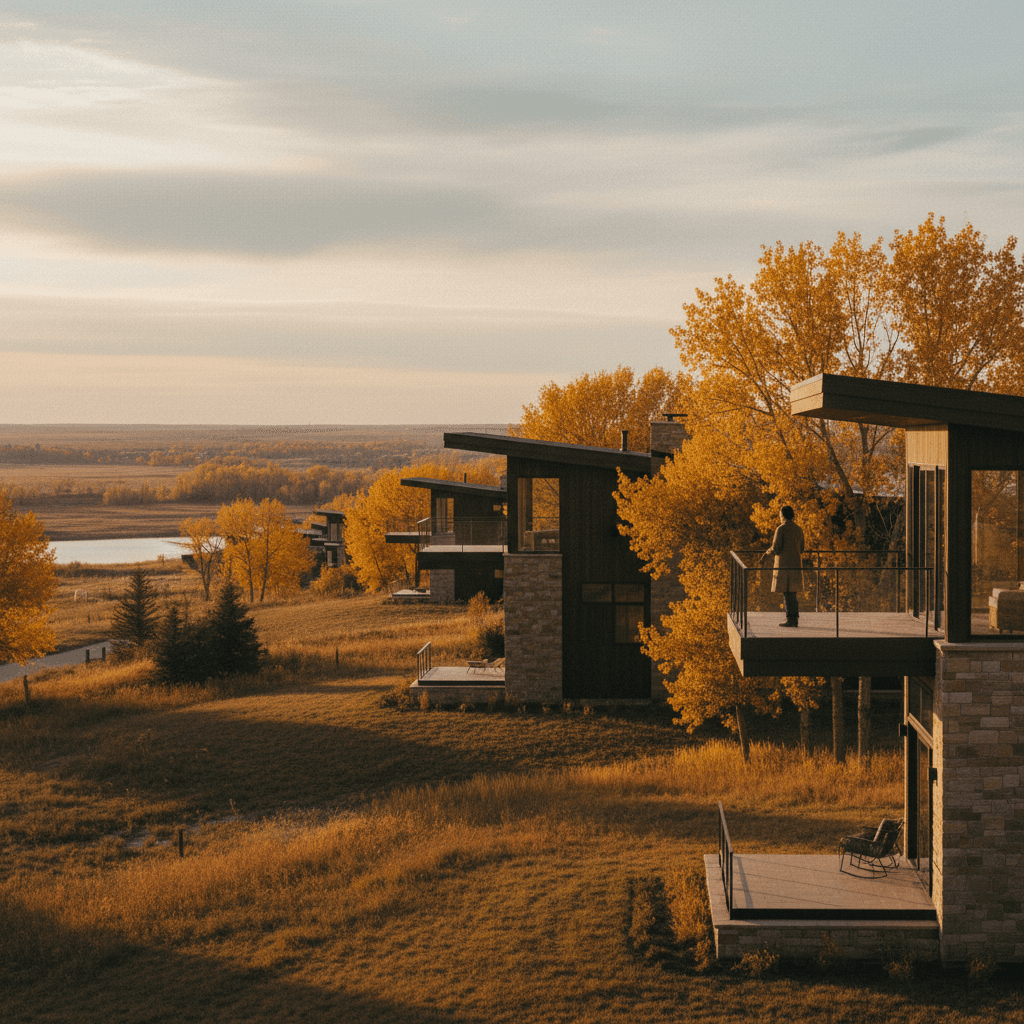

Horace, ND, is quickly becoming a go-to spot for families and individuals seeking a blend of small-town charm with modern conveniences. The community boasts excellent educational opportunities, like the highly-regarded West Fargo School District, which includes both Horace Elementary and the new Horace High School. Families appreciate the safe neighborhoods and recreational spaces such as Horace Lions Park and Horace City Park, perfect for outdoor activities. This growth and emphasis on quality of life naturally lead to a demand for larger, more upscale homes, making jumbo loans a practical and necessary financing option for many homebuyers here. Whether you're eyeing a spacious property near the parks or a custom build with all the latest amenities, a jumbo loan can bridge the gap.

Understanding the Requirements for a Jumbo Loan

Because jumbo loans represent a larger financial commitment for both you and the lender, the qualification standards are typically more stringent than for conventional mortgages. But don't worry, they are entirely achievable with careful planning! Learn more about Budgeting for Your Purchase: Financial Steps to Buying a....

Credit Score and Down Payment Expectations

Lenders want to see a strong financial history when considering a jumbo loan. Generally, you'll need a higher credit score – often 700 or above, with 740+ being ideal – to qualify for the best rates. This demonstrates your reliability as a borrower. Regarding down payments, while conventional loans might allow as little as 3% down, jumbo loans typically require a more substantial initial investment. Expect to put down anywhere from 10% to 20% or even more, depending on the loan amount and your financial profile. A larger down payment not only reduces your loan amount but can also help you secure a lower interest rate.

Debt-to-Income Ratio and Reserve Requirements

Your debt-to-income (DTI) ratio is another critical factor. Lenders calculate this by comparing your total monthly debt payments to your gross monthly income. For jumbo loans, lenders typically look for a DTI of 43% or lower, though some might go up to 45% for highly qualified borrowers. This ensures you have enough disposable income to comfortably manage your new, larger mortgage payments. Additionally, lenders often require you to have significant cash reserves – liquid assets like savings, checking, or investment accounts – to cover several months of mortgage payments after closing. This acts as a financial safety net, assuring the lender you can handle unexpected expenses without jeopardizing your loan payments. The exact number of months varies but can range from six to twelve months of payments.

Navigating the Application Process in Horace

Applying for a jumbo loan in Horace doesn't have to be intimidating. With the right approach and a knowledgeable lender, you can streamline the process and focus on finding your dream home.

Finding the Right Lender and Preparing Your Documentation

Not all lenders offer jumbo loans, and among those that do, their terms and requirements can vary. It's crucial to shop around and work with a mortgage professional who has experience with jumbo financing and understands the Horace market. They can guide you through the specific documentation needed, which often includes extensive proof of income (W-2s, tax returns, pay stubs), asset statements, and a detailed credit report. Being organized and having all your financial documents ready will significantly speed up the approval process. A local lender might also have insights into property values and appraisal processes specific to Horace, which can be invaluable.

Understanding Appraisal and Underwriting

Given the higher loan amounts, jumbo loans typically involve a more thorough appraisal process to ensure the property's value aligns with the loan amount. The appraisal will consider the home's features, size, location, and comparable sales in Horace. Sometimes, two appraisals might even be required for very large loans. The underwriting process for a jumbo loan is also more rigorous, with lenders scrutinizing your financial history, creditworthiness, and ability to repay the loan in great detail. Be prepared for a few extra questions and requests for information; it's all part of the due diligence to secure your significant investment.

Beyond the Loan: Enjoying Your Luxury Home in Horace

Securing a jumbo loan is a major milestone, but it's just the beginning of enjoying the luxury lifestyle Horace has to offer. Imagine settling into your beautiful new home and exploring all that this vibrant community provides.

Community Life and Local Amenities

Horace is more than just a place to live; it's a community where you can thrive. With excellent schools like Horace Elementary and Horace High School, it's a fantastic place for families. You'll find plenty of opportunities for recreation and relaxation at places like Horace Lions Park, which offers green spaces and playgrounds perfect for a family day out. For those evenings when you want to unwind without going far, local spots like The Dirty Daiquiri offer a casual atmosphere to enjoy good food and company. Owning a luxury home here means you're not just buying property; you're investing in a lifestyle that balances comfort, community, and convenience.

Making Your Luxury Investment Count

A luxury home in Horace is not only a personal haven but also a significant investment. As the area continues to develop, property values are likely to appreciate, making your jumbo loan a smart financial decision in the long run. Embrace the opportunity to customize your space, enjoy the peace and quiet of a growing town, and become part of a welcoming community that values quality living. With careful financial planning and the right guidance, your journey to luxury homeownership in Horace, ND, will be a rewarding one. Learn more about Living in Horace, ND: A Spotlight on One of Fargo's....

Navigating jumbo loans for a luxury home in Horace, ND, might seem complex at first, but with a clear understanding of the requirements and a proactive approach, it's an entirely manageable and exciting process. By focusing on your credit health, preparing for a solid down payment and reserves, and partnering with an experienced lender, you'll be well on your way to unlocking the door to your dream home in this fantastic community. Horace offers a unique blend of growth, amenities, and a high quality of life, making it an ideal location for your next substantial real estate investment.

Frequently Asked Questions

What is considered a 'luxury home' for jumbo loan purposes in Horace, ND?

While 'luxury' can be subjective, for jumbo loan purposes in Horace, it generally refers to homes whose purchase price exceeds the conforming loan limits set by the FHFA, which is $766,550 for a single-family home in most areas for 2024. These homes typically feature larger square footage, premium finishes, extensive amenities, or desirable locations within the Horace community.

Are interest rates higher for jumbo loans compared to conventional loans?

Historically, jumbo loan interest rates could be slightly higher due to the increased risk for lenders. However, in today's competitive market, jumbo loan rates are often comparable to, and sometimes even lower than, conforming loan rates, especially for borrowers with excellent credit and substantial down payments. It's always best to compare offers from multiple lenders.

What kind of down payment is typically required for a jumbo loan in Horace?

For jumbo loans, lenders usually require a larger down payment than for conventional loans. While some programs may allow as little as 10% down, a 15% to 20% down payment is more common. A higher down payment can not only reduce your monthly payments but may also help you secure a more favorable interest rate and better loan terms.

Do I need to live in Horace to get a jumbo loan for a property there?

No, you do not need to currently live in Horace, ND, to apply for a jumbo loan for a property in the area. Lenders focus on your financial qualifications, creditworthiness, and the property's value, regardless of your current residence. However, if you are relocating, understanding the local market and working with a lender familiar with Horace can be a significant advantage.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.