Horace, North Dakota, a charming and growing community, offers a wonderful backdrop for those considering their next chapter – a golden era focused on comfort, convenience, and financial peace of mind. As you contemplate downsizing or exploring senior living options, the financial aspects can feel like a maze. But don't worry, we're here to help you navigate it. This guide is specifically designed for Horace residents, offering a clear, conversational look at how to finance your senior living and downsizing journey right here in our beloved community. We'll break down the key financial considerations, from unlocking your home's equity to understanding the costs of various senior living arrangements and finding local support. Let's explore how to make your transition smooth and financially sound, ensuring your golden years in Horace are truly golden. Learn more about Downsizing in Horace, ND: A Practical Guide for Seniors....

Understanding the Financial Benefits of Downsizing in Horace

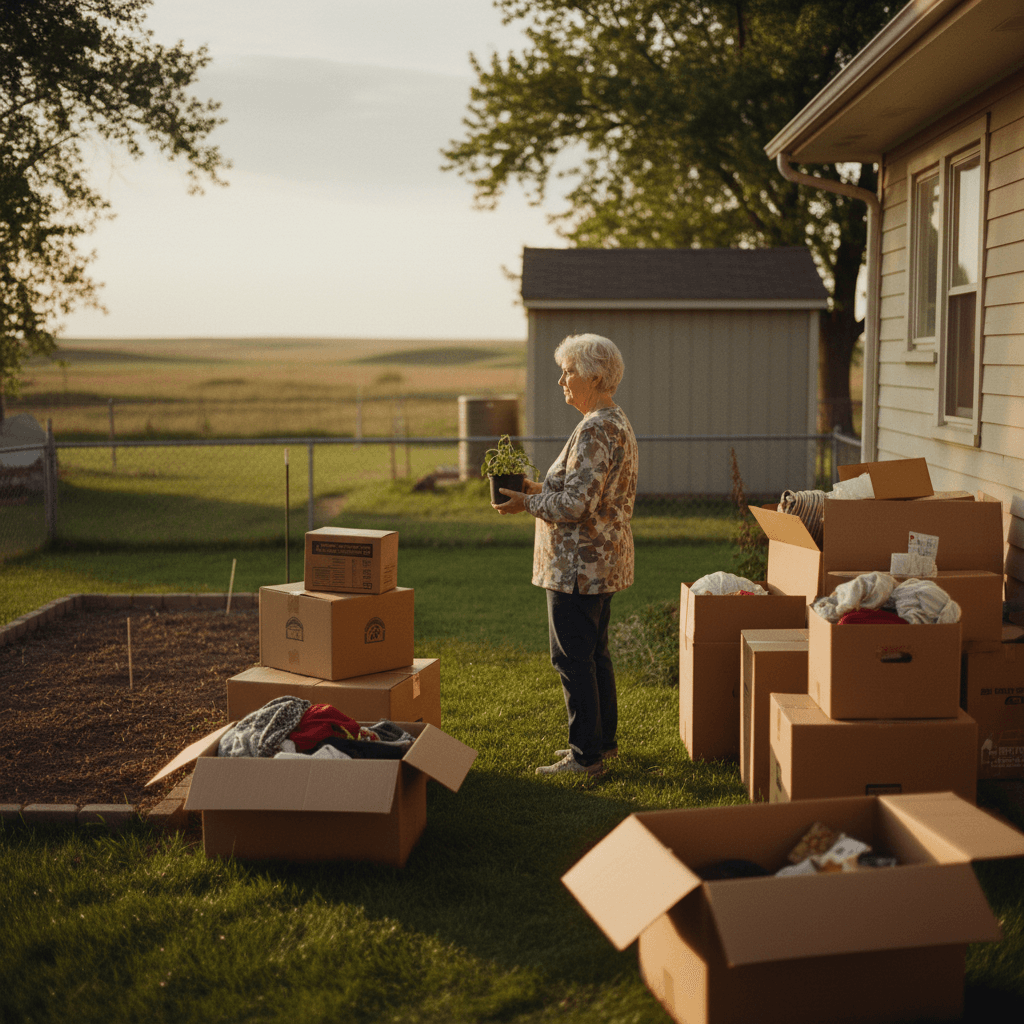

Downsizing isn't just about moving to a smaller space; it's a strategic financial decision that can significantly impact your retirement lifestyle. For many homeowners in Horace, their current home represents a substantial asset. Tapping into that asset wisely can provide a financial cushion, reduce monthly expenses, and free up capital for other pursuits, whether it's travel, hobbies, or simply enjoying a more relaxed pace of life.

Unlocking Home Equity: Your Horace Home's Value

Your home in Horace, whether it’s a cozy ranch near Horace City Park or a family home in a newer development, has likely appreciated in value over the years. This accumulated equity is a powerful tool in your downsizing strategy. When you sell your larger home, the profit can be used in several ways:

- Purchasing a Smaller Home: You might be able to buy a smaller, more manageable home outright or with a much smaller mortgage, significantly reducing housing payments.

- Investing for Retirement Income: The proceeds can be invested to generate additional income, supplementing your pensions or social security.

- Funding Senior Living Costs: If you're considering a senior living community, the equity from your home can help cover entrance fees or ongoing monthly costs.

- Creating an Emergency Fund: A robust emergency fund provides peace of mind, covering unexpected medical expenses or other unforeseen costs.

Understanding your home's current market value is the first crucial step. A local real estate agent specializing in the Horace market can provide an accurate valuation, helping you understand just how much equity you have available. They can factor in the unique charm of our community, the growth of the West Fargo School District (which includes both Horace High School and Horace Elementary), and the desirability of living in a town that balances small-town feel with access to larger city amenities.

Reducing Monthly Expenses: A Smaller Footprint in Horace

Beyond the initial influx of cash from selling your home, downsizing offers ongoing financial benefits through reduced monthly expenses. Think about it:

- Lower Mortgage Payments or No Mortgage: If you buy a smaller, less expensive home, your mortgage payments will likely decrease or even disappear entirely if you're able to pay cash.

- Reduced Property Taxes: A smaller, less valuable home typically means lower annual property taxes.

- Lower Utility Bills: Fewer square feet to heat, cool, and light translates directly into savings on electricity, gas, and water.

- Decreased Maintenance Costs: Smaller homes generally require less upkeep. Less lawn to mow, fewer rooms to clean, and potentially newer construction means fewer repair costs. Imagine spending less time on home maintenance and more time enjoying the community at Horace Lions Park or catching up with friends at The Dirty Daiquiri.

- Lower Insurance Premiums: Homeowner's insurance for a smaller, less expensive property will typically be lower.

These cumulative savings can free up hundreds, if not thousands, of dollars each month, significantly enhancing your disposable income and financial flexibility during retirement. This allows you to truly enjoy your golden years in Horace, perhaps by participating in local events or simply relaxing without the constant worry of high household costs.

Navigating Senior Living Options and Their Costs in Horace

Horace, while a smaller community, is part of a larger region with diverse senior living options. Understanding the financial implications of each is vital for making an informed decision that aligns with your budget and lifestyle preferences. From independent living to assisted care, each option comes with its own cost structure and benefits. Learn more about Senior Living Trends in Horace, ND: New Developments and....

Independent Living vs. Assisted Living: What to Expect Financially

When exploring senior living, you'll primarily encounter two main categories, each with distinct financial models:

- Independent Living: These communities are designed for active seniors who are self-sufficient but desire a maintenance-free lifestyle and opportunities for social engagement. They often feature amenities like communal dining, fitness centers, and planned activities.

- Costs: Typically involve a monthly rental fee or, in some cases, an entrance fee followed by lower monthly fees. These fees cover housing, utilities, meals, housekeeping, and access to amenities. The cost can vary widely based on the size of the unit and the services included. In the wider Fargo-Moorhead area, which Horace is close to, independent living costs can range from $1,500 to $4,000+ per month.

- Financial Considerations: Often financed through personal savings, home equity conversion, or long-term care insurance (though less common for independent living).

- Assisted Living: For seniors who need help with daily activities such as bathing, dressing, medication management, or meal preparation, assisted living facilities provide a higher level of care.

- Costs: Generally more expensive than independent living due to the personalized care services. Costs are usually structured as a base monthly fee, with additional charges for extra care services. Expect costs to range from $3,000 to $6,000+ per month in the region, depending on the level of care required.

- Financial Considerations: Often funded by a combination of private funds, long-term care insurance, veterans' benefits, or potentially Medicaid (for those who qualify and in facilities that accept it). Understanding what services are included in the base rate and what incurs additional charges is crucial.

It's essential to visit potential communities in the broader Horace area, ask detailed questions about pricing structures, and understand what happens if your care needs change over time. Many facilities offer different levels of care, allowing residents to age in place, which can provide significant peace of mind.

Exploring Local Senior Resources and Support

While Horace itself is a growing community, its proximity to Fargo provides access to a wealth of senior resources. These resources can be invaluable, not just for finding housing but also for understanding financial aid programs, legal advice, and social support.

- Area Agencies on Aging (AAA): These agencies are a fantastic starting point, offering information on local senior services, benefit programs, and care options. They can help connect you with financial counseling and resources specific to North Dakota.

- Veterans' Benefits: If you or your spouse served in the military, you might be eligible for Aid and Attendance benefits, which can help cover the costs of assisted living or in-home care.

- Long-Term Care Insurance: If you have a long-term care insurance policy, now is the time to understand its coverage and how it can be utilized for senior living expenses.

- Community Senior Centers: While a dedicated senior center might be a future addition to Horace as it grows, the nearby cities often have vibrant centers offering activities, meals, and information. These can be great for staying active and connected within the broader community, much like how Horace Lions Park serves as a hub for local families.

Proactive research and engagement with these resources can significantly lighten the financial burden and emotional stress of transitioning to senior living. Don't hesitate to reach out and explore all available options.

Financial Planning for Your Move: Budgeting and Beyond

The decision to downsize or move into senior living involves more than just selecting a new home; it requires meticulous financial planning for the transition itself. Beyond the cost of the new residence, there are moving expenses, potential renovations, and long-term care considerations that all need to be factored into your budget. A well-thought-out financial plan ensures a smooth transition without unexpected surprises.

Estimating Moving Costs and Renovation Expenses

Moving, even a short distance within Horace or to a nearby community, comes with its own set of costs. It's crucial to budget for these:

- Professional Movers: Hiring a moving company can range from a few hundred to a few thousand dollars, depending on the volume of your belongings and the distance. Get multiple quotes.

- Packing Supplies: Boxes, tape, bubble wrap, and markers add up. Consider doing some packing yourself to save on labor costs.

- Temporary Storage: If there's a gap between selling your old home and moving into your new one, you might need temporary storage for your possessions.

- Utilities Transfer/Setup: Don't forget fees associated with transferring or setting up new utility accounts.

- Cleaning Services: You might want to hire professional cleaners for both your old home (to prepare it for sale) and your new home (before you move in).

In addition to moving, consider potential renovation or repair expenses for your current Horace home. Small upgrades, like fresh paint or minor repairs, can significantly increase its market appeal and sale price. Conversely, your new home might require minor modifications for accessibility or personal preference. Budgeting for these upfront avoids dipping into your retirement savings unexpectedly. For example, if you're selling a family home near Horace Elementary, ensuring it's in top condition can attract families looking for a move-in ready property. Learn more about Budgeting for Your Purchase: Financial Steps to Buying a....

Long-Term Care Insurance and Estate Planning Considerations

While you might be focused on the immediate move, it’s also a good time to review your long-term financial health and estate plan.

- Long-Term Care Insurance: If you have a policy, understand its provisions. What services does it cover? What are the daily or monthly limits? When do benefits kick in? If you don't have one, consider if it's still a viable option, though premiums can be high as you age. This type of insurance can be a critical financial safeguard against the high costs of future care needs.

- Estate Planning Review: Downsizing often means decluttering and distributing belongings. It's an opportune moment to review your will, trusts, power of attorney, and healthcare directives. Ensure your beneficiaries are up-to-date and that your wishes are clearly documented. This process, while sometimes daunting, provides immense peace of mind for you and your loved ones. It's about ensuring your legacy and assets are managed according to your desires, providing clarity for future generations, whether they remain in Horace or live elsewhere.

- Financial Advisor: Consulting a financial advisor specializing in retirement planning can be incredibly beneficial. They can help you create a comprehensive budget, understand tax implications of selling your home, and optimize your investments for income generation, ensuring your finances are robust for the years ahead.

Taking these steps now will not only help with your immediate transition but also secure your financial future for many years to come, allowing you to truly enjoy the quiet charm and growing opportunities that Horace offers.

Tapping into Local Resources and Community Support in Horace

One of the greatest advantages of living in a tight-knit community like Horace is the inherent support network and the potential for local resources. While Horace is still growing, its connection to the wider West Fargo and Fargo areas means residents have access to a broad range of services and community engagement opportunities that can enhance their senior living experience, both socially and financially.

Connecting with Horace's Vibrant Community

Staying active and connected is crucial for a fulfilling retirement, and Horace offers wonderful opportunities. While not a direct financial resource, community engagement can lead to a richer, more satisfying life, potentially reducing the need for costly external entertainment or support services.

- Parks and Recreation: Horace boasts lovely green spaces like Horace Lions Park and Horace City Park. These are fantastic for gentle walks, enjoying nature, or simply sitting and watching the world go by. Many local events are held in these areas, providing opportunities to meet neighbors and stay involved.

- Local Establishments: Places like The Dirty Daiquiri serve as casual gathering spots where you can enjoy a meal, catch up with friends, and feel connected to the pulse of the town. Supporting local businesses also strengthens the community fabric, which benefits everyone.

- Volunteer Opportunities: Many seniors find immense satisfaction and purpose through volunteering. Check with local churches, schools (like Horace Elementary), or community organizations for ways to contribute your time and talents. This can be a great way to stay active and mentally engaged without a financial cost.

The social capital built within a community like Horace is invaluable. It provides a sense of belonging, reduces isolation, and offers informal support networks that can be just as important as formal financial planning.

Financial Assistance Programs and Senior Services

Beyond the immediate community, the broader region offers various programs designed to support seniors financially and with essential services.

- Property Tax Relief Programs: North Dakota, like many states, may offer property tax relief programs for seniors, particularly those with limited incomes. Researching these can lead to significant annual savings on your new Horace home.

- Energy Assistance Programs: Programs like LIHEAP (Low Income Home Energy Assistance Program) can help eligible seniors with heating and cooling costs, a vital support during North Dakota's distinct seasons.

- Transportation Services: While many seniors remain active drivers, knowing about local senior transportation services can provide peace of mind and access to medical appointments, shopping, and social outings without the burden of driving.

- Legal Aid for Seniors: Organizations often provide free or low-cost legal assistance to seniors on matters such as wills, benefits, and consumer protection, ensuring you have access to expert advice when needed.

Don't hesitate to reach out to local government offices, senior advocacy groups, or social services agencies in the West Fargo/Fargo area. They are excellent resources for understanding eligibility requirements and applying for programs that can provide financial relief and support, allowing you to enjoy your senior years in Horace with greater security and comfort.

Downsizing and navigating senior living options in Horace, ND, is a significant life transition, and approaching it with a clear financial strategy is key to a successful and peaceful future. By understanding the value of your current home, exploring the costs of various senior living arrangements, meticulously planning your move, and tapping into the rich tapestry of local and regional resources, you can ensure your golden years are financially secure and personally fulfilling. Horace is a community that embraces its residents, and with careful planning, you can continue to thrive here, enjoying all the charm and comfort our town has to offer. Remember, you're not alone in this journey; resources and support are available to help you every step of the way. Learn more about Navigating Jumbo Loans and Financing for Luxury Homes in....

Related Articles

Frequently Asked Questions

What are the key financial steps to consider when planning to downsize in Horace, ND?

The first key steps involve getting a professional appraisal of your current Horace home to understand its equity, creating a detailed budget for moving and potential new home purchases, and exploring senior living costs if applicable. It's also wise to consult with a financial advisor to understand tax implications and investment strategies for your proceeds.

How can I reduce monthly expenses by downsizing my home in Horace?

Downsizing typically leads to lower monthly expenses through reduced mortgage payments (or no mortgage), lower property taxes, decreased utility bills for a smaller space, and fewer maintenance costs. These savings free up capital for retirement living and recreational activities in and around Horace.

Are there specific financial assistance programs available for seniors in the Horace, ND area?

While Horace is growing, residents have access to regional programs. You can explore property tax relief programs for seniors, energy assistance programs like LIHEAP, and potentially veterans' benefits if eligible. Area Agencies on Aging (AAA) are excellent resources for finding local and state-level financial aid and support services.

What are the financial differences between independent and assisted living options near Horace?

Independent living communities are generally less expensive, involving a monthly fee for housing, utilities, and amenities, suitable for active seniors. Assisted living, on the other hand, includes personalized care services for daily activities, making it more costly with base fees plus charges for additional care, often ranging from $3,000-$6,000+ monthly in the broader region.

Should I update my estate plan when downsizing or moving to senior living in Horace?

Yes, downsizing is an ideal time to review and update your estate plan. This includes revisiting your will, trusts, power of attorney, and healthcare directives. Ensuring these documents reflect your current wishes and asset distribution, especially after a home sale, provides crucial peace of mind for you and your family.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.