In the dynamic landscape of real estate investment, discerning investors often look beyond major metropolitan areas to uncover hidden gems in secondary markets. These communities, while smaller, can offer unique advantages such as more stable growth, lower entry costs, and robust rental demand driven by regional economic hubs. Glyndon, Minnesota, a charming community nestled in Clay County, epitomizes such an opportunity. Situated conveniently close to the thriving Fargo-Moorhead metropolitan area, Glyndon presents a compelling case for those seeking to build wealth through rental property investments. Learn more about Analyzing the ROI: Why Investors are Turning to Real....

This comprehensive guide delves into the financial intricacies and strategic considerations for investing in Glyndon, MN. We will explore the local market dynamics, identify prime investment opportunities, dissect the financial analysis required for profitable ventures, and discuss effective property management strategies. Our goal is to equip you with the data-driven insights necessary to make informed decisions and capitalize on Glyndon’s potential for stable rental income and long-term appreciation. Learn more about Budgeting for Home Maintenance: Tips for Glyndon, MN....

The Glyndon Market: An Overview for Investors

Understanding the foundational economic and demographic characteristics of a market is paramount for any successful real estate investment. Glyndon, while a smaller community, benefits significantly from its strategic location and a stable local environment. Learn more about Understanding Market Value: A Financial Analysis of Real....

Demographic and Economic Foundations

Glyndon’s population, recorded at 1,438 in the 2020 Census, reflects a steady, modest growth pattern. This stability is a key indicator for rental property investors, suggesting a consistent demand for housing without the volatile swings often seen in rapidly expanding or contracting markets. The median household income in Glyndon is competitive, often aligning with or slightly exceeding state averages for similar-sized communities, which supports a tenant base with reliable income streams.

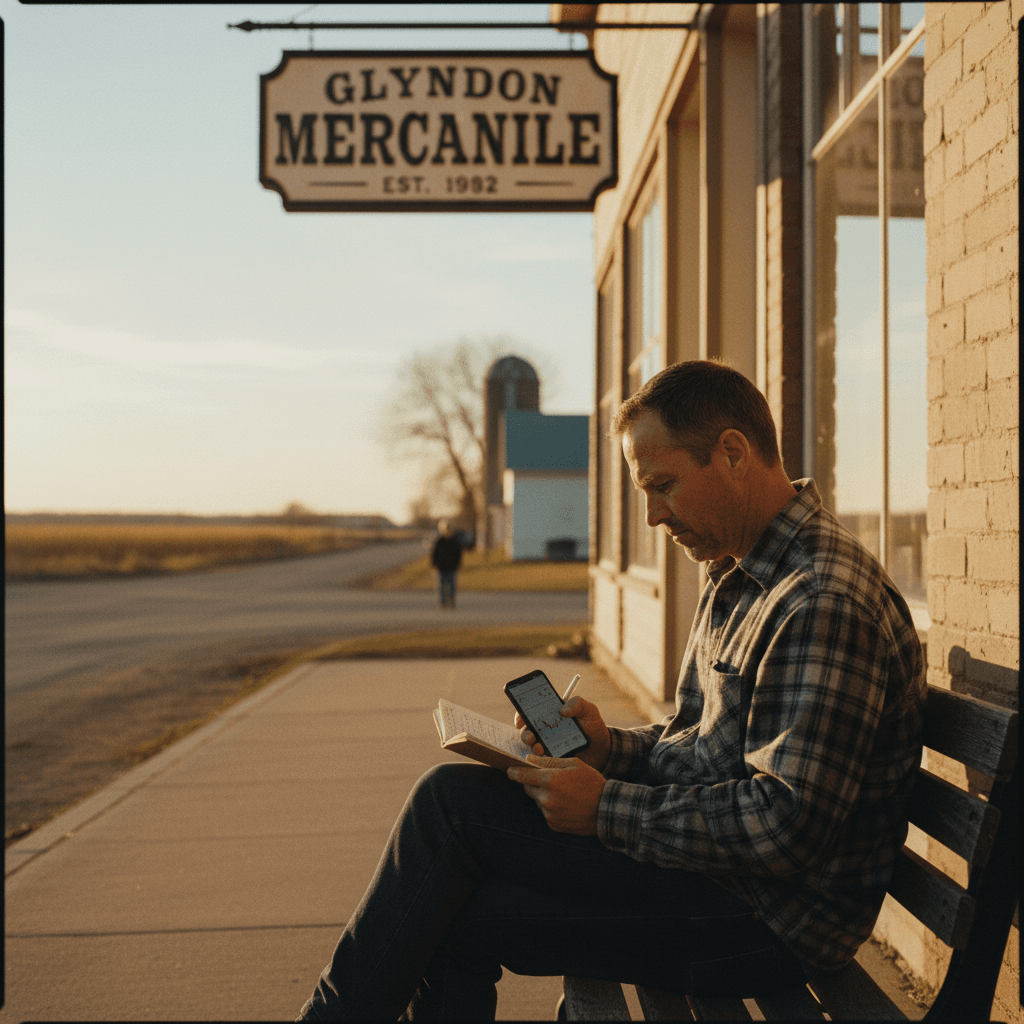

The local economy is a blend of agricultural heritage and a strong connection to the broader Fargo-Moorhead metropolitan area. While Glyndon maintains its small-town charm with local businesses like Glyndon Family Foods and Glyndon Grill providing essential services and community hubs, a substantial portion of its workforce commutes to Fargo and Moorhead. This proximity, typically a 15-20 minute drive, means Glyndon benefits from the robust job market, educational institutions (like North Dakota State University and Concordia College), and amenities of a larger city, without the associated higher cost of living or property values. This spillover effect creates a consistent demand for affordable, quality housing in Glyndon.

Housing Market Dynamics

The housing market in Glyndon is characterized by its affordability relative to its larger neighbors. As of late 2023, the median home price in Glyndon typically ranges from $220,000 to $280,000, significantly lower than the median prices observed in Fargo or Moorhead, which can often exceed $300,000. This lower entry point allows investors to acquire properties with potentially higher cash flow and better cap rates.

Inventory levels in Glyndon tend to be tighter than in larger markets, with homes often staying on the market for an average of 45-60 days. This indicates a healthy demand, particularly for well-maintained properties. Rental demand is strong, driven by families seeking good schools within the Glyndon-Felton School District, individuals working in the Fargo-Moorhead area but preferring a quieter lifestyle, and those seeking more space for their housing dollar. Vacancy rates in the broader Clay County area have historically remained low, often below 5%, suggesting a robust environment for landlords.

Identifying Prime Investment Opportunities in Glyndon

Successful real estate investment hinges on the ability to identify properties that align with market demand and offer strong potential for rental income and appreciation. In Glyndon, specific property types and locations stand out.

Property Types and Target Tenants

The most prevalent and often most lucrative property type in Glyndon for rental investment is the single-family home. These properties appeal strongly to families, who typically seek longer-term leases and tend to be more stable tenants. A 3-bedroom, 2-bathroom single-family home with a garage and yard is a highly sought-after configuration. The presence of the reputable Glyndon-Felton School District makes these properties particularly attractive to families with children.

While less common, opportunities for duplexes or smaller multi-family units may arise. These can be attractive for investors looking to maximize cash flow and potentially cater to young professionals or students commuting from Fargo-Moorhead, who may prefer more compact living arrangements. However, the market for multi-family units is smaller, and investors should conduct thorough due diligence on demand before committing.

Neighborhood Analysis and Amenity Impact

Glyndon’s relatively compact size means that most residential areas benefit from proximity to essential services and community features. Properties located closer to the town’s core, which offers easy access to local shops, the post office, and community events, tend to be highly desirable. Areas with newer construction or well-maintained existing homes generally command higher rents and attract more reliable tenants.

The impact of local amenities on rental desirability cannot be overstated. Proximity to Glyndon Park, a central community gathering space, adds significant appeal for families. Easy access to Highway 10 is also crucial for commuters, making properties with convenient ingress and egress points more attractive. Even unique local businesses, such as the Glyndon Locker Plant, contribute to the town's character and overall desirability, signaling a vibrant, self-sufficient community.

Financial Analysis and Investment Strategies

A rigorous financial analysis is the bedrock of any sound real estate investment. For Glyndon, understanding potential returns, managing costs, and securing appropriate financing are critical steps. Learn more about Understanding Property Taxes and Real Estate Contracts....

Calculating Potential Returns and Cash Flow

When evaluating a potential rental property in Glyndon, investors should focus on key metrics such as capitalization rate (cap rate) and gross rental yield. A typical 3-bedroom single-family home in Glyndon might rent for $1,400 to $1,800 per month, depending on size, condition, and specific amenities. For a property purchased at $250,000, this translates to a gross annual rental income of $16,800 to $21,600.

To calculate net operating income (NOI) and subsequently the cap rate, one must subtract operating expenses. These typically include property taxes (managed by Clay County), landlord insurance, maintenance reserves (e.g., 10% of gross rent), vacancy allowances (e.g., 5% of gross rent), and potential property management fees. For example, if annual expenses total $6,000, the NOI would be $10,800 to $15,600. Dividing this by the purchase price yields a cap rate of approximately 4.3% to 6.2%. While these figures are illustrative, they demonstrate the potential for solid, steady returns in Glyndon, especially when considering the relatively lower property acquisition costs compared to larger markets.

Financing Options and Risk Mitigation

Securing appropriate financing is a crucial step. Conventional mortgages are the most common route for investment properties, typically requiring a down payment of 20% to 25%. Local banks, such as the First State Bank of Glyndon, often have a deep understanding of the local market and may offer competitive rates or more flexible terms for local investors. It is advisable to explore options with both national lenders and local institutions. Learn more about Understanding Mortgage Options for Homebuyers in Glyndon, MN.

Risk mitigation is equally important. Thorough due diligence, including a comprehensive home inspection, is non-negotiable to identify potential structural issues or costly repairs. A detailed market analysis, perhaps with the assistance of local real estate professionals like those at Glyndon Realty Group, will ensure the purchase price aligns with market value and rental income potential. Robust tenant screening processes, including credit checks, employment verification, and rental history reviews, are vital to minimize vacancy and ensure consistent rental income. Additionally, adequate landlord insurance is essential to protect against unforeseen events and liabilities.

Managing Your Glyndon Rental Property

Effective property management is key to maximizing profitability and ensuring a positive experience for both landlords and tenants. Investors in Glyndon have options ranging from self-management to engaging professional services.

Self-Management vs. Property Management

For investors with the time, expertise, and proximity, self-management can save on costs. This involves handling all aspects: marketing vacancies, screening tenants, collecting rent, coordinating maintenance, and responding to tenant inquiries. In a smaller community like Glyndon, developing relationships with local contractors for repairs can be straightforward. However, self-management demands significant time commitment and knowledge of landlord-tenant laws.

Alternatively, engaging a professional property management company, such as a regional firm like Prairie Property Management, can be a valuable investment, especially for out-of-town investors or those with multiple properties. These companies typically charge a percentage of the monthly rent (e.g., 8-12%) but handle all operational aspects, from marketing and tenant placement to rent collection and maintenance coordination. They also bring expertise in local regulations and market conditions, ensuring compliance and efficient operations.

Legal and Regulatory Landscape

Understanding Minnesota's landlord-tenant laws is crucial for compliance and avoiding potential legal issues. These laws cover lease agreements, security deposit regulations, eviction procedures, and tenant rights. Familiarity with fair housing regulations is also paramount to ensure non-discriminatory practices in advertising and tenant selection.

Clear, comprehensive lease agreements are essential. These documents should clearly outline rent payment terms, responsibilities for utilities, maintenance expectations, pet policies, and lease duration. Staying informed about property tax assessments by Clay County and any local ordinances that might affect rental properties will help prevent surprises and ensure smooth operations.

Long-Term Growth and Future Outlook

Investing in real estate is often a long-term play, and Glyndon's future outlook suggests continued stability and potential for appreciation, supported by regional economic trends.

Regional Economic Development

The Fargo-Moorhead metropolitan area, a significant economic engine for the region, continues to demonstrate robust growth across various sectors, including technology, healthcare, education, and agriculture. This sustained growth inevitably creates a ripple effect on surrounding communities like Glyndon. As housing costs in the core metro area continue to rise, Glyndon becomes an increasingly attractive, more affordable alternative for individuals and families seeking quality housing within a reasonable commute.

Future infrastructure projects and ongoing community initiatives in the broader Clay County area are likely to further enhance Glyndon's appeal. Population projections for Clay County generally indicate continued modest growth, reinforcing the expectation of sustained demand for housing in well-located communities.

Sustaining Investment Value

To ensure the long-term value and profitability of your Glyndon investment, proactive management is key. Regular property maintenance and strategic upgrades (e.g., updating kitchens or bathrooms, improving energy efficiency) can help command higher rents and attract premium tenants. Staying informed about local market trends, including changes in rental rates, property values, and demographic shifts, will enable you to adapt your investment strategy as needed.

Engaging with the local community, whether through supporting local businesses or understanding community developments, can also provide valuable insights and foster a positive relationship with the town that your investment calls home. Glyndon’s community-oriented atmosphere provides a strong foundation for stable, long-term real estate investments.

Conclusion

Glyndon, MN, represents a compelling opportunity for real estate investors seeking stable rental income and long-term appreciation in a growing secondary market. Its strategic proximity to the Fargo-Moorhead metro area, coupled with its affordable housing market, strong community character, and reliable tenant base, creates an attractive investment environment. By conducting thorough financial analysis, identifying suitable property types, and implementing effective management strategies, investors can confidently navigate the Glyndon market.

The data points towards a community poised for continued stability, making Glyndon an excellent choice for those looking to diversify their portfolio with a property that offers both immediate cash flow potential and enduring value. As with any investment, careful planning and informed decision-making are paramount, and Glyndon stands ready to reward the diligent investor.

Frequently Asked Questions

Why is Glyndon, MN a good place to invest in rental properties?

Glyndon offers a strategic location near the growing Fargo-Moorhead metropolitan area, providing a stable job market and tenant pool. Its lower property acquisition costs compared to the larger cities, combined with consistent rental demand and a strong community, contribute to favorable rental yields and long-term appreciation potential for investors.

What types of properties are best for rental income in Glyndon?

Single-family homes, particularly 3-bedroom, 2-bathroom configurations with a garage and yard, are highly sought after by families and long-term tenants due to the excellent Glyndon-Felton School District. While less common, well-located duplexes can also offer good cash flow opportunities.

What are the typical rental yields or cap rates in Glyndon, MN?

Based on current market conditions, a typical 3-bedroom single-family home in Glyndon could generate a gross annual rental income between $16,800 and $21,600. After accounting for operating expenses, investors might expect capitalization rates ranging from 4.3% to 6.2%, which is competitive, especially given the relatively lower property acquisition costs.

Should I self-manage my rental property or hire a property management company in Glyndon?

The decision depends on your time availability, proximity to Glyndon, and experience. Self-management can save costs but requires significant time and knowledge of landlord-tenant laws. Hiring a local or regional property management company is often recommended for out-of-town investors or those with multiple properties, as they handle all operational aspects, from tenant screening to maintenance, for a percentage of the monthly rent.

What are the key financial considerations for investing in Glyndon real estate?

Key financial considerations include a thorough analysis of potential rental income versus operating expenses (property taxes, insurance, maintenance, vacancy) to determine net operating income and cap rate. Investors should also explore financing options from both local and national lenders, plan for a 20-25% down payment, and budget for due diligence costs like home inspections.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.