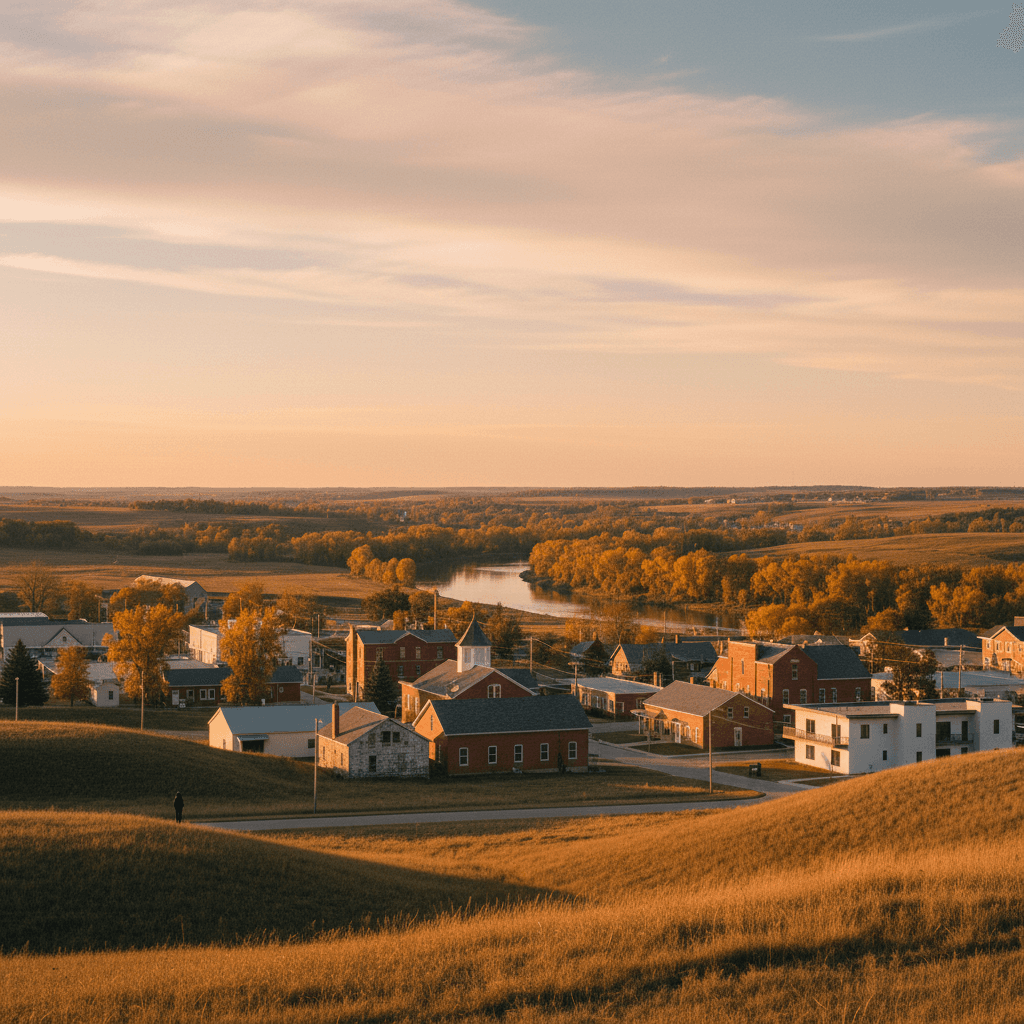

Hillsboro, North Dakota, a charming community nestled within Traill County, presents a distinct and often underestimated opportunity for real estate investors prioritizing stability, predictable cash flow, and long-term appreciation. While larger metropolitan areas frequently dominate investment headlines, the unique dynamics of smaller, resilient markets like Hillsboro offer compelling advantages, particularly within the residential rental sector. This comprehensive guide aims to provide a data-driven perspective on the financial intricacies of investing in Hillsboro, meticulously analyzing its economic underpinnings, the performance of its rental market, and the strategic approaches essential for successful property leasing and management. For discerning investors who value community stability and robust returns over speculative growth, Hillsboro warrants a detailed examination. Learn more about Investing in Hillsboro, ND: A Financial Look at the....

Hillsboro's Economic Foundation and Enduring Investment Allure

The economic resilience of Hillsboro is firmly rooted in its pivotal role within North Dakota's agricultural sector and its function as a vital service hub for Traill County. A thorough understanding of these foundational economic elements is paramount for accurately assessing the long-term viability and stability of real estate investments in the area.

Demographic Trends and Sustained Growth Potential

Despite its modest population, typically hovering around 1,600 residents, Hillsboro exhibits demographic patterns that are remarkably favorable for consistent rental demand. Data from the U.S. Census Bureau, while showing general rural population shifts, often highlights the stability or slight growth of communities that serve as county seats or critical agricultural centers due to the concentration of essential services and local employment opportunities. Hillsboro's strategic location, approximately 30 miles west of the thriving economic hub of Fargo, also plays a significant role. This proximity allows residents to enjoy the tranquility and lower cost of living in Hillsboro while maintaining convenient access to Fargo’s diverse employment market and urban amenities. This dual advantage contributes to a steady and predictable tenant pool, crucial for minimizing vacancy risks. Learn more about Local Investment Opportunities: The Rising Real Estate....

Core Economic Drivers and Market Resilience

The local economy is robustly supported by its agricultural base, complemented by a network of essential services in retail, healthcare, and education. Significant local employers include the Hillsboro Public School District, various government offices, and agricultural processing facilities. The presence of established financial institutions, such as Hillsboro Community Bank, further underscores the solid local economic infrastructure, providing vital support to both businesses and residents. This diversified, albeit localized, economic framework fosters a resilient market environment, inherently less vulnerable to the rapid economic fluctuations that can impact single-industry towns. Furthermore, North Dakota, particularly its agricultural regions, consistently reports unemployment rates well below the national average, often in the 2-3% range, signifying a strong and stable workforce that requires reliable housing. Learn more about The Financial Side of Selling: Closing Costs and Net....

In-Depth Analysis of the Hillsboro Rental Market

A meticulous analysis of current market statistics and trends is indispensable for uncovering Hillsboro's potential for attractive investment returns. This section will delve into current demand drivers, prevalent property types, and critical rental rate dynamics.

Identifying Rental Demand and Optimal Property Types

The primary drivers of rental demand in Hillsboro include local families seeking affordable housing, agricultural workers requiring proximity to their workplaces, and a segment of the workforce commuting to Fargo who prefer Hillsboro's community atmosphere and lower housing costs. Market observations indicate that single-family homes, particularly those offering 2-3 bedrooms, and well-maintained duplexes are the most coveted property types, collectively representing an estimated 65-75% of the local rental market's demand. The limited pace of new residential construction means that the existing housing stock experiences consistent demand. Investors focusing on properties that are well-maintained and strategically located – perhaps within easy reach of local amenities like the Hillsboro City Park or the Traill County Medical Center – typically benefit from significantly lower vacancy rates, often in the range of 2-4%. This figure is notably below the national average, indicating a tight and competitive rental environment.

Projecting Rental Rates and Investment Returns

Current market data suggests that average monthly rental rates for a 2-bedroom home in Hillsboro typically fall between $900 and $1,200, while 3-bedroom properties can command $1,100 to $1,450, depending on condition and amenities. These rates, when juxtaposed with the relatively affordable property acquisition costs characteristic of the region, present compelling opportunities for positive cash flow. For illustrative purposes, an investment property acquired for $175,000 generating $1,100 in monthly rent could achieve a gross rental yield of approximately 7.5% annually. After meticulously factoring in operational expenses such as property taxes, insurance, maintenance reserves (which can be estimated at 30-40% of gross rent), and potential property management fees, a net cash flow can still be robust. Savvy investors should target properties that demonstrate a capitalization rate (cap rate) of 6.5% or higher, as this typically signals strong potential for optimal long-term financial performance. Local real estate professionals, such as those at Prairie Realty Group, can offer invaluable, granular data on specific neighborhoods and recent sales comparables, aiding in precise valuation.

Mastering Property Management and Leasing Strategies in Hillsboro

Successful real estate investment transcends the initial purchase; diligent property management and strict adherence to local leasing best practices are paramount for maximizing profitability, safeguarding asset value, and ensuring high tenant satisfaction.

Adhering to North Dakota Landlord-Tenant Regulations

All rental agreements in Hillsboro are governed by the comprehensive landlord-tenant laws of North Dakota. It is imperative for investors to possess a thorough understanding of these regulations, which encompass critical aspects such as security deposit limitations, proper notice periods for property entry, and the legally prescribed eviction procedures. A meticulously drafted lease agreement, fully compliant with all state statutes, is not merely advisable but essential. This document should unambiguously delineate responsibilities for maintenance, utility payments, pet policies, and a clear schedule for rent collection. Engaging with local legal counsel or partnering with a reputable property management firm specializing in North Dakota real estate law is highly recommended to mitigate potential legal liabilities and navigate the complexities effectively. For routine maintenance and property upkeep, local suppliers like Hillsboro Hardware & Supply can be excellent resources, offering not just materials but also local expertise on building standards.

Strategic Tenant Acquisition and Long-Term Retention

In Hillsboro's close-knit community, a multi-faceted approach to tenant acquisition typically yields the best results. While online platforms are essential for broader reach, local advertising channels, community bulletin boards, and even word-of-mouth within established local networks prove exceptionally effective. A stringent and comprehensive tenant screening process, including detailed credit checks, thorough background checks, and verification of previous rental references, is non-negotiable for securing reliable and responsible renters. Equally crucial are robust tenant retention strategies; these include prompt and efficient responses to maintenance requests, transparent and fair rental adjustments, and the cultivation of positive, professional landlord-tenant relationships. Reducing tenant turnover significantly impacts profitability by minimizing vacancy periods and re-leasing costs. Fostering a welcoming environment, perhaps by highlighting local community hubs like The Hillsboro Coffee House as part of the neighborhood appeal, can enhance tenant satisfaction and integration. Furthermore, connecting with local development initiatives, such as those promoted by the Traill County Economic Development Corporation, can provide valuable insights into future growth patterns and emerging tenant demographics.

Investing in the Hillsboro, North Dakota, real estate market presents a compelling and financially sound proposition for those seeking a stable, cash-flow-positive venture with long-term growth potential. Its enduring agricultural economy, consistent demographic trends, and a rental market characterized by manageable dynamics collectively forge a robust foundation for investor success. By diligently leveraging comprehensive market analysis, adhering strictly to local regulatory frameworks, and implementing proactive, effective property management strategies, investors are well-positioned to unlock the significant value inherent within this charming North Dakota community. The pathway to success in Hillsboro lies in a data-driven investment approach, coupled with a genuine commitment to local engagement and professional asset management, ensuring that investments not only yield strong returns but also contribute meaningfully to the sustained vibrancy of Hillsboro. Learn more about Investing in Hillsboro, ND: A Landlord’s Guide to the....

Related Articles

Frequently Asked Questions

What makes Hillsboro, ND, an attractive location for real estate investment?

Hillsboro offers a stable, agriculturally-driven economy, consistent demographic patterns, and a lower cost of living compared to larger cities. Its proximity to Fargo provides access to a broader job market while maintaining a tight-knit community feel, leading to steady rental demand and predictable cash flow opportunities.

What are the typical rental property types in demand in Hillsboro?

The highest demand in Hillsboro is typically for 2-3 bedroom single-family homes and duplexes. These properties cater to local families, agricultural workers, and commuters seeking affordable housing. Well-maintained properties in good locations tend to experience lower vacancy rates.

What kind of rental yields can investors expect in Hillsboro, ND?

While specific yields vary by property, investors can generally target gross rental yields of 7.5% or higher due to relatively affordable property acquisition costs balanced against competitive monthly rental rates (e.g., $900-$1,450 for 2-3 bedroom homes). A target capitalization rate (cap rate) of 6.5% or more is advisable for strong long-term financial performance.

What are the key considerations for property management and leasing in Hillsboro?

Key considerations include a thorough understanding of North Dakota's landlord-tenant laws, implementing robust tenant screening processes, and utilizing both online and local advertising channels for tenant acquisition. Prompt maintenance responses and fostering positive landlord-tenant relationships are crucial for high tenant retention and minimizing turnover costs.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.