Wahpeton, North Dakota, a vibrant community nestled in the rich agricultural landscape of the Red River Valley, presents a compelling, albeit often overlooked, market for real estate investors. While larger metropolitan areas often dominate investment headlines, astute investors understand the value proposition of smaller, stable communities with consistent demand drivers. Wahpeton, with its strategic location, a robust local economy, and the significant presence of the North Dakota State College of Science (NDSCS), offers a unique blend of stability and potential for those looking to diversify their portfolio or enter the rental market. Learn more about Real Estate Investment in Wahpeton, ND: Buying and....

This analysis delves into the critical factors shaping Wahpeton's rental landscape, providing a data-driven perspective on what makes this city an attractive prospect for real estate investment. From understanding demographic shifts to identifying profitable property types and navigating local regulations, our aim is to equip potential investors with the insights needed to make informed decisions in this distinctive North Dakota market. Learn more about Smart Investing: Real Estate Opportunities in Jamestown, ND.

Wahpeton's Economic Landscape: Foundations for Investment

Understanding the economic bedrock of any city is paramount for real estate investors. Wahpeton’s economy is characterized by a resilient mix of education, manufacturing, and agriculture, creating a stable environment for the rental market. Learn more about Pelican Rapids, MN Rental Market: Opportunities for....

Demographic Shifts and Driving Forces

Wahpeton’s population has shown remarkable stability, hovering around 7,700 residents. This consistency, while not indicative of rapid growth, signals a predictable demand for housing. A significant driver of this stability is the presence of the North Dakota State College of Science (NDSCS). NDSCS enrolls approximately 3,000 students annually and employs a substantial faculty and staff, injecting a consistent influx of temporary and permanent residents into the community. This academic institution acts as a cornerstone, ensuring a steady demand for rental properties, particularly those suitable for students and young professionals.

Beyond education, Wahpeton benefits from a strong manufacturing sector, with companies contributing to local employment and attracting skilled labor. These industries contribute to a diverse workforce, reducing reliance on any single sector and fostering a stable tenant base. The city's location near the Minnesota border also provides access to a broader regional job market, subtly bolstering its economic resilience.

Rental Demand and Vacancy Rates

The Wahpeton rental market generally experiences low to moderate vacancy rates, a positive indicator for investors. While specific up-to-the-minute statistics can fluctuate, historical trends suggest that well-maintained and competitively priced properties tend to fill quickly. Demand is often highest for properties close to NDSCS, reflecting the student population's needs, and for family-friendly homes in established neighborhoods. Anecdotal evidence from local property managers suggests vacancy rates typically range from 3-7%, which is considered healthy and indicative of a balanced market. This balance allows investors to maintain consistent occupancy while also offering opportunities for rental rate adjustments in line with market conditions. Factors influencing demand include the annual NDSCS enrollment cycles and local economic development initiatives promoted by entities like the Wahpeton Chamber of Commerce, which works to attract and retain businesses.

Identifying Opportunities: Property Types and Investment Niches

Wahpeton offers a variety of property types that cater to different investment strategies. Understanding the nuances of each can help investors align their goals with the most suitable assets.

Single-Family Homes vs. Multi-Unit Properties

Single-family homes in Wahpeton appeal to families, young professionals, and even some NDSCS staff. These properties often offer stable, long-term tenancy and can appreciate steadily. Investors might find opportunities in neighborhoods with good school access or proximity to parks. The median home price in Wahpeton tends to be more accessible than in larger urban centers, making entry into the market feasible for many investors. While specific figures vary, typical median home values might range from $180,000 to $250,000, offering attractive entry points compared to national averages.

Multi-unit properties, such as duplexes, triplexes, or small apartment buildings, present a different advantage: multiple income streams from a single asset. These are particularly popular near the NDSCS campus, catering to student populations or smaller households. While the initial capital outlay might be higher, the potential for higher gross rental income and better cash flow can be significant. Multi-unit properties also offer a hedge against vacancy, as the loss of one tenant does not result in a complete loss of income.

The Student Housing Advantage

The presence of NDSCS is a dominant factor in Wahpeton's rental market, creating a robust demand for student housing. Investors targeting this niche can focus on properties offering convenient access to the college, either within walking distance or a short commute. Features like multiple bedrooms, communal living spaces, and proximity to local amenities are highly valued by students. While student tenants may require more active management, the consistent annual turnover and strong demand can translate into reliable rental income. Properties that offer furnished options or include utilities can often command higher rents and attract students seeking convenience. Understanding the academic calendar is key to managing turnovers and securing new tenants efficiently each year.

Financial Prudence and Local Market Navigation

Successful real estate investment hinges on sound financial analysis and a thorough understanding of the local operational environment.

Analyzing Property Values and Return on Investment (ROI)

Wahpeton's property values have demonstrated steady growth, reflecting the city's economic stability. When evaluating potential investments, investors should look at key metrics such as rental yields (annual rental income as a percentage of property value) and capitalization rates (net operating income as a percentage of property value). While these can vary greatly by property type and condition, a general range for rental yields in Wahpeton might fall between 6% and 9% for well-managed properties, depending on the purchase price and rental income. This often provides a healthier cash flow scenario compared to markets with significantly higher property acquisition costs.

Financing options are also crucial. Local financial institutions like Gate City Bank often have a deep understanding of the local market dynamics and can offer tailored lending solutions for investment properties. Working with local lenders can provide an advantage in navigating the specific financial landscape of Wahpeton.

Understanding Local Regulations and Property Management

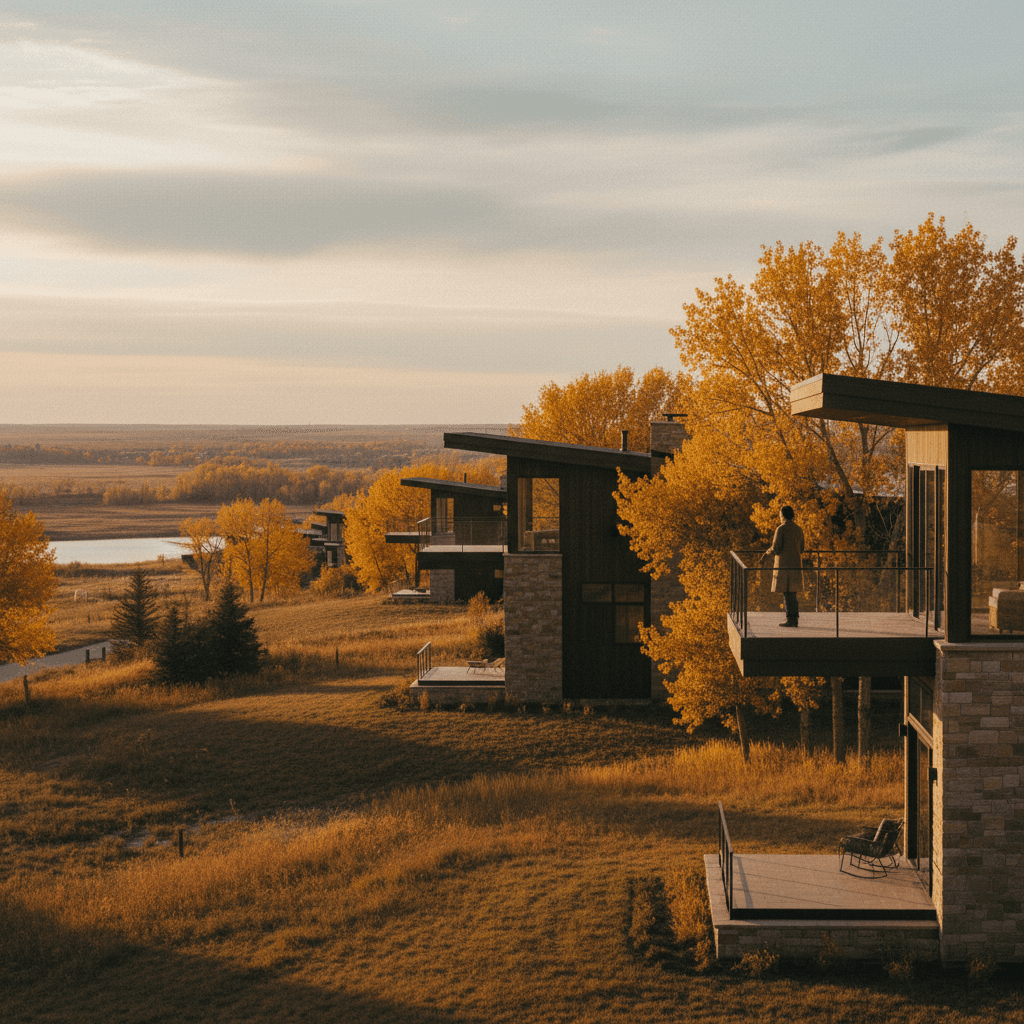

Navigating local ordinances, zoning laws, and landlord-tenant regulations is a critical component of successful real estate investment. Wahpeton, like any municipality, has its own set of rules governing property use, maintenance, and rental agreements. Investors should familiarize themselves with these regulations to ensure compliance and avoid potential legal issues. Resources are typically available through the city clerk's office or planning department. For out-of-town investors, or those with multiple properties, engaging a reputable local property management company can be invaluable. A local manager understands market rents, tenant screening best practices, and can efficiently handle maintenance, ensuring properties remain attractive and profitable. This local expertise is particularly important in a market like Wahpeton, where community relationships and local knowledge can significantly streamline operations. Learn more about New Construction in Wahpeton, ND: What Buyers Need to Know.

Conclusion

Wahpeton, ND, offers a compelling investment proposition for those seeking stability, consistent demand, and a favorable entry point into the real estate market. Its unique blend of educational influence, industrial stability, and community appeal creates a resilient rental market. While due diligence, including thorough market research, financial analysis, and an understanding of local dynamics, remains essential, the foundational elements for successful real estate investment are firmly in place. By focusing on key drivers such as NDSCS, understanding the nuances of property types, and diligently managing financial and regulatory aspects, investors can confidently navigate Wahpeton's rental landscape and cultivate a prosperous real estate portfolio.

Related Articles

Frequently Asked Questions

What are the primary drivers of rental demand in Wahpeton, ND?

The primary drivers of rental demand in Wahpeton are the North Dakota State College of Science (NDSCS), which brings a consistent influx of students and staff, and the stable local manufacturing and agricultural sectors that employ a significant portion of the workforce. These factors ensure a steady tenant pool for both student housing and family-oriented rentals.

What types of properties are best for investment in Wahpeton?

Both single-family homes and multi-unit properties offer good investment potential. Single-family homes attract stable, long-term tenants like families and professionals. Multi-unit properties, especially those near NDSCS, are ideal for student housing, offering multiple income streams and catering to a consistent demand from the college population.

What are typical vacancy rates in the Wahpeton rental market?

Wahpeton generally experiences low to moderate vacancy rates, typically ranging from 3-7% for well-maintained and competitively priced properties. This indicates a healthy, balanced market where properties tend to fill efficiently, particularly those that align with the needs of the student population or local workforce.

How important is local property management for out-of-town investors in Wahpeton?

For out-of-town investors, local property management is highly recommended. A local manager possesses invaluable knowledge of market rents, tenant screening best practices, and local regulations. They can efficiently handle maintenance, turnovers, and tenant relations, ensuring the property remains profitable and compliant with local ordinances, which is crucial for long-term success.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.