Dreaming of a home built just for you, designed to your exact specifications, nestled in the charming community of Pelican Rapids? It's a wonderful vision, and for many first-time buyers, building from the ground up can feel like a daunting prospect, especially when it comes to financing. But don't let the complexities of construction loans deter you! With the right knowledge and a clear understanding of the process, your custom-built home in Pelican Rapids is well within reach. Let's break down everything you need to know about construction financing, making it approachable and easy to understand so you can confidently take the first steps toward your dream home.

Understanding Construction Loans: Your First Step to Building in Pelican Rapids

Construction loans are a unique beast compared to traditional mortgages. When you buy an existing home, the lender knows the property's value from the start. With new construction, the home isn't built yet, so the financing works differently. It's designed to cover the costs of building, from purchasing the land to pouring the foundation, framing the walls, and all the finishing touches. Learn more about Mortgage Options for Vacation Homes and Primary....

What Makes Construction Loans Different?

Unlike a standard mortgage that gives you a lump sum, a construction loan disburses funds in stages, known as 'draws.' These draws are typically released to your builder as specific phases of construction are completed and inspected. This phased approach protects both you and the lender, ensuring that the work is progressing as planned and the funds are used appropriately. It also means you're only paying interest on the money that has actually been disbursed, which can be a relief during the building phase. Learn more about Navigating Home Loans: Mortgage Tips for Buyers in....

Why Build in Pelican Rapids?

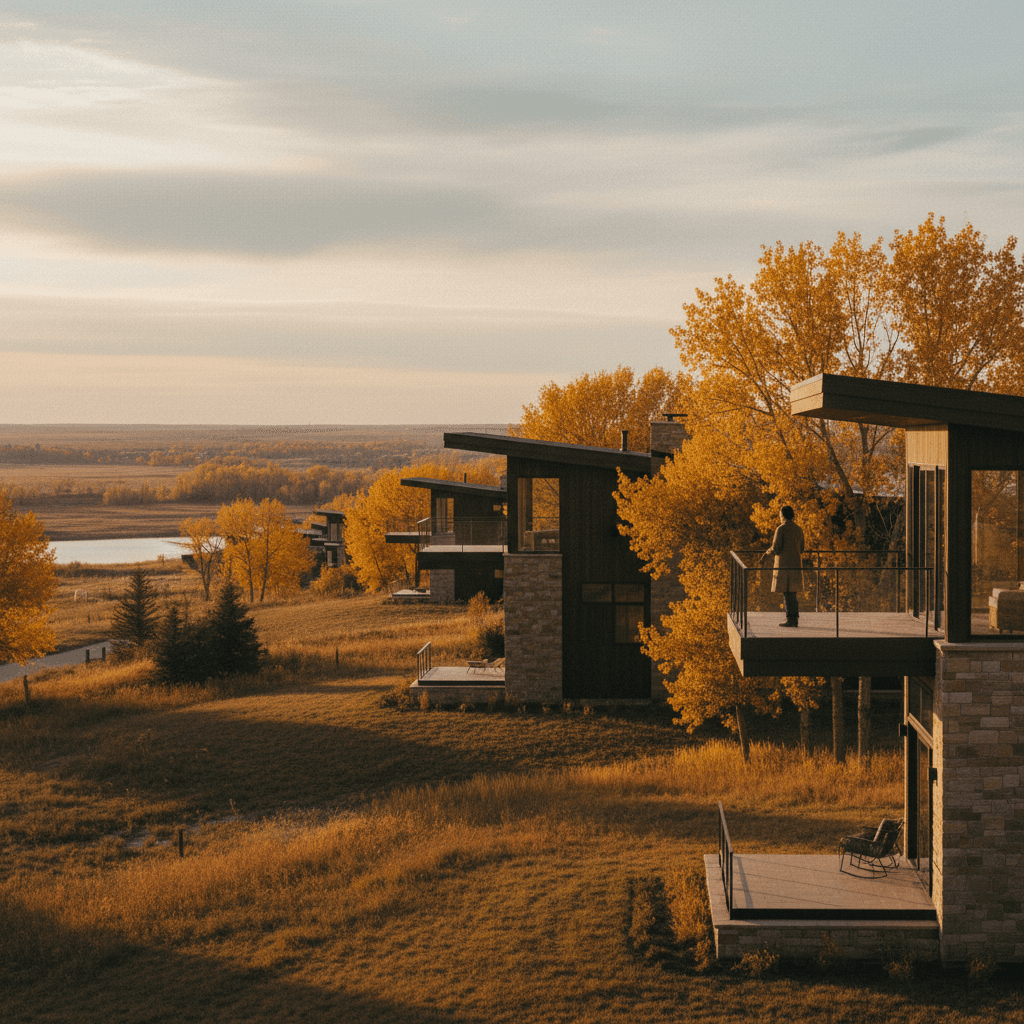

Pelican Rapids, with its picturesque setting by Pelican Lake and its friendly, tight-knit community, offers an idyllic backdrop for a custom-built home. Imagine designing a home that perfectly captures the serene beauty of Minnesota lake country, with easy access to outdoor activities and the charm of a small town. Building here allows you to integrate your home seamlessly into the local landscape, whether you're looking for a lakeside retreat or a cozy family home close to town amenities. The unique character of Pelican Rapids makes it a fantastic place to put down roots and create a home that truly reflects your lifestyle.

Types of Construction Financing Available

When it comes to construction loans, you generally have a couple of main options. Understanding the differences will help you choose the best path for your project and financial situation. Learn more about Investing in Luxury: The Financial Outlook for High-End....

Construction-to-Permanent Loans: The Streamlined Approach

This is often the most popular choice for first-time builders. A construction-to-permanent loan, sometimes called a single-close loan, combines your construction financing and your long-term mortgage into one loan with a single closing. During the construction phase, you'll make interest-only payments on the funds drawn. Once construction is complete and the home receives its certificate of occupancy, the loan automatically converts into a permanent mortgage, usually with a fixed or adjustable interest rate. This option saves you time and money by avoiding a second closing, and you lock in your permanent interest rate early in the process. Learn more about Navigating Mortgage Options and Home Financing in....

Standalone Construction Loans: Flexibility for Specific Projects

A standalone construction loan, or two-close loan, involves two separate loans. First, you get a short-term construction loan to cover the building costs. Once the home is finished, you'll then need to apply for a separate, traditional mortgage to pay off the construction loan. While this means two application processes and two sets of closing costs, it can offer more flexibility. For instance, if you anticipate interest rates might drop during your construction period, you could wait to lock in your permanent mortgage rate closer to completion. It can also be beneficial if you're planning to sell your current home and use the proceeds to pay off the construction loan.

Navigating the Construction Loan Process in Pelican Rapids

Embarking on a construction project can feel like a big undertaking, but breaking it down into manageable steps makes it much clearer. Here's a general overview of what to expect.

From Pre-Approval to Project Completion

The journey begins with pre-approval, much like a traditional mortgage. Your lender will assess your financial health, including income, credit score, and debt-to-income ratio. Once pre-approved, you'll need to finalize your building plans, secure a qualified builder, and get detailed cost estimates. The lender will review these plans, the builder's credentials, and an appraisal based on the future value of the completed home. After closing, funds are released in draws as construction progresses, subject to inspections at each stage. It's crucial to stay in close communication with your builder and lender throughout this process to ensure everything stays on track.

Local Lenders and Resources

When seeking construction financing in Pelican Rapids, working with a local lender can offer significant advantages. They often have a deeper understanding of the local real estate market, building codes, and even relationships with local appraisers and contractors. For example, institutions like Pelican Rapids Savings & Loan might offer tailored construction loan products and personalized service that can be invaluable. Additionally, connecting with the Pelican Rapids Area Chamber of Commerce can provide resources for finding reputable local builders and understanding local economic conditions. Don't hesitate to visit Pelican Rapids City Hall for information on permits and local zoning regulations—these details are critical for a smooth build.

Key Considerations for Your Pelican Rapids Dream Home

Building a home is more than just securing a loan; it's about making informed decisions every step of the way to ensure your project's success and your long-term satisfaction.

Budgeting Beyond the Build

While the construction loan covers the physical building, remember to budget for other crucial expenses. This includes the cost of the land if you don't already own it, permits and fees from the city or county, utility hookups, landscaping, and even potential cost overruns. It's wise to have a contingency fund – typically 10-15% of the total project cost – to cover unexpected expenses that can arise during construction. A clear, detailed budget is your best friend throughout this process.

Finding the Right Team

Your builder is arguably the most critical partner in your home-building journey. Look for experienced, licensed, and insured contractors with a strong track record in Pelican Rapids and the surrounding areas. Ask for references, view their previous work, and ensure their communication style aligns with yours. A good architect or home designer who understands local aesthetics and building requirements is also invaluable. Building a strong, trustworthy team will alleviate much of the stress and ensure your vision is executed to the highest standards.

Building a custom home in Pelican Rapids is an exciting endeavor that offers the unique opportunity to create a living space perfectly suited to your life. While construction financing may seem complex at first, understanding the different loan types, the process, and the importance of thorough planning will empower you to move forward with confidence. With the beauty of Pelican Lake at your doorstep and a supportive community, your dream home awaits. Take the first step today and explore the possibilities of building your future in Pelican Rapids, MN. Learn more about The Cost of Living by Neighborhood: A Financial Guide to....

Frequently Asked Questions

What is a construction-to-permanent loan in Pelican Rapids, MN?

A construction-to-permanent loan combines your construction financing and your long-term mortgage into one loan. You make interest-only payments during construction, and once the home is complete, the loan converts into a permanent mortgage, often with a locked-in rate. This saves you from having two separate closings and associated fees.

How do I find a reliable builder for my new home in Pelican Rapids?

To find a reliable builder in Pelican Rapids, start by asking for recommendations from local real estate agents, lenders, or friends. Check with the Pelican Rapids Area Chamber of Commerce for local business directories. Always verify their licensing, insurance, and ask for references from past clients, viewing their completed projects if possible. Get multiple bids and ensure detailed contracts.

What are common extra costs to budget for when building a home in Pelican Rapids?

Beyond the construction itself, common extra costs include land purchase (if not already owned), city and county permits and fees, utility hookups (water, sewer, electricity), landscaping, site preparation, and potentially unexpected expenses or change orders. It's highly recommended to set aside a contingency fund, typically 10-15% of your total project cost, to cover unforeseen issues.

Can I use a construction loan to renovate an existing home in Pelican Rapids?

While construction loans are primarily for new builds, some lenders offer renovation or 'construction-rehab' loans that function similarly for extensive remodels. These loans might be suitable if the renovation significantly alters the home's structure or value. It's best to discuss your specific project with a local lender in Pelican Rapids to see if a construction loan or a home equity loan/line of credit is more appropriate for your renovation needs.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.