Perham, Minnesota, with its sparkling lakes, friendly community, and vibrant downtown, presents a truly inviting backdrop for anyone looking to plant roots. If you’re considering buying a home, whether it’s your first or you’re looking for a change of scenery, Perham offers a unique blend of small-town charm and modern conveniences. As an expert in guiding first-time buyers, I’m thrilled to walk you through everything you need to know about navigating the Perham real estate market. This comprehensive guide is designed to empower you with the knowledge and confidence to find your perfect home in this beautiful corner of Otter Tail County. From understanding local market dynamics to securing financing and embracing the Perham lifestyle, we’ll cover it all. Let’s dive in and discover why Perham might just be the ideal place to call home. Learn more about Buying a Home in Fargo, ND: A Comprehensive Market Guide.

Discovering Perham, MN: Your Ideal Home Base

Perham isn't just a dot on the map; it's a thriving community nestled amidst Minnesota's famous 10,000 lakes, offering a quality of life that's hard to beat. Known for its picturesque landscapes, robust local economy, and strong community spirit, Perham has become an increasingly popular destination for individuals and families seeking a peaceful yet engaging lifestyle.

Why Perham Stands Out for Homebuyers

What makes Perham so special for those looking to buy a home? For starters, its natural beauty is unparalleled. The area is dotted with pristine lakes like Little Pine Lake, Big Pine Lake, and Rush Lake, providing endless opportunities for fishing, boating, swimming, and simply enjoying the great outdoors. This connection to nature fosters a relaxed pace of life, but don't let that fool you – Perham is far from sleepy. The town boasts a dynamic downtown area filled with unique shops, delicious eateries, and community events that bring everyone together.

Economically, Perham is stable and growing, with a diverse range of industries contributing to its vitality. From manufacturing to healthcare and tourism, there are ample opportunities for employment and entrepreneurship. The community prides itself on its strong schools and family-friendly atmosphere, making it particularly attractive to those looking to raise children in a supportive environment. The low crime rates and sense of belonging further enhance its appeal, promising a secure and welcoming place to call home.

Popular Neighborhoods and Areas

When you begin your home search in Perham, you'll discover a variety of neighborhoods, each with its own character and appeal. Depending on what you're looking for, certain areas might resonate more with your lifestyle. Learn more about Investing in Perham, MN Real Estate: A Market Overview.

- Lakeside Living: For those dreaming of waking up to lake views and having direct access to water activities, properties around Little Pine Lake, Big Pine Lake, and Rush Lake are highly sought after. These areas often feature a mix of charming cabins, modern lake homes, and spacious properties, though they typically come with a higher price tag due to their prime location.

- Downtown Perham: If you prefer to be at the heart of the action, close to shops, restaurants, and community events, the downtown area offers a blend of historic homes and newer developments. This area is perfect for those who enjoy walking to local amenities and being part of the town's vibrant daily life.

- Residential Subdivisions: Perham also features several well-established residential subdivisions that offer a quieter, family-friendly environment. These areas typically have a mix of single-family homes, often with good-sized yards, and are usually located within easy reach of schools and parks. They provide a sense of community and a safe place for children to grow up.

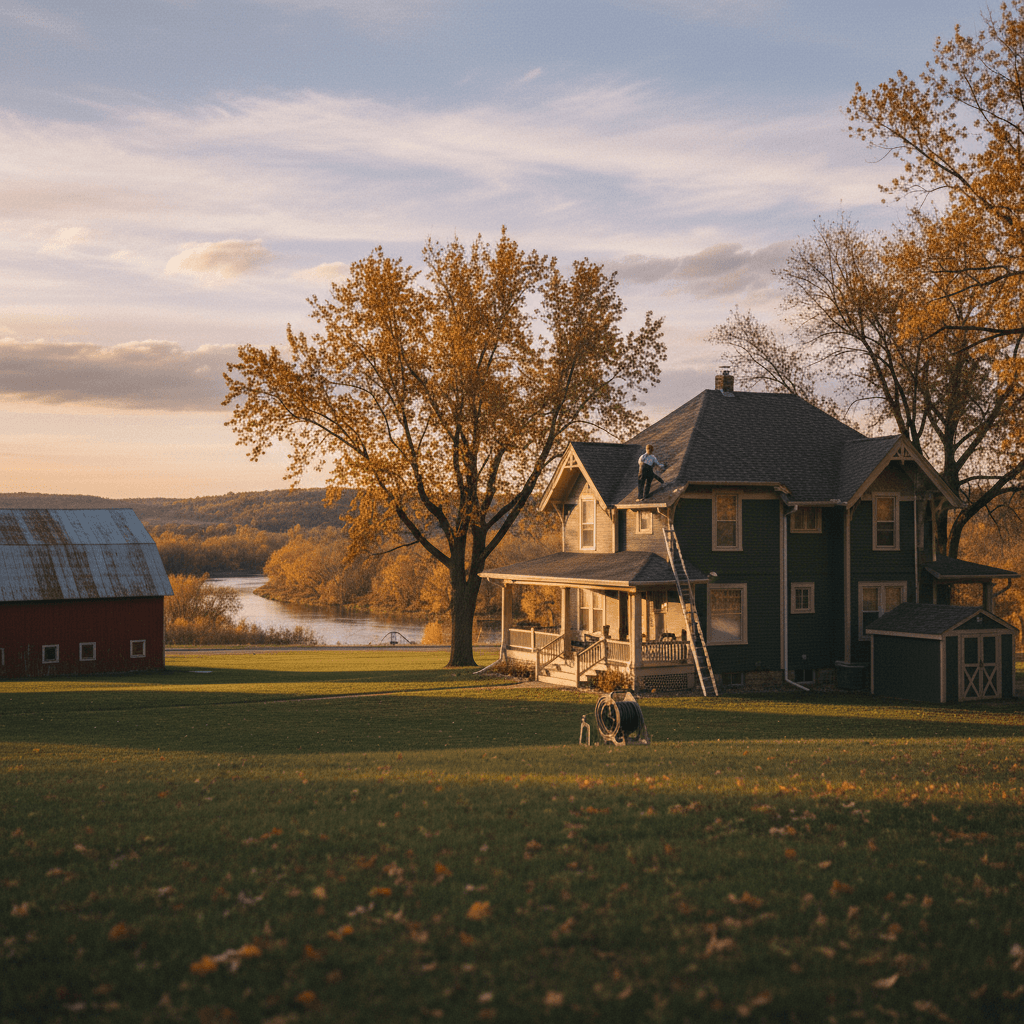

- Rural Fringe: For buyers seeking more space, privacy, or even a small hobby farm, the areas just outside the immediate city limits offer larger lots and a more rural feel, while still being a short drive from Perham's conveniences.

Exploring these areas with a local real estate agent can help you pinpoint the perfect fit for your needs and preferences. Each neighborhood offers a distinct lifestyle, contributing to the rich tapestry that is Perham, MN.

Navigating the Perham Real Estate Market

Understanding the local real estate market is crucial for any homebuyer, and Perham's market, while stable, has its own unique characteristics. Knowing what to expect in terms of trends, inventory, and pricing will help you approach your home search with confidence and realistic expectations.

Current Market Trends and Insights

The Perham real estate market, much like many desirable areas, can experience fluctuations. Generally, it's characterized by a steady demand, particularly for well-maintained properties in good locations. We often see a seasonal ebb and flow, with more homes typically coming onto the market in spring and summer, coinciding with warmer weather and school breaks. However, demand often remains strong year-round, especially for lakefront properties or homes in prime residential areas.

One key trend to note is the continued appeal of Perham for those seeking a balance between natural beauty and community amenities. This has led to a relatively stable market with consistent property value appreciation over time. While not prone to the dramatic swings seen in larger metropolitan areas, it's still a dynamic market where being prepared and acting decisively can make a big difference. Keeping an eye on interest rates, local economic developments, and inventory levels will provide you with valuable insights.

What to Expect: Home Prices and Inventory

Home prices in Perham are generally more approachable than in major urban centers, offering excellent value for money, especially when considering the quality of life. However, prices vary significantly based on location, property type, and amenities.

- Single-Family Homes: These make up the bulk of the market. Prices can range from the mid-$200,000s for smaller, older homes in residential areas to well over $500,000 or even $1 million+ for newer, larger homes or those with significant lake frontage.

- Lakefront Properties: As expected, homes directly on the lakes command premium prices. These highly desirable properties offer direct access to water and stunning views, making them a significant investment.

- Townhomes and Condos: While less common than single-family homes, there are some townhome and condo options available, often appealing to those looking for lower maintenance living or second homes. These typically fall into a more moderate price range.

- Land and Lots: For those dreaming of building their custom home, there are also opportunities to purchase undeveloped land, particularly on the outskirts of town or near lakes, allowing for personalized construction.

Inventory levels can fluctuate. In a seller's market, homes might receive multiple offers and sell quickly. In a more balanced market, buyers may have more time and leverage for negotiations. Working with a local real estate agent who has their finger on the pulse of the Perham market is invaluable. They can provide up-to-the-minute information on new listings, recent sales, and help you understand what current prices truly mean for your budget and goals.

The Perham Home Buying Journey: Step-by-Step

Embarking on the home buying journey can feel overwhelming, but by breaking it down into manageable steps, you'll find it's an exciting and rewarding process. Here’s a clear roadmap for buying your home in Perham, MN. Learn more about Buying a Home in Hillsboro, ND: Market Insights and....

Getting Pre-Approved and Setting Your Budget

Before you even start looking at homes, the very first and most crucial step is to get pre-approved for a mortgage. This isn't just about knowing how much you can borrow; it shows sellers that you are a serious and qualified buyer, which can be a significant advantage in a competitive market. A pre-approval involves a lender reviewing your financial situation – income, debts, credit score – to determine the maximum loan amount they are willing to offer you.

This step also helps you define your budget. Beyond the mortgage principal and interest, remember to factor in property taxes (which vary in Otter Tail County), homeowner’s insurance, potential HOA fees, and maintenance costs. Getting a clear picture of your total monthly housing expense will prevent surprises down the road and ensure you're comfortable with your investment. Connect with local lenders, who are familiar with the Perham market.

Finding Your Dream Home with a Local Agent

Once you have your pre-approval in hand and a clear budget, it's time for the fun part: finding your home! This is where a knowledgeable local real estate agent becomes your most valuable asset. An agent specializing in the Perham area will have an intimate understanding of the neighborhoods, current listings, and upcoming properties that might not even be on public sites yet. They can help you:

- Define Your Needs: Clarify your must-haves, nice-to-haves, and deal-breakers (e.g., number of bedrooms, lot size, proximity to Perham’s downtown or the Perham School District).

- Access Listings: Provide access to the most comprehensive and up-to-date listings, including properties that might not be widely advertised.

- Schedule Showings: Arrange viewings of homes that match your criteria, saving you time and effort.

- Provide Local Insights: Offer invaluable information about specific areas, local amenities, and future development plans.

- Negotiate: Represent your best interests during negotiations, helping you get the best possible price and terms.

The Offer and Negotiation Stage

When you find "the one," your agent will help you prepare a compelling offer. This offer isn't just about the price; it includes various terms and contingencies designed to protect you, such as:

- Contingencies: These are conditions that must be met for the sale to go through, like a satisfactory home inspection, appraisal, and your ability to secure financing.

- Earnest Money: A deposit showing your serious intent to purchase, held in escrow.

- Closing Date: The proposed date when ownership will transfer.

Your agent will guide you through the negotiation process, which can involve counter-offers from the seller. Their expertise in the local Perham market will be critical here, helping you understand what’s a fair price and when to hold firm or compromise. Remember, a good negotiation aims for a win-win outcome.

Financing Your Dream Home in Perham

Securing the right financing is a cornerstone of a successful home purchase. In Perham, you’ll find a range of options, and understanding them will help you make informed decisions.

Local Lenders and Mortgage Programs

While national lenders are always an option, working with a local mortgage lender often provides a distinct advantage. Local lenders are deeply familiar with the nuances of the Perham market, property values in Otter Tail County, and even local appraisers. They can offer personalized service and often have insights into specific programs that might benefit you. Look for lenders who have a strong presence in the Perham community and can offer a variety of mortgage products, including:

- Conventional Loans: The most common type, requiring good credit and a down payment (often 5-20%).

- FHA Loans: Government-insured loans popular with first-time homebuyers, requiring lower credit scores and smaller down payments.

- VA Loans: For eligible service members, veterans, and their spouses, offering competitive interest rates and often no down payment.

- USDA Loans: Available for properties in designated rural areas (many parts of Otter Tail County may qualify), offering low or no down payment options for eligible buyers.

Don't hesitate to shop around and compare offers from several lenders to find the best rates and terms for your situation. A local expert will also be able to advise on any state or county-specific first-time homebuyer assistance programs that might be available. Learn more about First-Time Home Buyer’s Guide to Pelican Rapids, MN Real....

Understanding Closing Costs and Escrow

Beyond your down payment, you'll need to budget for closing costs. These are fees associated with finalizing your mortgage and transferring ownership of the property. They typically range from 2-5% of the loan amount and can include:

- Loan Origination Fees: What the lender charges for processing your loan.

- Appraisal Fees: For assessing the home's value.

- Title Insurance: Protects you and the lender from future claims against the property's title.

- Recording Fees: To officially record the sale with the county.

- Prepaid Expenses: Such as property taxes and homeowner’s insurance premiums for a certain period.

Your lender will provide a Loan Estimate, detailing all these costs. It’s crucial to review this carefully and ask questions. Many buyers also establish an escrow account, managed by their lender, where a portion of their monthly mortgage payment is set aside to cover property taxes and homeowner’s insurance. This simplifies budgeting and ensures these important bills are paid on time. Understanding these financial aspects beforehand will make the closing process much smoother.

Embracing the Perham Lifestyle: Community and Amenities

Buying a home is also about buying into a lifestyle, and Perham offers a rich tapestry of community spirit, natural beauty, and local amenities that truly enhance daily living. Learn more about Exclusive Lake Living: Buying Luxury Property in Pelican....

Education and Family Life

Perham is renowned for its excellent educational opportunities, making it a prime location for families. The Perham School District is highly regarded, offering a strong curriculum and a wide array of extracurricular activities, from sports to arts. Parents often appreciate the smaller class sizes and the dedicated teaching staff, fostering a supportive learning environment. Beyond K-12, the community also provides resources for early childhood education and lifelong learning opportunities. The town's commitment to youth development is evident in its well-maintained parks, playgrounds, and community programs that keep children engaged and active year-round.

Recreation and Outdoor Activities

Life in Perham truly revolves around its stunning natural surroundings. With numerous lakes at your doorstep, outdoor enthusiasts will find endless ways to spend their time. Summer brings opportunities for swimming, fishing, boating, and kayaking on the pristine waters of Little Pine Lake or Big Pine Lake. Golfers can enjoy a round at the scenic Lakeside Golf Club, known for its beautiful fairways and challenging holes. The area also boasts an extensive network of trails for hiking and biking, including sections of the Heartland State Trail.

When winter arrives, Perham transforms into a snowy wonderland, offering ice fishing, snowmobiling, cross-country skiing, and ice skating. The changing seasons provide a dynamic backdrop for an active lifestyle, encouraging residents to embrace the outdoors no matter the time of year. For health and wellness, Perham Health provides comprehensive medical services, ensuring residents have access to quality care close to home.

Dining, Shopping, and Local Flavor

Perham’s downtown area is a charming hub of activity, featuring a delightful mix of local businesses. You’ll find unique boutiques, antique shops, and specialty stores perfect for finding that one-of-a-kind item. When it comes to dining, Perham offers a surprising variety for a town its size. From cozy cafes serving up breakfast and lunch to family-friendly restaurants and more upscale options, there’s something to satisfy every palate. Local favorites include establishments like Disgruntled Brewing, a popular spot for craft beer enthusiasts and casual dining, or the iconic Zorbaz on Little Pine Lake, a lakeside institution offering pizza and Mexican fare with fantastic views.

The community also hosts various events throughout the year, from farmers' markets to holiday festivals, fostering a strong sense of local pride and connection. The Perham Area Chamber of Commerce is a great resource for staying updated on local happenings and community initiatives, while the Red Willow Arts Coalition enriches the community with cultural events and artistic endeavors. Living in Perham means being part of a vibrant community that values both tradition and progress.

From Offer to Keys: Closing Your Perham Home Purchase

You've found your dream home, your offer has been accepted, and financing is in order. Now, let’s talk about the final steps to ensure a smooth transition to homeownership in Perham.

Home Inspections and Appraisals

After your offer is accepted, two critical contingencies typically come into play: the home inspection and the appraisal.

- Home Inspection: This is your opportunity to have a qualified professional thoroughly examine the property for any potential issues, from structural problems to electrical and plumbing concerns. It's an essential step to uncover any hidden defects and ensure you're making a sound investment. If significant issues are found, your agent can help you negotiate with the seller for repairs or a credit, or in some cases, you may decide to walk away if the problems are too extensive.

- Appraisal: Your lender will order an appraisal to determine the fair market value of the home. This ensures that the property is worth at least the amount you are borrowing. If the appraisal comes in lower than the agreed-upon purchase price, it can impact your loan amount, and your agent will help you navigate options, which might include renegotiating the price with the seller or covering the difference yourself.

Both of these steps are designed to protect your interests and ensure you're getting a fair deal on your Perham home.

The Final Walkthrough and Closing Day

Just before closing, you'll typically conduct a final walkthrough of the property. This is your chance to ensure that the home is in the agreed-upon condition, any negotiated repairs have been completed, and no new damage has occurred since your last visit. It’s also an opportunity to confirm that all personal belongings of the seller have been removed.

Finally, the big day arrives: Closing Day! You'll meet with your agent, lender, and a closing agent (often from a title company) to sign a stack of legal documents. This includes the promissory note (your promise to repay the loan), the mortgage (which gives the lender a claim on the property if you don't repay), and the deed (transferring ownership to you). You'll also finalize the payment of closing costs and any remaining down payment. Once all documents are signed and funds are disbursed, you'll receive the keys to your new home in Perham, MN! Congratulations, you’re officially a homeowner!

Buying a home in Perham, MN, is more than just a transaction; it's an investment in a lifestyle rich with community, natural beauty, and opportunity. From understanding the local market nuances and securing your financing to navigating the offer process and embracing the vibrant local culture, this guide has aimed to equip you with the knowledge needed for a successful journey. Remember, partnering with a local real estate expert who understands the Perham area can make all the difference, providing invaluable insights and support every step of the way. We hope this guide empowers you to confidently take the next step towards finding your perfect place in this wonderful Minnesota community. Welcome home to Perham!

Frequently Asked Questions

What is the average home price in Perham, MN?

Home prices in Perham vary significantly based on location (especially lakefront vs. inland), size, and condition. While residential homes can start in the mid-$200,000s, lakefront properties or larger, newer homes can easily exceed $500,000 or even $1 million. Consulting a local real estate agent for current market data is the best way to get accurate pricing information.

How competitive is the real estate market in Perham for buyers?

The Perham real estate market typically sees steady demand, particularly for desirable properties. It can be competitive, especially during peak seasons (spring/summer) or for lakefront homes, with properties sometimes receiving multiple offers. However, it generally maintains a more stable pace than larger metropolitan areas. Being pre-approved for a mortgage and working with a proactive local agent can give you an advantage.

Are there specific first-time homebuyer programs available in Minnesota or Perham?

Yes, Minnesota offers various programs through the Minnesota Housing Finance Agency (MN Housing) designed to assist first-time homebuyers with down payment and closing cost assistance, as well as favorable loan terms. Additionally, federal programs like FHA, VA, and USDA loans are available. A local mortgage lender familiar with the Perham area can guide you through eligibility and application for these programs.

What are the property tax rates like in Perham?

Property tax rates in Perham are determined by Otter Tail County, the city of Perham, and the Perham School District, among other local entities. These rates are applied to the assessed value of your home and can vary. It's advisable to research specific property tax details for homes you are interested in or consult with a local real estate professional or the county assessor's office for the most accurate and up-to-date information.

What are the best neighborhoods for families in Perham?

Perham offers several family-friendly neighborhoods. Areas close to the Perham School District are popular for their convenience and community feel. Residential subdivisions often provide quieter streets, parks, and a mix of single-family homes. For families seeking more space and a rural ambiance, the outskirts of town offer larger lots while still being a short drive to amenities. A local real estate agent can help you explore options that best fit your family's specific needs and preferences.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.