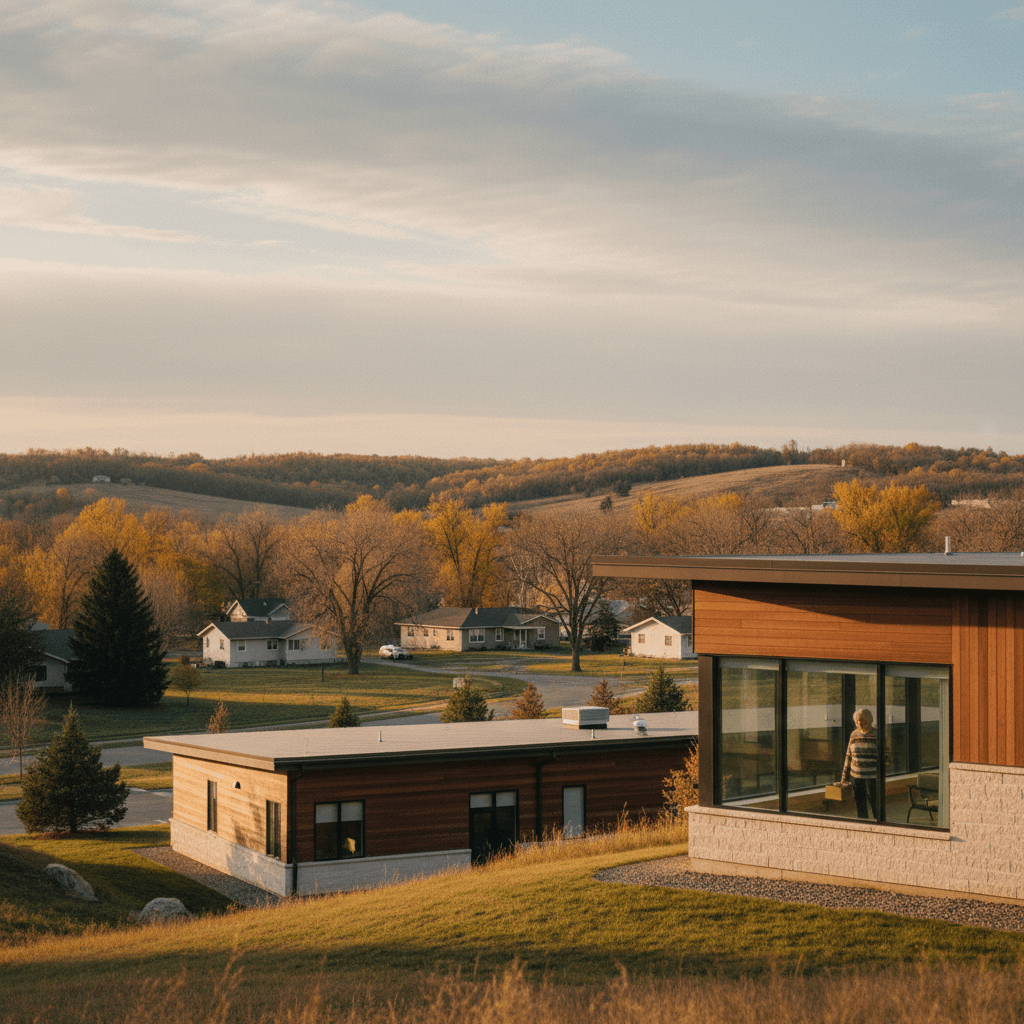

Retirement marks a significant life transition, often accompanied by a reevaluation of living arrangements and financial priorities. For many seniors in Hillsboro, North Dakota, the concept of downsizing emerges as a practical and financially astute strategy to enhance their retirement years. This comprehensive guide, from a market analyst's perspective, delves into the financial intricacies of downsizing, offering data-driven insights and strategic considerations for retirees and empty nesters in the Hillsboro community. Learn more about Relocating to Hillsboro, ND: The Ultimate Buyer's Guide.

The decision to downsize is not merely about moving to a smaller home; it's a strategic financial maneuver that can unlock significant capital, reduce ongoing expenses, and simplify daily life. In a market like Hillsboro, understanding local real estate dynamics and available financial resources is paramount. As of recent analyses, the housing market in smaller North Dakota communities like Hillsboro has shown stable growth, with a median home value that allows for considerable equity liberation for long-term homeowners. This article will navigate the financial benefits, potential challenges, and strategic approaches to make your downsizing journey in Hillsboro both successful and financially empowering. Learn more about Investing in Hillsboro, ND: A Financial Guide to Rental....

Understanding the Hillsboro Real Estate Market for Seniors

The real estate landscape in Hillsboro, while part of the broader North Dakota market, possesses unique characteristics that seniors contemplating downsizing should thoroughly understand. A data-driven approach to evaluating your current property and the local market is the cornerstone of a successful financial plan. Learn more about Investing in Hillsboro, ND: A Guide to the Local Rental....

Current Market Trends and Valuation in Traill County

Hillsboro, situated in Traill County, benefits from a stable, community-oriented housing market. While not experiencing the dramatic fluctuations seen in larger metropolitan areas, property values here have demonstrated consistent appreciation over the past decade. According to recent data from the North Dakota Association of Realtors, the median sales price for homes in rural counties, including Traill, has seen an average annual increase of approximately 3-5% over the last five years. This steady growth implies that many long-term homeowners in Hillsboro are likely sitting on substantial home equity.

Understanding your home's current market value is the first critical step. Engaging with a local real estate professional, such as an agent from Hillsboro Homes Realty, who specializes in the local market, can provide an accurate valuation. They can analyze comparable sales (comps) within Hillsboro, taking into account factors like location, property condition, and recent market activity to give you a realistic assessment. For instance, a well-maintained three-bedroom home near the city center might command a different price point than a similar property on the outskirts, reflecting micro-market variations within Hillsboro.

Assessing Your Current Home's Equity

Your home equity represents the portion of your property you truly own—the market value minus any outstanding mortgage balance. For many seniors, this equity is their largest asset. A recent study by the National Association of Home Builders indicated that homeowners aged 65 and older have an average of 80% equity in their homes. In Hillsboro, given the consistent market appreciation and the likelihood that many seniors have paid off or significantly reduced their mortgages, this percentage could be even higher.

Calculating your equity is straightforward: Current Market Value - Outstanding Mortgage Balance = Home Equity. This equity can be a powerful financial tool for retirement. It can fund the purchase of a smaller, more manageable home, cover healthcare costs, supplement retirement income, or even create a financial legacy. Understanding this asset's potential is key to strategic downsizing. Consider a scenario where a Hillsboro homeowner sells a property valued at $250,000 with a remaining mortgage of $50,000. This liberates $200,000 in equity, significantly impacting retirement planning.

Financial Benefits of Downsizing in Hillsboro

The financial advantages of downsizing extend far beyond simply moving to a smaller space. For Hillsboro seniors, it presents a multifaceted opportunity to optimize their financial health in retirement.

Reducing Housing Costs: Property Taxes, Utilities, and Maintenance

One of the most immediate and tangible benefits of downsizing is the reduction in ongoing housing expenses. Larger homes inherently come with higher costs. For example, property taxes in Traill County are assessed based on property value. A smaller, less valuable home will result in lower annual property tax bills, providing immediate savings. Furthermore, utilities—heating, cooling, electricity, and water—are typically lower for smaller residences. In North Dakota's climate, heating costs can be substantial, making a more energy-efficient, smaller footprint home particularly appealing.

Maintenance is another significant financial drain on larger properties. From roofing repairs and exterior painting to landscaping and interior upkeep, the costs and physical demands can accumulate rapidly. Downsizing often means moving into a home with less square footage, a smaller yard, or even a community where exterior maintenance is handled by an association, drastically cutting down on these expenses. For instance, moving from a 2,500 sq ft home to a 1,200 sq ft home could realistically reduce utility bills by 20-30% and eliminate thousands of dollars annually in maintenance costs, freeing up capital for other retirement pursuits or investments.

Capitalizing on Home Equity for Retirement Income

The equity released from selling a larger home can be strategically deployed to bolster retirement income. This capital can be used in several ways: to purchase a new, smaller home outright, eliminating mortgage payments entirely; to invest in income-generating assets; or to create a cash reserve for unexpected expenses. Eliminating a mortgage payment, for example, can free up hundreds, if not thousands, of dollars each month, significantly improving cash flow during retirement. Data indicates that eliminating housing debt is a top financial goal for many retirees, and downsizing offers a direct path to achieving this.

Alternatively, the surplus funds can be invested. Working with a financial advisor at a local institution like Hillsboro Community Bank can help identify suitable low-risk, income-generating investments that align with your retirement goals. This could include annuities, dividend-paying stocks, or bonds, providing a steady stream of income to complement Social Security and pension benefits. The goal is to transform a static asset (home equity) into a dynamic financial resource that supports your desired retirement lifestyle in Hillsboro.

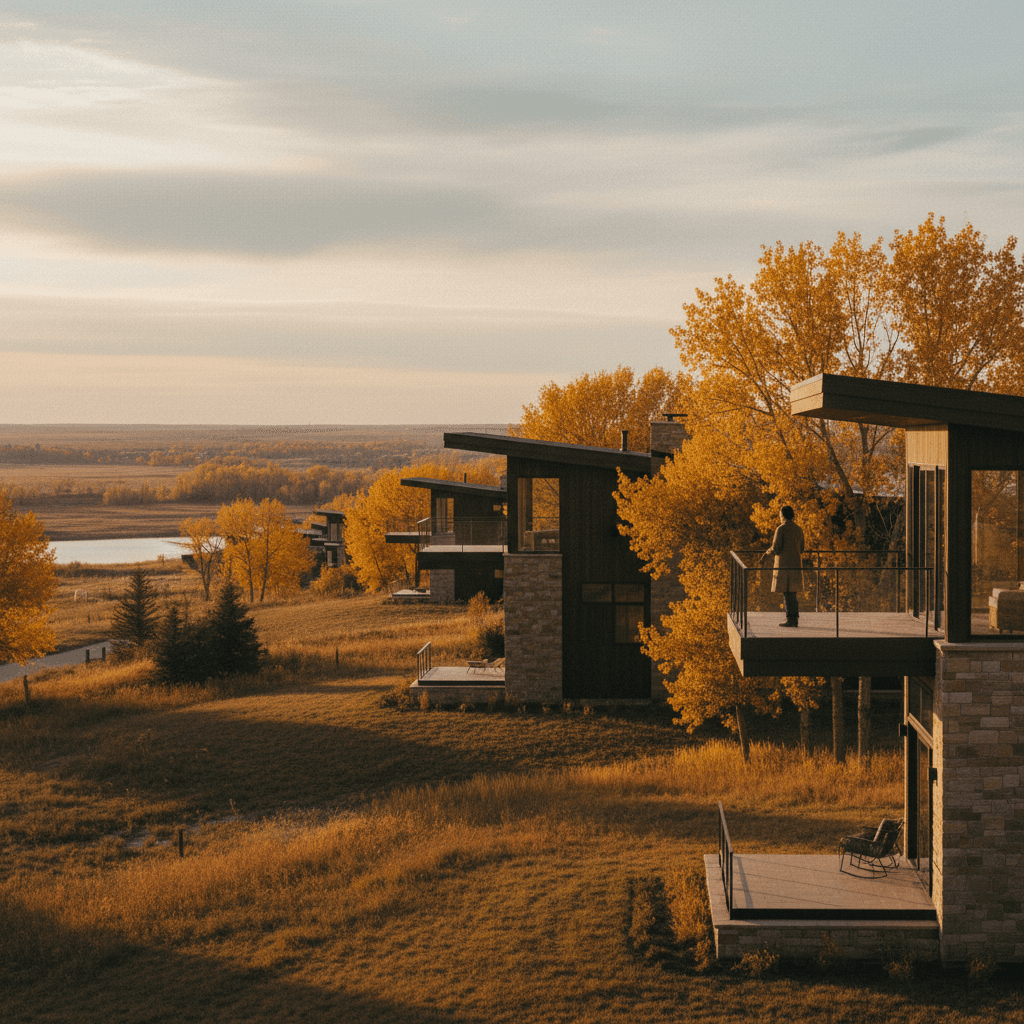

Navigating Senior Living Options and Associated Costs

Hillsboro and its surrounding areas offer various living arrangements suitable for seniors. Understanding the financial implications of each option is crucial for making an informed decision.

Independent Living vs. Assisted Living: A Financial Comparison

The spectrum of senior living options ranges from independent living communities to assisted living facilities, each with distinct cost structures and levels of care. Independent living typically involves age-restricted communities or apartments where residents maintain full autonomy but benefit from amenities like communal dining, social activities, and sometimes light maintenance. Costs for independent living in North Dakota can range from $1,500 to $3,500 per month, depending on services included and location.

Assisted living, on the other hand, provides more comprehensive support, including help with daily activities such as bathing, dressing, and medication management, in addition to meals and social programs. The cost of assisted living is significantly higher, often ranging from $3,500 to $6,000 per month or more in North Dakota, largely due to the personalized care services. When considering a move to a facility, it's vital to assess not only the monthly fees but also any entry fees, potential increases over time, and what services are included versus additional charges. For example, a hypothetical local option like Parkview Apartments might offer independent living with amenities, while a more specialized facility would cater to assisted living needs.

Exploring Local Resources and Support Services

Hillsboro, as a close-knit community, offers various local resources and support services that can help seniors manage their finances and well-being, whether they choose to stay in their homes or move to a senior living facility. The Traill County Senior Center is an invaluable hub, offering programs, meals, and information on local services. These centers often provide assistance with navigating Medicare, Medicaid, and other state and federal benefits that can offset healthcare and living costs.

Additionally, local healthcare providers, such as those at Valley Medical Clinic - Hillsboro, can connect seniors with resources for in-home care, physical therapy, or other health-related services that might enable them to age in place longer. Exploring these local networks can lead to significant savings and improved quality of life, demonstrating that financial planning for seniors in Hillsboro is not just about assets, but also about leveraging community support.

Strategic Financial Planning for a Post-Downsizing Lifestyle

Once the decision to downsize has been made and the equity liberated, the next crucial step is to strategically plan how this newfound financial flexibility will support your retirement lifestyle.

Investment Strategies for Liberated Capital

The capital freed from downsizing opens up new avenues for investment, tailored to a retirement horizon. Unlike pre-retirement investments that might focus on growth, retirement investments often prioritize income generation and capital preservation. A balanced portfolio might include a mix of low-risk bonds, dividend-paying stocks, and potentially real estate investment trusts (REITs) that offer steady income streams. For instance, investing a portion of the liberated equity in a diversified portfolio yielding 3-5% annually could generate a significant supplement to your retirement income without depleting the principal. Learn more about Investing in Hillsboro, ND: A Financial Look at the....

It is prudent to consult with a financial advisor to craft an investment strategy that aligns with your risk tolerance, income needs, and long-term goals. They can help create a withdrawal strategy that ensures your funds last throughout retirement, accounting for inflation and potential market fluctuations. The aim is to convert a significant illiquid asset (your home) into a flexible, income-producing portfolio that can adapt to your evolving needs in Hillsboro.

Estate Planning and Wealth Transfer Considerations

Downsizing also presents an opportune moment to review and update your estate plan. With a potentially larger liquid asset base, ensuring your wishes are clearly documented becomes even more critical. This includes updating wills, trusts, and beneficiary designations. For families in Hillsboro, understanding North Dakota's estate laws is essential. For example, the state does not have an inheritance tax, but federal estate tax laws still apply to larger estates.

Strategic wealth transfer can also be a part of this planning. You might consider gifting strategies to children or grandchildren, establishing charitable foundations, or setting up trusts that protect assets and ensure they are distributed according to your wishes. This proactive approach not only provides peace of mind but can also minimize potential tax liabilities for your heirs. Consulting with an estate planning attorney is highly recommended to navigate these complex considerations and ensure your financial legacy is secured.

Legal and Tax Implications of Selling and Buying in Retirement

The financial journey of downsizing involves navigating various legal and tax considerations that can significantly impact the net proceeds from your sale and the cost of your new home.

Understanding Capital Gains Exemptions

One of the most favorable tax provisions for homeowners is the capital gains exclusion on the sale of a primary residence. For individuals, you can exclude up to $250,000 of profit from the sale, and for married couples filing jointly, this exclusion increases to $500,000. To qualify, you must have owned and lived in the home as your primary residence for at least two of the five years leading up to the sale. This means that for many Hillsboro seniors who have lived in their homes for decades, a substantial portion, if not all, of their profit from downsizing may be tax-free.

It's crucial to calculate your basis (what you paid for the home plus the cost of any significant improvements) to determine your true profit. For instance, if you bought your home for $100,000 and invested $50,000 in improvements over the years, your basis is $150,000. If you sell it for $350,000, your profit is $200,000, which would fall entirely within the individual exclusion limit, meaning no federal capital gains tax would be owed. Keeping meticulous records of home improvements is vital for maximizing this exemption. This benefit is a cornerstone of the financial advantage of downsizing for many long-term homeowners.

Navigating Property Tax Relief Programs for Seniors in North Dakota

North Dakota offers several property tax relief programs that can benefit seniors, which are particularly relevant after downsizing to a potentially less expensive property. The Homestead Tax Credit is one such program designed to reduce property taxes for eligible homeowners who are 65 or older, or permanently disabled, and meet specific income requirements. The amount of the credit varies based on income and property value but can provide significant annual savings.

Additionally, some municipalities or counties may offer specific deferral programs or further exemptions. For Hillsboro residents, it’s advisable to contact the Traill County Tax Director's office or a local financial advisor to inquire about all available state and local property tax relief programs. Even after downsizing, these programs can further reduce the financial burden of homeownership, making your retirement budget more robust. Understanding and applying for these benefits can be a critical component of optimizing your post-downsizing finances, ensuring that every possible saving is realized.

Conclusion

Downsizing in Hillsboro, North Dakota, is a multifaceted decision with profound financial implications for seniors. By taking a strategic, data-driven approach to evaluating the local real estate market, understanding the financial benefits of reducing housing costs and leveraging home equity, and navigating the various living and investment options, retirees can significantly enhance their financial security and quality of life. From capitalizing on robust home equity to optimizing tax benefits and exploring local support services, the journey of downsizing offers a powerful pathway to a more financially flexible and fulfilling retirement. Proactive planning, informed decision-making, and consultation with local experts are key to unlocking the full potential of this important life transition in the heart of Hillsboro.

Related Articles

Frequently Asked Questions

What are the primary financial benefits of downsizing in Hillsboro, ND?

Downsizing in Hillsboro offers several key financial benefits, including a significant reduction in ongoing housing costs like property taxes, utilities, and maintenance. It also allows seniors to unlock substantial home equity, which can be used to eliminate mortgage payments, supplement retirement income through investments, or create a financial reserve for future needs. For many, it transforms a large illiquid asset into flexible capital.

How can I assess my home's value and equity in the Hillsboro market?

To assess your home's value, it's recommended to consult with a local real estate professional in Hillsboro who can provide a comparative market analysis (CMA) based on recent sales of similar properties in the area. Once you have an estimated market value, subtract any outstanding mortgage balance and other liens to calculate your home equity. This figure represents the capital you could potentially liberate through a sale.

Are there specific tax benefits for seniors selling their homes in North Dakota?

Yes, North Dakota seniors selling their primary residence can benefit from federal capital gains exclusions: up to $250,000 for single filers and $500,000 for married couples filing jointly, provided they meet ownership and residency requirements. Additionally, North Dakota offers property tax relief programs for seniors, such as the Homestead Tax Credit, which can reduce property tax burdens on a new, potentially smaller home. It's advisable to consult with a tax advisor for personalized guidance.

What are the typical costs associated with senior living options in or near Hillsboro?

Costs for senior living vary significantly by type. Independent living communities, which offer amenities but minimal care, typically range from $1,500 to $3,500 per month in North Dakota. Assisted living facilities, providing more comprehensive daily support, can range from $3,500 to $6,000 or more per month. These costs can include rent, meals, utilities, and various services, with additional charges for higher levels of care. It's crucial to inquire about all fees and what's included when exploring options.

How should I invest the capital liberated from downsizing for my retirement in Hillsboro?

The capital liberated from downsizing should be invested strategically to align with your retirement goals, focusing on income generation and capital preservation. Common strategies include diversified portfolios of low-risk bonds, dividend-paying stocks, or annuities. Consulting with a financial advisor is highly recommended to create a personalized investment plan that considers your risk tolerance, income needs, and ensures your funds last throughout your retirement years in Hillsboro.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.