Thinking about selling your home in Hillsboro, ND, but feel like it needs a little refresh to truly shine on the market? You're not alone! Many homeowners consider renovations to boost their property's appeal and value. However, the big question often comes down to financing: how do you pay for these improvements without draining your savings, especially when the goal is to get a great return on investment? Learn more about Hillsboro, ND Real Estate Market Report: Financial....

As a first-time buyer guide, I understand the importance of making smart financial decisions. Strategic home improvements, when financed wisely, can significantly increase your home's resale value and attract more buyers in our charming Hillsboro community. Let's explore how to navigate the world of renovation financing, focusing on what works best for Hillsboro homeowners looking to maximize their resale potential. Learn more about Smart Renovations: Financing Home Improvements for....

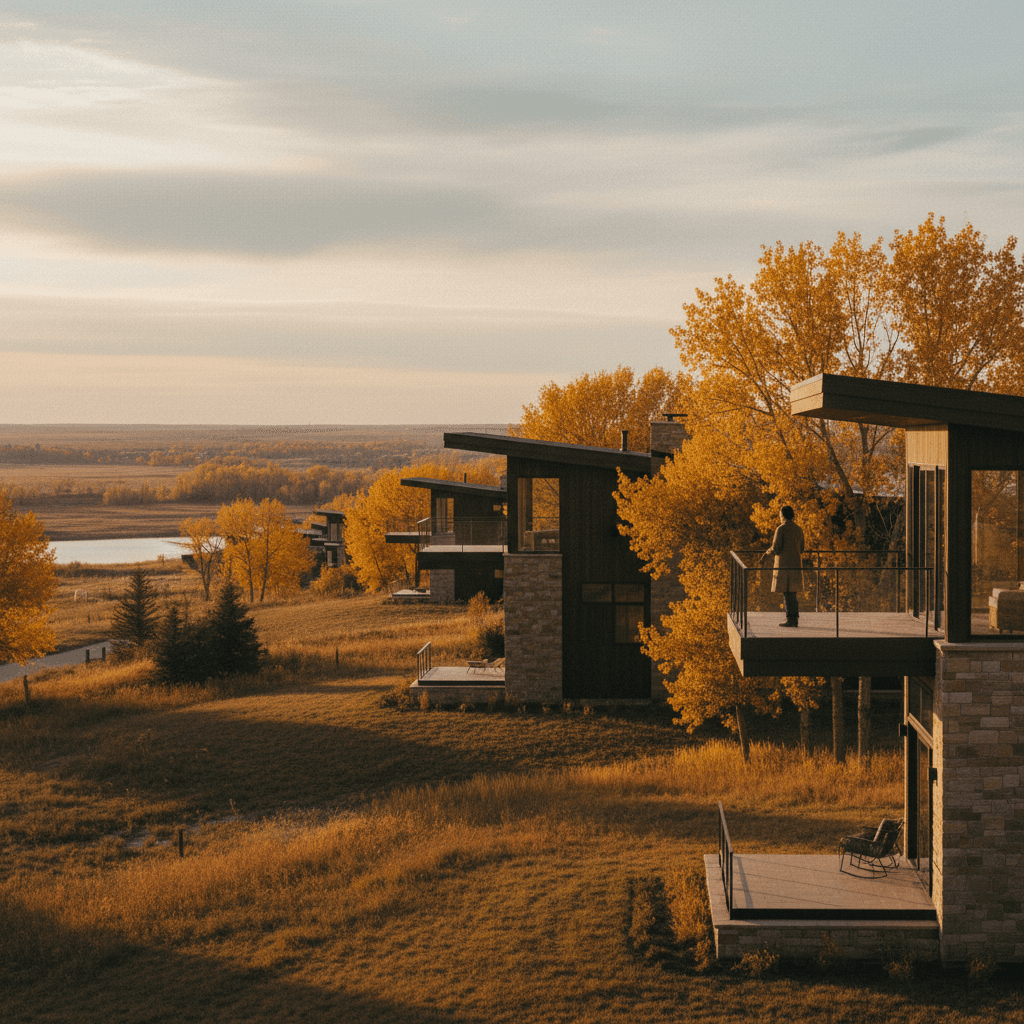

Why Smart Renovations Boost Your Hillsboro Home's Value

Hillsboro, with its friendly atmosphere and strong community ties, offers a unique real estate market. Homes here are cherished, and buyers often look for properties that offer comfort, functionality, and a touch of modern convenience. Understanding what local buyers value is the first step in planning renovations that truly pay off. Learn more about Understanding Property Taxes and Zoning Laws in....

Understanding the Hillsboro Market

While Hillsboro maintains its small-town charm, its proximity to larger cities like Fargo means that buyers often come with expectations shaped by broader market trends. They appreciate well-maintained homes with updated features that blend seamlessly with the local lifestyle. Homes that stand out for their condition and thoughtful upgrades tend to sell quicker and for a better price. Think about the practicalities of North Dakota living – energy efficiency, durable materials, and functional spaces are often high on a buyer's list. Learn more about Local Investment Opportunities: The Rising Real Estate....

The Power of Curb Appeal and Modern Updates

First impressions matter, especially in a close-knit community like Hillsboro. A well-kept exterior, inviting landscaping, and a welcoming entrance significantly boost curb appeal. Inside, modern updates in key areas like kitchens and bathrooms can transform a home. Buyers envision themselves living in these spaces, and if they see updated, clean, and functional rooms, it's easier for them to fall in love with your home.

Navigating Your Financing Options for Home Improvements

Once you have a clear vision for your renovations, the next step is figuring out the best way to fund them. There are several financing avenues available, each with its own advantages and considerations. Choosing the right one depends on your financial situation, the scope of your project, and your comfort level with debt. Learn more about The Financial Side of Selling: Closing Costs and Net....

Home Equity Loans and HELOCs

These are popular choices for homeowners who have built up equity in their property. A home equity loan provides a lump sum of money with a fixed interest rate, while a Home Equity Line of Credit (HELOC) offers a revolving line of credit that you can draw from as needed, similar to a credit card, but usually with a lower interest rate. Both use your home as collateral, meaning the interest is often tax-deductible, and rates are generally lower than unsecured loans. Local institutions like Hillsboro Community Bank can guide you through these options.

Cash-Out Refinance and FHA 203(k) Loans

A cash-out refinance involves replacing your current mortgage with a new, larger one, and you receive the difference in cash. This can be a good option if interest rates are favorable and you want to consolidate your mortgage and renovation costs into one payment. For more extensive renovations, an FHA 203(k) loan is specifically designed for home rehabilitation. It allows you to finance both the purchase or refinance of a home and the cost of its renovation into a single mortgage. This can be particularly useful for older homes in Hillsboro that might need significant upgrades.

Personal Loans and Credit Cards: When to Consider (and When to Avoid)

For smaller projects or emergencies, a personal loan might be an option. They are unsecured, meaning you don't use your home as collateral, but they typically come with higher interest rates. Credit cards should generally be a last resort for renovations due to their very high interest rates, unless you have a 0% introductory APR offer and are confident you can pay off the balance quickly. Always weigh the cost of borrowing against the potential return on your renovation investment.

High-ROI Renovations for Hillsboro Homes

Not all renovations are created equal when it comes to resale value. In Hillsboro, focusing on practical upgrades that enhance comfort, efficiency, and aesthetics will generally yield the best returns.

Kitchen and Bathroom Upgrades

These are consistently top performers for ROI. You don't always need a full gut remodel. Minor kitchen updates, like refacing cabinets, upgrading countertops, or replacing old appliances, can make a huge difference. For bathrooms, a fresh coat of paint, new fixtures, and updated tiling can create a spa-like feel without breaking the bank. Buyers in Hillsboro appreciate functional, clean, and updated spaces that don't require immediate work.

Enhancing Energy Efficiency and Outdoor Living

Given North Dakota's climate, energy-efficient upgrades are highly valued. Replacing old windows, adding insulation, or updating your HVAC system not only saves you money now but is a huge selling point. Outdoor spaces are also important. Simple landscaping improvements, a well-maintained deck, or a welcoming patio can extend your living space and add significant appeal. Consider visiting Red River Lumber & Supply for quality materials for your outdoor projects.

Essential Maintenance vs. Cosmetic Changes

Before you dive into cosmetic upgrades, ensure your home's fundamental systems are sound. Addressing issues like a leaky roof, outdated electrical wiring, or a failing furnace will always be more critical than a new paint color. Buyers are often willing to pay more for a home that is structurally sound and well-maintained, as it reduces their immediate repair worries.

Partnering with Local Professionals in Hillsboro

Undertaking a renovation project can be exciting, but it's crucial to have the right team by your side. From planning to execution, local professionals can offer invaluable expertise and ensure your project stays on track and within budget.

Finding Reputable Contractors

For any significant renovation, hiring a reputable contractor is key. Ask for recommendations from neighbors, check online reviews, and always get multiple bids. Make sure your chosen contractor is licensed and insured, and clearly outline the scope of work, timeline, and payment schedule in a written contract. Companies like Prairie Builders of Hillsboro can provide the expertise needed for quality work.

Consulting Financial Experts

Before making any big financial decisions, it’s always a good idea to consult with a financial advisor or a loan officer. They can help you understand the nuances of different financing options, evaluate your current financial health, and help you create a realistic budget that aligns with your resale goals. Their insights can save you money and stress in the long run.

Embarking on a renovation project to boost your Hillsboro home's resale value can be a rewarding endeavor. By carefully planning your improvements, choosing the right financing, and partnering with local experts, you can make strategic changes that not only enhance your living space but also secure a stronger return when it's time to sell. It's all about making smart, informed decisions for your biggest investment.

Frequently Asked Questions

What are the most popular home renovations in Hillsboro, ND, that increase resale value?

In Hillsboro, renovations that typically yield high returns include minor kitchen and bathroom remodels, enhancing energy efficiency (like new windows or insulation), and improving curb appeal with updated landscaping or exterior paint. Buyers in the area appreciate practical upgrades that offer comfort and functionality.

Can I use a VA loan or FHA loan to finance renovations in Hillsboro?

While VA loans are primarily for purchasing a home, some programs exist for energy-efficient improvements. FHA loans, however, offer a specific product called the FHA 203(k) loan, which allows you to finance the purchase or refinance of a home along with the cost of its rehabilitation into a single mortgage. This is an excellent option for more extensive renovations in Hillsboro.

How do I find a trustworthy contractor for my home improvement project in Hillsboro?

To find a reliable contractor in Hillsboro, start by asking for referrals from friends, family, or neighbors who have had positive experiences. Check online reviews, verify their licenses and insurance, and always get at least three detailed bids for your project. Ensure a clear, written contract is in place before any work begins.

What's the typical timeline for getting a home equity loan for renovations in Hillsboro?

The timeline for securing a home equity loan or HELOC in Hillsboro can vary, but generally, it takes anywhere from 2 to 6 weeks. This includes the application process, property appraisal, underwriting, and closing. Working with a local lender like Hillsboro Community Bank can sometimes streamline the process due to their familiarity with the local market.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.