Buying a home is one of the most exciting journeys you can embark on, and for many, Valley City, North Dakota, offers that perfect blend of small-town charm and community spirit. Nestled along the beautiful Sheyenne River, with its historic bridges and vibrant downtown, it's a wonderful place to put down roots. But before you start picturing yourself in a cozy bungalow near Chautauqua Park or a spacious family home in a quiet neighborhood, it’s crucial to lay a solid financial foundation. Navigating the world of mortgages and home financing can seem daunting, especially for first-time buyers. However, with a clear understanding and a little preparation, you can confidently step into the Valley City real estate market. Let’s break down the essential financial steps to get you ready for your home purchase.

Understanding Your Financial Foundation in Valley City

Before you even begin browsing listings, taking a good, honest look at your current financial situation is the first and most important step. This isn't just about knowing how much money you have; it's about understanding your entire financial picture to ensure a smooth and stress-free homebuying experience in Valley City.

Budgeting for Your Valley City Dream Home

Your budget is the roadmap to your home purchase. Start by tracking your income and expenses rigorously. Consider all your monthly outgoings – not just rent and utilities, but also groceries, transportation, entertainment, and any existing debt payments. Once you have a clear picture, you can determine how much you can comfortably allocate to a mortgage payment, property taxes, home insurance, and potential home maintenance. Remember, your mortgage payment shouldn't leave you feeling financially stretched. Valley City's cost of living can be appealing, but it's essential to factor in all potential housing costs. It's also wise to start saving for a down payment and closing costs as early as possible. Even a small down payment can make a big difference in your loan terms and overall financial health. Many local financial institutions, like First State Bank of Valley City, offer resources to help you plan your savings strategy.

Boosting Your Credit Score

Your credit score is like your financial report card, and it plays a huge role in the interest rate you’ll receive on your mortgage. Lenders use it to assess your reliability as a borrower. A higher credit score can translate to thousands of dollars in savings over the life of your loan. If your score isn't where you want it to be, don't fret! There are actionable steps you can take. Start by checking your credit report for any errors (you can get a free report annually from each of the three major credit bureaus). Pay your bills on time, every time, and try to keep your credit utilization (the amount of credit you're using compared to your total available credit) low. Avoid opening new lines of credit just before applying for a mortgage, as this can temporarily ding your score. Building a strong credit history takes time, but it's an investment that pays off significantly when you're ready to buy a home in Valley City.

Navigating Mortgage Options in the Sheyenne Valley

Once you have your finances in order, the next step is to explore the various mortgage options available. This is where many first-time buyers can feel overwhelmed, but understanding the basics will empower you to make informed decisions that are right for your situation and your future home in the Sheyenne Valley.

Conventional vs. Government-Backed Loans

Mortgages generally fall into two main categories: conventional loans and government-backed loans. Conventional loans are not insured or guaranteed by the government and typically require a higher credit score and a larger down payment (though some programs allow for as little as 3% down). If you have excellent credit and a substantial down payment, a conventional loan might offer competitive rates.

Government-backed loans, such as FHA, VA, and USDA loans, are designed to make homeownership more accessible. FHA loans are great for buyers with lower credit scores or smaller down payments. VA loans offer incredible benefits for eligible service members and veterans, often requiring no down payment. USDA loans are specifically for rural areas, which could be a fantastic option for certain properties in and around Valley City, offering zero down payment options for qualified buyers. Each loan type has specific eligibility requirements, so it's worth exploring all options to see which best fits your financial profile.

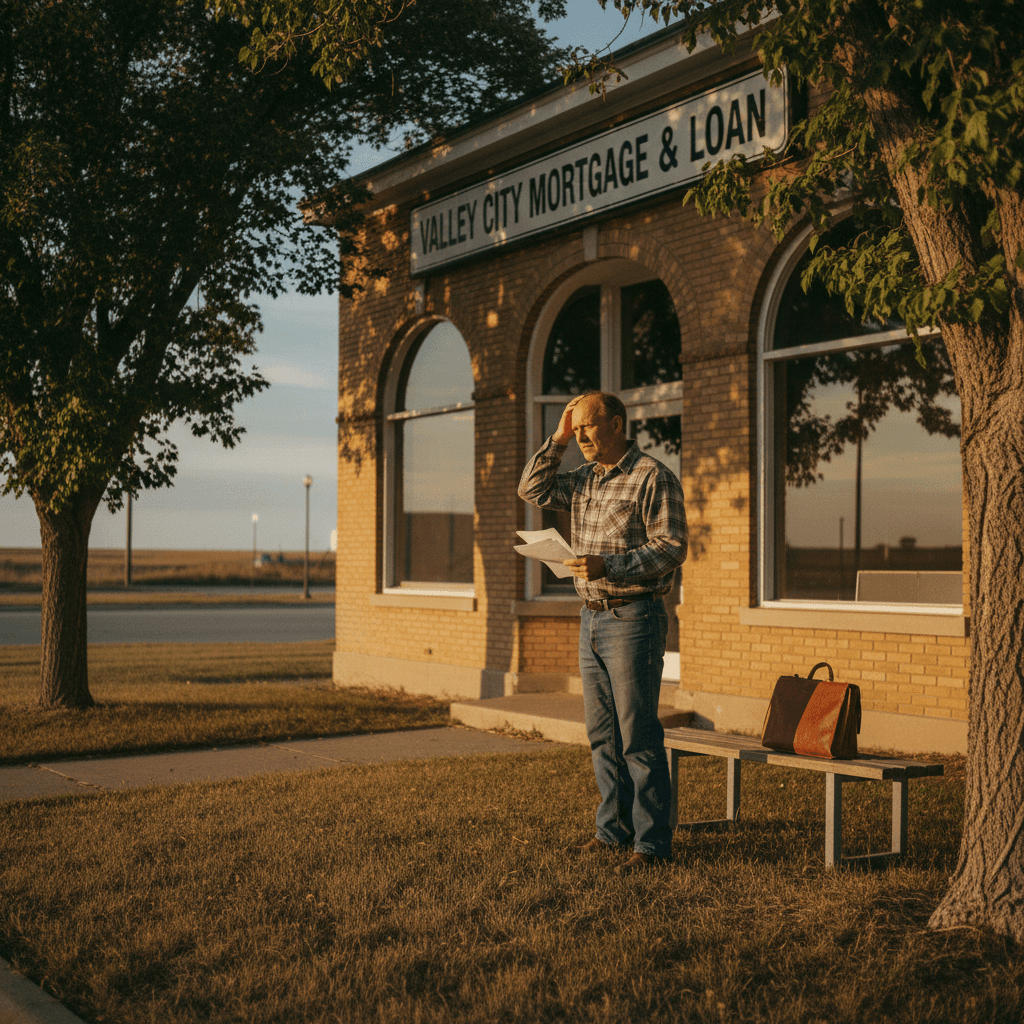

Finding the Right Lender in Valley City

Choosing the right mortgage lender is just as important as choosing the right loan. You want a lender who understands the local market and can guide you through the process with clarity and support. While national lenders are an option, working with a local institution like Valley City Community Credit Union or a local mortgage broker can offer personalized service and a deeper understanding of the Valley City community. Don’t be afraid to shop around and compare offers from several lenders. Look beyond just the interest rate; consider fees, closing costs, and the lender’s responsiveness and customer service. A good lender will take the time to explain everything and answer all your questions, making you feel confident every step of the way.

The Homebuying Process: From Pre-Approval to Closing in Valley City

With your financial foundation strong and your mortgage options explored, you’re ready to dive into the actual homebuying process. Knowing what to expect at each stage will help you stay organized and reduce stress as you move closer to owning your piece of Valley City.

The Importance of Pre-Approval

Getting pre-approved for a mortgage is a critical step before you start seriously looking at homes. Pre-approval means a lender has reviewed your financial information (credit, income, assets) and determined how much they are willing to lend you. This isn't just a suggestion; it's a powerful tool. Firstly, it gives you a realistic budget, so you're only looking at homes you can truly afford, whether that's a charming historic home near the VCSU campus or a newer build on the outskirts. Secondly, a pre-approval letter makes you a much more attractive buyer to sellers in a competitive market, showing them you are serious and financially capable. It streamlines the offer process once you find your dream home, giving you an edge.

What to Expect at Closing

The closing day is the exciting culmination of your homebuying journey! This is when ownership of the home officially transfers from the seller to you. It involves signing a lot of documents – everything from the mortgage note to the deed. You’ll need to bring your photo ID and a cashier's check or wire transfer for your remaining down payment and closing costs. Closing costs typically range from 2-5% of the loan amount and include fees for appraisal, title insurance, legal services, and more. Your lender will provide you with a detailed Closing Disclosure form a few days before closing, outlining all these costs. It’s essential to review this document carefully and ask any questions you have. While it can feel like a lot of paperwork, remember that this is the final step before you get the keys to your new home in Valley City!

Local Resources and Support for Valley City Buyers

Buying a home is a team effort, and Valley City has a supportive community ready to help you every step of the way. Don't hesitate to lean on local experts and resources.

Connecting with Valley City Professionals

Beyond your lender, you'll work with several other professionals. A knowledgeable local real estate agent who understands the Valley City market is invaluable. They can guide you through neighborhoods, identify suitable properties, and negotiate on your behalf. You'll also need a reputable home inspector to ensure your potential home is structurally sound and free of major issues. Additionally, an attorney specializing in real estate can provide legal guidance and review contracts. Don't be afraid to ask for recommendations from friends, family, or your lender. Building a trusted team of local professionals ensures you have expert advice at every turn, making your home purchase as smooth as possible.

Embarking on the path to homeownership in Valley City, ND, is an exciting adventure. By taking the time to prepare financially, understand your mortgage options, and work with a trusted team of local professionals, you can navigate the process with confidence and clarity. Remember, every step you take in financial preparation brings you closer to holding the keys to your very own home in this charming community. Welcome home!

Frequently Asked Questions

What is a good credit score to buy a home in Valley City, ND?

While it varies by loan type, a credit score of 620-640 is generally the minimum for many mortgage programs. For the best interest rates on conventional loans, aiming for a score of 740 or higher is ideal. Government-backed loans like FHA may accept lower scores, often around 580, but a higher score always offers more favorable terms.

How much should I save for a down payment and closing costs in Valley City?

A common recommendation for a down payment is 20% to avoid private mortgage insurance (PMI) on conventional loans, but many programs allow as little as 3-5% down. Government-backed loans like FHA may require 3.5% down, and VA/USDA loans can be 0% down. Closing costs typically range from 2-5% of the loan amount. So, for a $200,000 home with a 5% down payment and 3% closing costs, you'd need approximately $10,000 for the down payment and $6,000 for closing costs, totaling around $16,000.

Are there specific first-time homebuyer programs available in North Dakota or Valley City?

Yes, North Dakota offers programs through the North Dakota Housing Finance Agency (NDHFA), which can assist first-time homebuyers with down payment and closing cost assistance, as well as affordable mortgage options. These programs often have income limits and other eligibility requirements. It's recommended to contact a local lender in Valley City or the NDHFA directly to learn about current offerings and see if you qualify.

What local lenders in Valley City, ND, can help with mortgages?

Valley City has several local financial institutions that can assist with home mortgages. Options include banks such as First State Bank of Valley City and credit unions like Valley City Community Credit Union. It's always a good idea to speak with multiple lenders to compare rates, fees, and service to find the best fit for your homebuying needs.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.