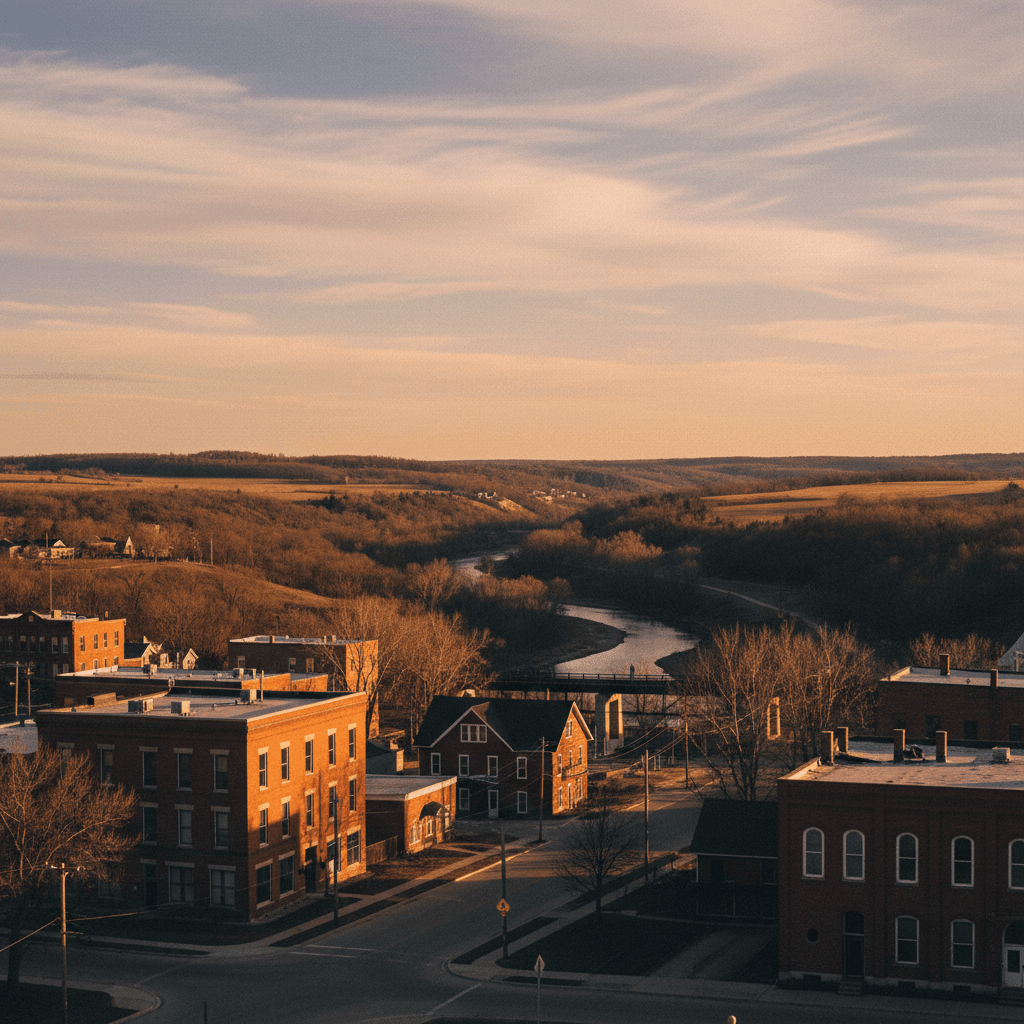

Investing in real estate offers a compelling path to wealth creation, and for the discerning investor, understanding the unique financial landscape of specific markets is paramount. Valley City, North Dakota, a vibrant community nestled along the scenic Sheyenne River, presents a distinct set of opportunities and challenges for those considering rental property investments. This comprehensive guide delves into the financial intricacies of real estate investment in Valley City, providing a data-driven perspective for maximizing returns and mitigating risks. Learn more about The Financial Guide to Selling Your Property in Valley....

Valley City, often referred to as the 'City of Bridges,' boasts a resilient local economy, largely anchored by Valley City State University (VCSU), a key educational institution that draws students and faculty, creating a consistent demand for housing. Additionally, its strategic location on Interstate 94 positions it as a regional hub, contributing to a stable employment base in sectors such as agriculture, manufacturing, and healthcare. For investors, this translates into a market with potentially predictable tenant pools and a steady, albeit perhaps not explosive, growth trajectory. Analyzing the financial viability here requires a nuanced understanding of local demographics, economic drivers, and property-specific metrics.

Understanding Valley City's Real Estate Market Dynamics

Before committing capital, a thorough analysis of Valley City's market dynamics is essential. Unlike larger metropolitan areas that may experience rapid price fluctuations, smaller markets like Valley City often exhibit greater stability, driven by local employment and community growth rather than speculative trends. This stability can be a significant advantage for long-term investors seeking consistent cash flow.

Key Economic Indicators and Their Impact

Valley City's economy is characterized by a strong community focus and sectors that provide steady employment. The presence of VCSU, for instance, generates demand for both student housing and accommodations for staff and faculty. Local businesses, ranging from small enterprises to regional agricultural services, also contribute to the local workforce, creating a need for rental housing for families and young professionals. Data from the North Dakota Department of Commerce often indicates a robust state economy with low unemployment rates, which generally translates to a healthy rental market statewide. In Valley City specifically, understanding the student enrollment trends at VCSU, the growth of local businesses, and any planned infrastructure projects can offer predictive insights into future rental demand and property value appreciation. For instance, a consistent enrollment at VCSU would suggest ongoing demand for multi-family units or single-family homes near the campus. Learn more about New Construction Homes in Valley City, ND: A Lifestyle....

Property Types and Rental Demand

The Valley City market typically features a mix of single-family homes, duplexes, and smaller multi-unit apartment buildings. Each property type caters to different segments of the tenant pool. Single-family homes often attract families or long-term residents, offering stability but potentially higher maintenance costs. Duplexes and multi-unit properties, especially those near VCSU, can be ideal for student rentals, offering higher gross rental income per property, though potentially higher turnover. Investors must evaluate the local housing stock and align their investment strategy with the predominant rental demand. For example, properties with 2-3 bedrooms are often highly sought after by small families or groups of students, ensuring a broader tenant appeal. Vacancy rates in stable markets like Valley City tend to be lower than national averages, often hovering in the 3-5% range, indicating a competitive environment for renters and favorable conditions for landlords who price and maintain their properties appropriately.

Financial Analysis: ROI and Cash Flow Projections

The core of any successful real estate investment lies in meticulous financial analysis. For rental properties in Valley City, calculating realistic Return on Investment (ROI) and projecting consistent cash flow are critical steps. Learn more about The Financial Side of Downsizing to Senior Living in....

Calculating Potential ROI and Cap Rates

ROI for rental properties is typically assessed through several metrics, including cash-on-cash return and capitalization rate (cap rate). Cash-on-cash return measures the annual pre-tax cash flow against the total cash invested, providing a direct gauge of your equity's performance. For instance, if a property generates $10,000 in annual cash flow and you invested $50,000 of your own capital, your cash-on-cash return is 20%. Cap rates, calculated by dividing the Net Operating Income (NOI) by the property's purchase price, offer a way to compare the profitability of different investment opportunities, regardless of financing. In smaller, stable markets like Valley City, cap rates might range from 6% to 9%, depending on the property's condition, location, and tenant profile. This indicates a solid income-generating potential compared to higher-risk, higher-volatility markets. Investors should aim for properties that offer competitive cap rates while also considering potential for appreciation. Learn more about Financing Your First Home in Valley City, ND: A Local....

Projecting Rental Income and Expenses

Accurate projections of rental income and expenses are fundamental. Rental income should be based on comparable properties in Valley City, accounting for property size, condition, and amenities. Online rental listings and local property management insights can provide valuable data. Expenses are often underestimated by new investors. Beyond mortgage payments, these include property taxes (which can be researched via the Barnes County assessor's office), insurance, maintenance and repairs, potential vacancy costs, utilities (if covered by landlord), and property management fees (typically 8-12% of gross monthly rent). A common rule of thumb is the 50% rule, which suggests that operating expenses (excluding mortgage principal and interest) will consume roughly 50% of your gross rental income. While a generalization, it serves as a useful initial screening tool. A detailed pro forma statement, including all potential income and expense line items, is indispensable for understanding true cash flow.

Financing Your Valley City Investment

Securing appropriate financing is a cornerstone of real estate investment. Valley City offers access to various lending institutions, each with different products tailored to investor needs.

Exploring Loan Options and Interest Rates

Investors typically have several loan options, including conventional mortgages, FHA loans (if the property qualifies as owner-occupied for a period), and portfolio loans offered by local banks. Conventional loans often require a down payment of 20-25% for investment properties. Interest rates are influenced by broader economic conditions set by the Federal Reserve, as well as the investor's creditworthiness and the loan-to-value (LTV) ratio. Local lenders, such as Valley City Community Bank, may offer more flexible terms or have a deeper understanding of the local market, which can be advantageous. It's crucial to shop around and compare terms, points, and closing costs from multiple lenders to secure the most favorable financing. A difference of even half a percentage point in interest can significantly impact long-term profitability and monthly cash flow.

Understanding Down Payments and Closing Costs

Beyond the principal investment, investors must budget for a substantial down payment and various closing costs. Down payments for investment properties are generally higher than for primary residences, often starting at 20% or 25%. Closing costs can add another 2-5% of the purchase price, encompassing fees for appraisals, title insurance, loan origination, recording fees, and attorney fees. Overlooking these upfront expenses can severely impact an investor's initial capital and overall financial planning. It's advisable to have additional reserves set aside for unexpected repairs or periods of vacancy immediately after acquisition, typically 3-6 months of operating expenses.

Property Management and Operational Efficiency

Effective property management is critical for sustaining profitability and ensuring tenant satisfaction. In Valley City, investors have the choice of self-managing or hiring a professional property management company.

Self-Management vs. Professional Management

Self-management offers direct control and saves on management fees, but it demands significant time and effort for tenant screening, rent collection, maintenance coordination, and legal compliance. This can be particularly challenging for out-of-town investors or those with multiple properties. A local property management company, such as Sheyenne Property Management, offers expertise in local market conditions, tenant laws, and established networks of contractors. While they charge a fee (typically 8-12% of gross monthly rent, plus potential leasing fees), their services can often justify the cost by minimizing vacancies, ensuring timely rent collection, and handling tenant issues efficiently. For investors seeking a more passive income stream, professional management is often the preferred route, allowing them to focus on portfolio growth rather than day-to-day operations.

Maintenance, Repairs, and Capital Expenditures

Regular maintenance and timely repairs are non-negotiable for preserving property value and tenant satisfaction. Budgeting for these is essential. Routine maintenance, like landscaping or minor plumbing fixes, can often be handled by local handymen. However, investors must also plan for larger capital expenditures (CapEx) such as roof replacement, HVAC system upgrades, or major appliance replacements. A common budgeting strategy is to set aside 10-15% of gross rental income annually for CapEx. Proactive maintenance can prevent costly emergency repairs and extend the lifespan of critical property components. Building relationships with reliable local contractors, perhaps through a local resource like Valley City Home & Garden for supplies, is invaluable for efficient property upkeep.

Future Outlook and Risk Mitigation

Like any investment, real estate in Valley City carries inherent risks, but understanding and mitigating them is key to long-term success. The future outlook for Valley City's rental market appears stable, supported by its educational institution and regional economic role.

Market Appreciation and Economic Growth Projections

While Valley City may not experience the rapid appreciation seen in some larger markets, its stability offers predictable, steady growth. Long-term property value appreciation is often tied to continued economic stability, population growth, and local development initiatives. The Valley City Economic Development Corporation plays a vital role in attracting and retaining businesses, which in turn supports the housing market. Investors should monitor these local developments, as new employers or expansions can significantly boost rental demand. Historical data for North Dakota generally shows a resilient housing market, often outperforming national averages during economic downturns due to its strong natural resources and agricultural sectors. This resilience offers a layer of protection against significant market corrections.

Identifying and Mitigating Investment Risks

Key risks in any rental property investment include vacancy, unexpected repairs, problem tenants, and economic downturns. In Valley City, mitigating vacancy risk involves thorough tenant screening, competitive pricing, and maintaining attractive properties. Diversifying your portfolio, even within a single market, can also spread risk; for example, owning both student housing and family rentals. Having a robust cash reserve is crucial for covering unexpected expenses or periods of vacancy. Legal risks, such as landlord-tenant disputes, can be mitigated by understanding North Dakota's landlord-tenant laws and using legally sound lease agreements. Working with a local real estate attorney or a reputable property manager can provide an essential safeguard. Furthermore, staying informed about local zoning changes or property tax assessments is vital for proactive financial planning. Even a seemingly minor local event, like a new coffee shop opening like Riverbend Coffee House, can subtly influence neighborhood desirability over time.

Investing in rental properties in Valley City, ND, offers a compelling opportunity for investors seeking stability and consistent cash flow within a resilient market. Success hinges on a comprehensive understanding of local market dynamics, meticulous financial analysis, strategic financing, and efficient property management. By adopting a data-driven approach and carefully considering both the opportunities and potential risks, investors can build a robust and profitable real estate portfolio in this charming North Dakota community. The key is thorough due diligence and a long-term perspective, leveraging Valley City's unique economic drivers to achieve your investment goals. Learn more about Investing in Perham, MN Real Estate: A Market Overview.

Frequently Asked Questions

What makes Valley City, ND, an attractive market for rental property investment?

Valley City offers a stable market primarily due to the presence of Valley City State University (VCSU), which provides a consistent tenant pool of students and faculty. Its position as a regional hub on Interstate 94 also supports a diverse local economy in agriculture, manufacturing, and healthcare, contributing to steady employment and demand for housing. This stability often translates to lower vacancy rates and predictable cash flow for investors.

What are typical capitalization rates (cap rates) for rental properties in Valley City?

While specific numbers can fluctuate, stable, smaller markets like Valley City typically see capitalization rates ranging from 6% to 9%. This rate, calculated by dividing a property's Net Operating Income (NOI) by its purchase price, provides a good measure of a property's profitability relative to its cost. Investors should conduct thorough due diligence on individual properties to confirm these rates.

Should I self-manage my rental property in Valley City or hire a property manager?

The decision depends on your time availability, experience, and proximity to the property. Self-management can save on fees but requires significant time for tenant screening, maintenance, and legal compliance. For out-of-town investors or those seeking a more passive income, hiring a local property management company is often advisable. They possess local market expertise, understand North Dakota's landlord-tenant laws, and have established networks of contractors, typically charging 8-12% of gross monthly rent.

What are the key financial risks to consider when investing in Valley City rental properties?

Key financial risks include potential vacancies, unexpected maintenance and repair costs, and economic downturns that could impact tenant demand or rental rates. To mitigate these, investors should perform thorough tenant screening, maintain a robust cash reserve (e.g., 3-6 months of operating expenses) for emergencies, and budget proactively for both routine maintenance and major capital expenditures. Staying informed about local economic developments and legal requirements is also crucial.

What types of properties are most in demand for rentals in Valley City?

The demand in Valley City is generally for a mix of property types. Single-family homes are popular with families and long-term residents. Duplexes and multi-unit properties, especially those close to Valley City State University, are highly sought after by students and university staff. Properties with 2-3 bedrooms tend to have broad appeal, catering to both small families and student groups, ensuring a wider pool of potential tenants.

Need help with your real estate journey?

Our team is here to help you navigate the market with confidence.